[ad_1]

1.0 Introduction 1.1 use the indicator 1.2 Indicator Configuration

1.0 Introduction:

On this publish, we are going to clarify the settings of the ICT-SMC Ideas indicator for MetaTrader 5 (MT5). You’ll learn to customise its coloration palette, modify line kinds, and configure the required parameters for its correct functioning.

As well as, we are going to present an in depth rationalization of the extra complicated parameters, so that you could get probably the most out of the indicator.

If you have not bought the product but, get it now with a 19% low cost!: Click on right here

1.1 use the indicator:

To make use of the indicator, comply with these steps:

-

Drag the indicator to the chart on which you wish to show it.

-

Completed! The indicator will now be on the chart. Now all that continues to be is to configure it. Let’s transfer on to the following part to arrange the required parameters.

1.2 Indicator configuration:

To configure the indicator, comply with these steps:

-

Press Ctrl + I to open the indicator settings.

A window just like the one proven within the picture ought to seem:

-

Double-click on the indicator identify ( The SMC ICT Indicator ).

A window just like the next will seem:

As soon as you might be within the settings window, we are going to proceed to elucidate how you can modify the indicator parameters:

Indicator Settings:

On this part you’ll be able to configure common settings, such because the language during which indicator messages are displayed, texts, names of some objects and alerts.

Predominant Parameters:

-

Indicator in Backtesting? (Indicator in Backtesting?):

This parameter is advisable to be enabled ( true ) solely when utilizing the indicator within the technique tester. When you have already bought the indicator and wish to use it in actual time, it’s endorsed to depart it on false . -

Fill:

Permits you to add a background to object rectangles resembling OB (Order Block), FVG (Truthful Worth Hole), IMBALANCE (Imbalance), GAP, and so on. -

Object within the Background? (Object within the background?):

Permits you to outline whether or not an object might be displayed within the background or not.

Instance of object within the background:

Instance of an object that’s not within the background:

- Rectangle Line Thickness: Width of the road

- Modifiied Chart: Permits modification of the chart

Unmodified chart:

Modified graphic:

Configuration of graphic objects:

Right here you’ll be able to modify the colours and different elements of the graphic objects.

-

Low cost / Premium:

Change the colours of the rectangles that symbolize the Premium and Low cost areas. -

Order Blocks:

Permits you to change the colours of the Order Blocks.-

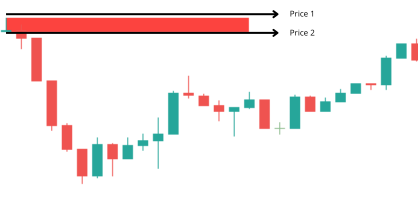

“Bullish Order Block” and “Bearish Order Block Value”:

Right here you’ll be able to choose the 2 key costs (Value 1 and Value 2) for every block of orders. Earlier than explaining how you can modify these costs, you will need to perceive how they work.When an Order Block is drawn on the chart, two costs are chosen:

-

“Value 2”: It represents the underside of the rectangle for a bearish Order Block. In a bullish Order Block, will probably be the highest.

-

“Value 1”: It represents the highest of the rectangle for a bearish Order Block. In a bullish Order Block, will probably be the underside.

-

-

Bullish Order Block:

Bearish Order Block:

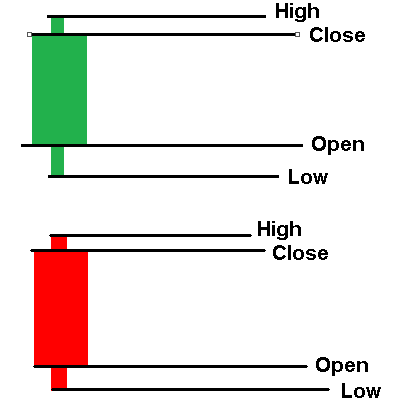

With this in thoughts you’ll be able to select the value for the “Price1” and “Price2” of an order block between:

4 Costs that will mainly be the OHCL of a candle:

- O: Open

- H: Excessive

- C: Shut

- L: Low

This setup might be utilized to the candle earlier than the sturdy transfer.

FVG – IMBALANCE – GAP – RDRB:

On this part, you’ll be able to configure all the pieces associated to the principle market formations resembling FVG (Truthful Worth Gaps), imbalances, gaps and RDRB.

-

Drawing Model:

Right here you’ll be able to select the show type of FVG, imbalances, gaps and RDRB in your chart.-

Draw on 3 candles:

This drawing type is predicated on the truth that the FVG, imbalance, hole or RDRB might be represented in 3 candles:- The candle earlier than the present one.

- The present candle (the place the FVG, imbalance, hole or RDRB happens).

- The candle after the present one.

-

Instance:

- Draw to present time: This type of drawing consists of the fvg, imbalance, hole and rdrb might be drawn and up to date to the present time*

Instance:

*The rectangle is NOT redrawn if it’s not moved utilizing the particular perform that mql5 has for shifting objects (ObjectMove()).

-On this part you can too select the colour of the fvg, imbalance, hole and rdrb every in its specified part.

- Minimal hole distance:

This parameter defines the minimal distance that’s thought-about for a spot to be legitimate.

Liquidity Zones:

Right here you’ll be able to modify the colours of the principle forms of liquidity zones, resembling day by day, weekly and month-to-month highs and lows, in addition to the liquidity strains. BSL (Purchase Facet Liquidity) and SSL (Promote Facet Liquidity).

Market Construction:

On this part, you’ll be able to configure all the pieces associated to the market construction, such because the Swings Excessive and Low , and bullish and bearish tendencies.

-

BOS / CHoCH (Break of Construction / Change of Character):

-

Colours of the strains and textual content of the BOS and CHoCH .

-

Line type BOS and CHoCH .

-

Now we are going to clarify the variable “Select the utmost look forward to the BOS and CHoCH (in bars)” .

- This variable defines how lengthy the indicator will wait till a Swing Excessive both Swing Low be damaged by the value, that’s, shut above or under the extent.

-

Traits:

- When you select a excessive worth (greater than 120 approx.), there might be extra tolerance for a swing to interrupt.

- When you select a low worth (lower than 30), the management might be stricter and fewer might be created. CHoCH and BOS .

Advice: A price between 30 and 90 is good, relying on the image and the technique you comply with.

-

HH / HL / LL / LH:

It is possible for you to to decide on the colours of the excessive and low factors of the market ( Larger Excessive , Larger Low , Decrease Low , Decrease Excessive ).

Swing Excessive / Swing Low:

Within the picture we observe that the Swing Excessive is larger than the earlier 4 candles, assembly the criterion. On this case, the variety of candles can be 4.

-

To sum up: This variable tells us what number of candles the worth ought to exceed or be lower than. Swing Excessive both Swing Low , respectively.

-

Swing Low Coloration and Swing Excessive Coloration:

Select the textual content coloration for the Swing Excessive and Swing Low . -

Min Diff Swing (POINT):

This variable defines the distinction (in factors) between the swing and the textual content indicating the Excessive both Low . It is a crucial variable, since primarily based on it you’ll be able to visually decide if a HH , HL , LL both LH It’s clear and legible. -

We suggest that you simply set a distance that’s visually aesthetic, however not too broad.

-

For instance:

It’s the identical earlier picture at most graphic zoom, this is able to be very best.

However, what will not be…

calculate the best distance between the swing excessive and the following reference stage:

- Zoom in on the graph to its most.

- Establish a swing excessive manually and utilizing the crosshair software, drag the cursor from the swing excessive to a protected distance.

- Observe the factors that the software exhibits you and use them to regulate your technique settings.

Normal suggestions:

- In Foreign exchange (besides USD/JPY), the best distance is normally between 3 and 6 factors.

- For gold, a advisable distance is between 7 and 10 factors.

- For cryptocurrencies resembling Ethereum (ETH), a distance of 25-35 factors is advisable.

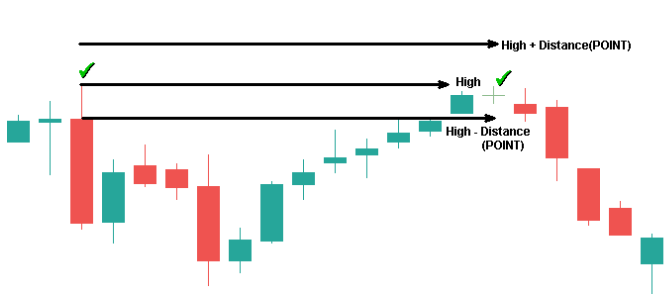

Equal-Excessive/Low:

- Minimal distinction between highs and lows: This would be the minimal tolerance in factors that might be given to a excessive or low when evaluating it with one other excessive and low.

Construction:

Standards for figuring out an “Equal Excessive”:

- An “Equal Excessive” is taken into account when at the very least one most worth (excessive) is throughout the vary outlined by (Excessive – Distance) and (Excessive + Distance).

Utilizing the “Distance” variable:

- The bigger the gap worth, the broader the “tolerance rectangle” might be, which is able to generate extra strains within the graph, making it “noisier”.

- Conversely, if the gap worth is small, will probably be harder to search out equals, as larger precision might be required, which may end in a graph with no equals detected.

Advice:

- Select a price barely decrease than that used for swing highs and lows. For instance, for those who chosen a price of 6 for swings, you’ll be able to select a price of 5 for equals.

Abstract:

- A bigger worth generates extra strains and noise within the graph.

- A smaller worth provides larger precision, however an excessive amount of precision might end in “equals” not being detected.

Personalization:

- Select the colour of the strains and textual content for “Equal Excessive” and “Equal Low”.

- Line type for equals : Choose the type you favor for the equals strains.

GMT 0 Classes

On this part, you’ll be able to select the hour and minute at which every session will start, utilizing GMT 0 time to facilitate world configuration.

It is very important word that the periods are already predefined, so there isn’t a must make any adjustments, until you favor a session to begin earlier or later than its normal time.

Construction of the periods:

-

Normal:

- Rectangle line type: Defines the type of the strains of the rectangles that symbolize the periods.

- Session textual content font measurement: Adjusts the font measurement of the texts related to every session.

-

Organising every session:

- Session begin time (“session” begin hour): Units the time at which the session will begin.

- Session begin minute: Outline the precise minute at which the session will begin.

- Session finish time (“session” finish hour): Units the time at which the session will finish.

- Session finish minute (“session” finish minute): Outline the precise minute at which the session will finish.

- Coloration of session rectangle: Choose the colour of the rectangle that visually represents the session.

- Session textual content coloration (coloration of “session” textual content): Choose the colour of the textual content that identifies the session.

Conclusion of the Handbook: Detailed Clarification of the Line Model

To conclude this guide, I’ll present a extra detailed rationalization of the “Line Model” in addition to some sensible examples. I didn’t embrace this rationalization in every part to keep away from excessively extending the content material.

Line Model refers back to the visible format that the strains will undertake within the graphs, which is important to enhance the readability and group of the data. Beneath, I describe the commonest forms of line type and when it’s advisable to make use of them:

-In MT5 now we have 5 forms of type for the strains:

- strong: Regular straight line with out modifications

- dashdot: dotted line and sprint

- dashdotdot: two-point line and sprint

[ad_2]

Supply hyperlink

Leave a Reply