[ad_1]

AW Donchian Pattern EA – an advisor buying and selling on the indicators of the pattern indicator AW Donchian Pattern. Makes use of the indicator methods TakeProfit and StopLoss, as well as, the advisor has a built-in Trailing, overlapping and breakeven operate. It could use multi-timeframe filtering, computerized lot calculation to avoid wasting the chance share from the deposit. Functionally, it’s doable to work by time and completely different averaging choices.

Consideration! The indicator parts are seen provided that the indicator is working. To commerce with the adviser, you do not want to purchase an indicator, because the adviser refers back to the built-in indicator when receiving information for buying and selling, however the adviser doesn’t show the indicator strains. If you wish to see the indicator strains, that you must run the indicator on the chart.

Advisor “AW Donchian Pattern EA”:

MT4 model

👉 https://www.mql5.com/ru/market/product/122816

MT5 model

👉 https://www.mql5.com/ru/market/product/122652

“AW Donchian Pattern” indicator:

MT4 model

👉 https://www.mql5.com/ru/market/product/121704

MT5 model

👉 https://www.mql5.com/ru/market/product/121573

Methods for opening positions:

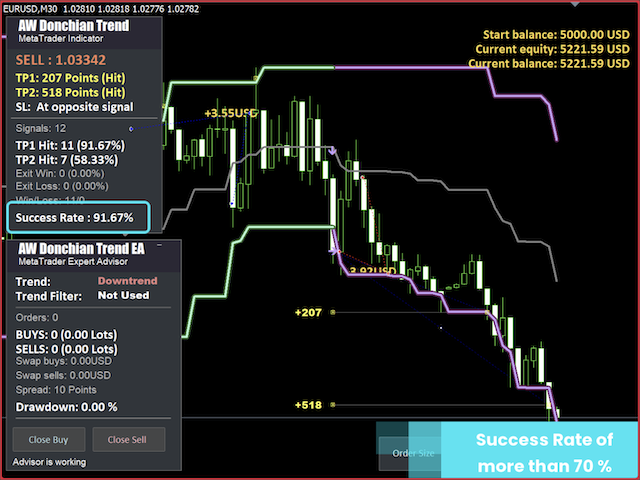

1 Success Ranking

A purchase sign was acquired with a sign success score better than or equal to 70%. If the indicator is lower than you specify, the advisor won’t open an order. You may specify any share of the score for opening orders, however we advocate utilizing a share of not less than 70 to be able to keep away from numerous false indicators. When utilizing a grid technique and utilizing extra filters, the success score worth might be diminished.

The “Success Charge” variable is situated within the enter settings within the “MAIN SETTINGS” part.

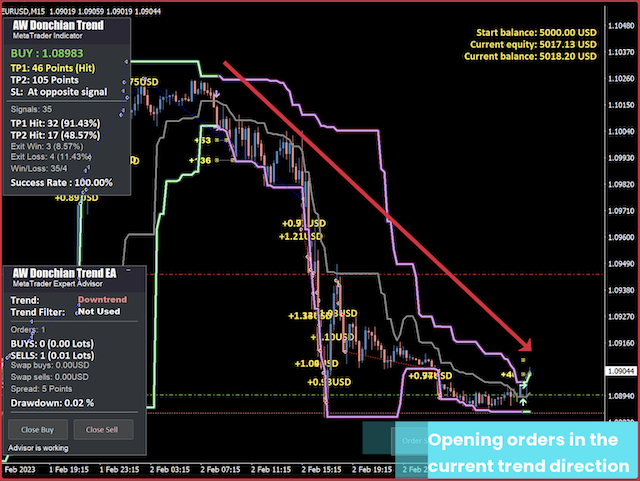

2 Opening orders on a brand new sign or within the route of the pattern

The advisor has a brand new built-in operate for opening extra orders.

- If within the variable ” First order on new sign solely” set the choice “TRUE”, then the adviser will open new orders solely when a brand new sign is acquired from the indicator. That’s, the adviser trades as soon as per sign. Should you enabled the power to commerce grids, then just one grid can open. (Much less trades – as within the screenshot beneath)

- If within the variable “First order on new sign solely” set the choice “False”, then the adviser will open new orders instantly after the earlier ones are closed all through your entire pattern route. When one basket is closed (when utilizing grids), or one order, even within the absence of a brand new sign, new orders can be opened based on the present pattern. (Extra trades – as within the screenshot beneath)

3 Buying and selling in two instructions concurrently or in flip.

The advisor has a built-in skill to work concurrently in each instructions, regulated by a variable “Can EA work in each instructions on the identical time”. If you choose “true”, if there are already open orders in a single route, the adviser will be capable of commerce in each instructions. On this case, each instructions of orders can be closed independently of one another. (Concurrently open transactions in each instructions – within the screenshot beneath)

Should you disable the operate, the adviser will first commerce in a single route. And solely after AW Donchian Pattern EA will shut orders on this route, then it is going to be in a position to open new orders in the other way. Each instructions of orders can be closed independently of one another. In the “false” mode, the adviser will commerce solely in a single route, opening one other route is feasible solely when the present one is closed. (Concurrently open transactions solely in a single route – within the screenshot beneath)

4 Limitation for opening no a couple of order per candle.

Limitation for opening no a couple of order per candle, or work with out limitation. When selecting the “false” choice, the adviser opens new orders as quickly as a sign for opening is acquired. When selecting the “true” choice, the adviser opens no a couple of order of 1 route per candle.

The limitation might be helpful:

- Avoidance of overtrading: And not using a restrict, the EA can open a number of orders on a single candlestick, which results in extreme threat and important prices. For instance, throughout a pointy up-and-down worth motion, a number of orders might be opened on a single candlestick, which will increase charges and reduces effectivity.

- Lowered Threat of Loss: When opening a number of orders on a single candle, the chance of every order is added collectively. Limiting helps scale back threat by making certain that every commerce relies on the distinctive market information of every new candle.

- Optimizing capital utilization: Opening a number of orders on one candle might be very taxing in your deposit, particularly when utilizing a big quantity, which limits the alternatives for subsequent trades on different indicators.

Disabling the limitation could have its benefits relying on the technique and market circumstances. In some instances, disabling this limitation permits for extra flexibility in responding to market adjustments and opening up extra revenue alternatives.

Potential advantages of disabling:

- Elevated Revenue Potential: In periods of sturdy actions or excessive volatility, if just one order is opened per candle, extra alternatives are missed. Disabling the restrict permits you to seize extra worthwhile entry factors, growing your possibilities of making a revenue.

- React rapidly to pattern adjustments: If the pattern adjustments rapidly, with the ability to open a number of trades briefly intervals of time will help you rapidly reverse positions and benefit from the brand new route of motion.

5 ” Use extra Donchian Pattern filtering”

Pluggable multi-timeframe and multi-period pattern filter. Utilizing an extra pattern filter when buying and selling is related for a number of causes, because it permits you to extra precisely decide the primary route of the market and improve the effectiveness of buying and selling selections. This method combines evaluation on completely different time intervals to keep away from false indicators and enhance the accuracy of market entries.

On decrease timeframes (reminiscent of M15 or M5) or with a low indicator interval, market noise and false indicators are frequent. The extra filter helps to disregard these indicators in the event that they contradict the pattern on greater timeframes. For instance, if a promote sign seems on a minute chart, however the pattern is up on an hourly chart, a dealer can ignore this sign and thus keep away from losses.

Utilization variations:

- Filtering by greater timeframe. The entry level makes use of the present chart timeframe. For filtering, that you must use a bigger timeframe. Orders will solely be opened when two indicators match.

- Filtering by a stricter indicator interval. For the entry level, the usual indicator interval of 24 is used. For filtering, a bigger interval is about, for instance 40. On this case, orders will even be opened solely when two indicators match.

- Filtering by timeframe and interval. For filtering, you may set each a bigger timeframe and a bigger interval on the identical time. This can be related for symbols with excessive volatility.

The gif reveals an instance of utilizing a multi-timeframe filter, it’s clear that when there’s a distinction within the route of the symptoms, the indicators on the present timeframe are ignored. And when the indicators match, the advisor makes transactions.

Variations for closing orders:

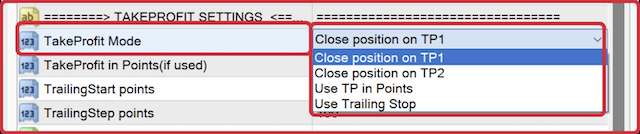

1 Take Revenue Closing: Establishing the TakeProfit technique.

“The TakeProfit operate is a instrument for routinely closing a place when a pre-set revenue degree is reached. It permits you to lock in revenue when the value reaches the goal worth. The principle activity of the operate is to make sure that the place is closed on the proper time to forestall a worth rollback and lack of earned revenue.

TakeProfit might be set for every order individually or for your entire place, relying on the technique. There are a number of choices for utilizing TakeProfit:

- Shut place on TP1 — Closing your entire place when the TP1 indicator worth is reached. This lets you lock in revenue on the first goal degree.

- Shut place on TP2 — Closing your entire place when the TP2 indicator worth is reached. This selection is used for longer-term profit-taking on the second degree.

- Use TP in Factors — Utilizing a hard and fast TakeProfit in factors for every order. On this case, when the required variety of revenue factors is reached, the order is closed routinely. When selecting this feature, it’s essential to specify the TakeProfit measurement within the variable “TakeProfit in Factors (if used)”.

2 Closings on Trailing

The trailing order closing algorithm is a operate that permits you to routinely pull stop-loss orders behind the value throughout favorable market motion.

The operate is enabled when the value passes the space specified within the variable “Trailing Begin in factors”. As soon as this distance is reached, the cease loss begins following the value at a distance specified within the variable “Trailing Step in factors”. As the value continues to maneuver in a single route, the cease loss can be routinely pulled up, defending the accrued revenue.

If the value reverses and reaches the stop-loss degree, the order is closed, locking in revenue on the degree set by the final trailing cease worth. This function permits you to reduce losses and protect income with out requiring handbook intervention, particularly in dynamic markets.

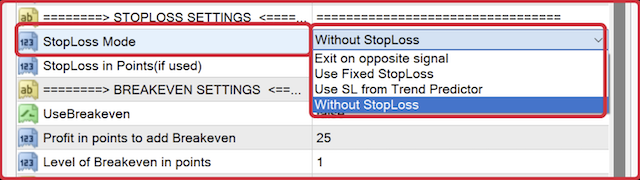

3 Closing by StopLoss

The StopLoss operate is a instrument for routinely closing a dropping place when a pre-set loss degree is reached. The principle function of StopLoss is to restrict potential losses and shield the dealer’s capital within the occasion of unfavorable market motion. As with TakeProfit, StopLoss might be set individually for every order or for your entire place. There are a number of choices for the StopLoss operate:

- Exit on reverse sign — Closing a place when the pattern reverses or when an reverse buying and selling sign seems. This selection is helpful for dynamic methods, the place the important thing criterion is a change within the pattern route. As quickly because the advisor receives a reversal sign, the order is routinely closed.

- Use SL in Factors — Utilizing a hard and fast StopLoss in factors for every order. When activating this operate, it’s essential to set the StopLoss measurement within the “StopLoss in Factors (if used)” variable. The order can be closed routinely as quickly as the value passes the set variety of factors in opposition to the place.

- Use SL from Indicator — Utilizing StopLoss based mostly on Donchian Pattern indicator indicators. On this case, StopLoss ranges are decided based mostly on the evaluation of indicator information, which permits versatile adaptation of protecting ranges relying available on the market situation and pattern conduct.

- With out StopLoss — Operation mode with out utilizing StopLoss. On this case, the advisor doesn’t set protecting ranges to restrict losses, for methods with various threat administration strategies or throughout aggressive buying and selling.

Further options:

1 Breakeven

The breakeven algorithm is a operate that permits you to transfer stop-loss orders to the breakeven zone. This occurs when the value strikes a specified variety of factors within the constructive route from the preliminary entry level of the commerce. The principle function of the breakeven is to guard the revenue already made and remove doable losses on the place.

When the breakeven operate is activated, the cease loss is moved to the order opening degree (or barely greater to cowl commissions and unfold). Thus, if the value goes in the other way, the commerce can be closed on the breakeven worth, which protects the deposit from losses.

The breakeven operate is activated provided that the place already has a constructive floating revenue and has handed the required variety of factors. The advisor doesn’t use breakeven if the place stays unprofitable or has not reached the required worth motion degree.

2 Computerized threat administration setup

The autolot operate works based mostly on two variables.

The primary variable is “Allow Autolot calculation” – enabling or disabling the operate of computerized calculation of opened positions.

The second variable is “Autolot deposit per 0.01 heaps”. Because of this for every quantity specified on this variable there can be 0.01 heaps for the opening quantity of the primary order.

For instance: your deposit is 1000 {dollars}, within the variable “Autolot deposit per 0.01 heaps” you specified 1000. Because of this the primary order within the order basket can be opened with a quantity of 0.01 heaps, as quickly as your deposit will increase and turns into 2000 {dollars}, then the quantity of the primary order within the basket will already be 0.02 heaps, and so forth with a deposit quantity of 3000 {dollars}, the quantity of the primary order can be 0.03.

Should you specified 500 within the variable “Autolot deposit per 0.01 heaps” and your present stability is $1,000, then the primary order can be opened with a quantity of 0.02. Additionally, in case your deposit subsequently decreases, then the quantity of the primary order will even lower in accordance with the setting.

Once you allow the autolot operate, the “Dimension of the order” variable won’t work, because the quantity of the primary order can be versatile based on your deposit.

3 Overlapping algorithm:

Overlapping algorithm – that is the overlap of the primary order by the final one. It is a partial closure of a basket of orders in a single route. When utilizing the overlap operate, not your entire grid is closed, however solely the very first unprofitable order. The primary and final orders are closed utilizing the revenue of the final order from the grid. This reduces the overall variety of orders, and in addition reduces the quantity of open lotage. One of these closure permits you to partially shut the grid by masking a shorter distance in factors.

Protecting the primary order with the final one works when your entire place is unprofitable. If your entire place is within the black when the TakeProfit degree of the primary + final orders is reached, the advisor won’t be lined, since it’s doable to shut your entire place.

If, upon reaching the TakeProfit degree of the primary + final orders, your entire place is within the minus, the advisor will shut the primary and final orders.

4 Work by time

Time-based algorithm is a operate that permits the advisor to open positions in strictly outlined time intervals. The principle aim is to manage buying and selling inside probably the most lively or most popular time intervals for the technique.

When utilizing the time-based operate, the advisor will open new orders solely in the course of the specified hours, which lets you exclude buying and selling throughout much less risky intervals or throughout necessary information releases. All orders that had been opened outdoors the set time won’t be taken into consideration for brand spanking new actions of the advisor.

The closing of positions won’t be regulated by time work.

Advisor “AW Donchian Pattern EA”:

MT4 model

👉 https://www.mql5.com/ru/market/product/122816

MT5 model

👉 https://www.mql5.com/ru/market/product/122652

Enter settings:

MAIN SETTINGS

Success Charge – Success score for opening an order.

First order on new sign solely – Risk to decide on to open new orders solely when a brand new sign is acquired from the indicator, or if you choose the “False” choice, orders can be opened within the present pattern route as quickly because the earlier ones are closed.

Can EA work in each instructions on the identical time – A variable that limits the power to open averaging orders in two instructions concurrently. If you choose “true”, the advisor will be capable of commerce in each instructions if the circumstances for this exist. If you choose “false”, no, that’s, the advisor will commerce solely in a single route.

Order measurement – Order quantity to open.

Allow Autolot measurement calculation – Use computerized lot calculation. Autolot permits you to save threat settings when altering the deposit

Quantity of deposit for one “Dimension of the order“ – The deposit quantity for which one “Dimension of the order” can be allotted when utilizing autolot

TAKE PROFIT SETTINGS

TakeProfit Mode – Deciding on a take revenue technique:

- Shut place on TP1 – Shut your entire place when TP1 is reached.

- Shut place on TP2 – Shut your entire place when TP2 is reached.

- Use TP in Factors – Use a hard and fast TakeProfit for every order.

TakeProfit in Factors (if used) – Fastened TakeProfit for every particular person order

Trailing Begin in factors – Worth in factors, after opening a market order when this quantity of factors is handed, Trailing can be set for the order. Trailing strikes StopLoss after the value when the value begins transferring in direction of revenue, after the value reverses, Trailing will shut the place with revenue.

Trailing Step in factors – Step in factors, after passing which Trailing can be pulled up by the value. Trailing can be pulled up by the value a limiteless variety of instances, so long as the unidirectional pattern continues. Every time Trailing can be pulled up after passing the required step worth.

Enable overlap TP final and first common orders – Use overlap of the primary order with the final one

Enable overlap TP after variety of orders – Use overlap after a given variety of open orders

STOPLOSS SETTING

StopLoss Mode – Deciding on a StopLoss technique.

- Exit on reverse sign – Exit when the pattern reverses or when there’s an reverse sign.

- Use SL in Factors – Use a hard and fast StopLoss for every order.

- Use SL from Indicator – Use StopLoss based mostly on indicators from the Pattern Predictor indicator.

- With out StopLoss – Working mode with out use StopLoss.

StopLoss in Factors (if used) – Fastened StopLoss for every particular person order

BREAKEVEN SETTING

Use Breakeven – It is a operate the place StopLoss can be equal to the order opening worth excluding dealer commissions and swaps. It’s set for every particular person worthwhile order on the present image.

Revenue in factors to add Breakeven – Order revenue in factors, upon reaching which StopLoss can be set at breakeven

Stage of Breakeven in factors – As quickly as the value went above the opening worth and went into revenue «Revenue in factors to add Breakeven» factors, the advisor will set StopLoss on the opening worth + the required revenue. Variable in order that the value can not carry a loss and is closed within the occasion that Вreakeven is reached when transferring in the other way to the worthwhile one.

GRID SETTINGS

Use grids – Use opening order baskets.

Averaging pattern filtering – After opening the primary order within the basket, additional growth of the grid is feasible provided that the present pattern is directed in the identical route.

Multiplier for order measurement – Multiplier for order volumes

Step for grids – The variable that regulates the step between orders is measured in factors

Most variety of orders – Most variety of orders in a single route within the basket

DONCHIAN TREND SETTINGS

Interval – The indicator interval, the longer it’s, the much less delicate the indicator indicators are

TakeProfit goal – Multiplier for TP1 and TP2. The upper the multiplier, the extra revenue from one transaction, however the decrease the share of profitable indicators

StopLoss goal – Multiplier for StopLoss. The upper the worth of the variable, the farther from the opening worth the StopLoss can be situated

Most bars – Variety of bars for calculating statistics

MULTI-TIMEFRAME TREND SETTINGS

Use extra Donchian Pattern filtering – Use or not use an extra pattern filter. Means that you can filter out market noise.

Interval for multitimeframe filter – Choose a timeframe to filter indicators. The timeframe of your present chart is used for the entry level.

Interval – The indicator interval, the longer it’s, the much less delicate the indicator indicators are.

ADVISOR SETTINGS

Orders Magic Quantity – The principle identifier of the advisor’s orders. Used primarily to determine orders

Feedback for orders – Advisor order commentary

Slippage Restrict – Most permissible slippage in factors

Unfold Restrict – Most allowed unfold for opening orders

One order per bur – A variable that limits the power to open a couple of order per candle. If you choose “false”, the advisor will open new orders as quickly as a sign for opening happens. If you choose “true”, the variety of orders can be restricted to the present candle, this feature is safer in case of sharp worth fluctuations.

Enable to open OP_BUY orders – Enable sending orders of sort OP_BUY

Enable to open OP_SELL orders – Enable sending orders of sort OP_SELL

Enable to open new orders after shut – Enable sending new orders in spite of everything orders are closed

Font measurement in panels – Change the font measurement within the panel

Present panel – Present or cover the advisor panel

WORKING TIME SETTINGS

Work on Time – Allow or disable work on time.

Begin Time – The beginning time of the advisor, used if time-based work is enabled.

Finish Time – The top time of the advisor, used if the time-based work is enabled. After the tip of the work, new orders won’t be opened, however closing will proceed to be carried out in accordance with the SL and TP settings.

NOTIFICATIONS SETTINGS

Ship push notifications when shut orders – Enable sending notifications to the cell model of the terminal. Letters are despatched when orders are closed.

Ship mails when shut orders – Enable sending letters to the consumer’s e mail handle. Letters are despatched when orders are closed.

Ship alerts when shut orders – Enable sending pop-up notifications on the consumer’s terminal. Alerts are despatched when orders are closed.

Purchase AW Donchian Pattern EA now:

MT4 model

👉 https://www.mql5.com/en/market/product/122816

MT5 model

👉 https://www.mql5.com/en/market/product/122652

“AW Donchian Pattern” indicator:

MT4 model

👉 https://www.mql5.com/ru/market/product/121704

MT5 model

👉 https://www.mql5.com/ru/market/product/121573

AW Buying and selling Software program

[ad_2]

Supply hyperlink

Leave a Reply