[ad_1]

In a current evaluation, Stanislas Bernard, the founding father of Sinz twenty first.Capital, delved into the complexities surrounding Hong Kong’s consideration to approve spot Bitcoin ETFs in opposition to the backdrop of China’s escalating financial disaster. With the nation grappling with a document debt-to-GDP ratio of 288% in 2023, and witnessing some of the extreme housing market collapses in three many years, the monetary instability has triggered an unprecedented capital flight in direction of abroad markets.

The Excellent Timing For A Spot Bitcoin ETF?

Amidst these turbulent financial instances, Hong Kong’s potential approval of spot Bitcoin ETFs stands out as a pivotal growth that would not solely be a secure haven for Chinese language traders but in addition considerably affect Bitcoin’s valuation, probably catapulting it to the elusive $100,000 mark.

China’s financial woes have been intensifying, marked by a towering debt ratio and a plummeting housing sector that has traders scrambling for options. “China at present faces a major financial downturn, exacerbated by hovering debt and malinvestments in actual property. The disaster, changing into well-known in 2021 with the default of Evergrande Group, has now unfold, inflicting a ripple impact that may seemingly decelerate the Chinese language economic system for years to come back,” Bernard identified.

This backdrop of financial instability has incited a major shift in investor habits, notably amongst Chinese language traders who, confronted with stringent capital controls, have sought refuge in ETFs that provide publicity to overseas markets. But, this avenue has been fraught with its personal challenges.

“Traders are paying premiums as excessive as 43% on sure US-focused ETFs attributable to quota limitations, which speaks volumes in regards to the desperation to seek out safer funding harbors,” Bernard notes. Such premiums underscore the pervasive concern and uncertainty which have gripped the Chinese language market, driving traders in direction of seemingly any out there exit from the volatility of the home market.

The Position Of Hong Kong

Bernard believes that not solely Hong Kongers but in addition Chinese language mainlanders will flock to Bitcoin ETFs. “They’re fairly built-in. Mainland is HK’s largest buying and selling associate. Wouldn’t be doable to approve a spot ETF after which shut it to mainland. They’ll implement transaction limits as an alternative,” the knowledgeable mentioned.

Within the midst of those developments, Hong Kong’ Securities and Futures Fee (SFC) is reportedly contemplating the approval of spot Bitcoin ETFs already by the top of April, as reported yesterday. This transfer is seen as a strategic effort to seize a portion of the capital flowing into Bitcoin, particularly within the wake of the SEC’s approval of comparable ETFs within the US, which noticed a meteoric rise with $12 billion of web circulate.

“Hong Kong is scrambling for a change. The approval of spot Bitcoin ETFs may unlock an enormous reservoir of stranded Chinese language capital into Bitcoin, offering a much-needed life raft for traders,” Bernard defined.

The anticipated approval of spot Bitcoin ETFs by Hong Kong authorities has been met with important enthusiasm throughout the crypto neighborhood. Influential figures resembling Bitcoin Munger and Stack Hodler have been vocal in regards to the potential impression of this growth on Bitcoin’s worth.

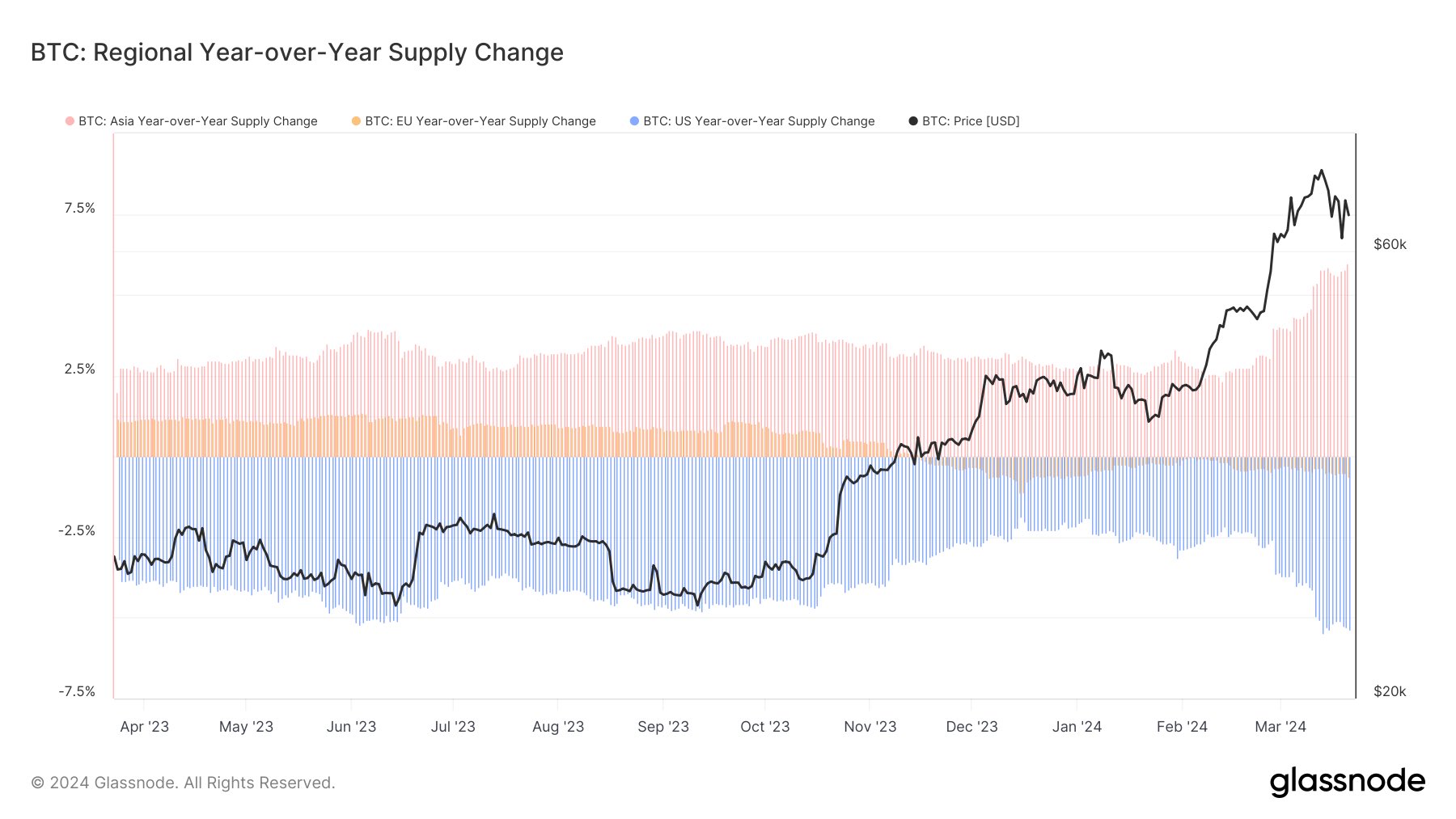

“Hong Kong ETFs approval have accelerated to subsequent week. Most accounts on CT weren’t making a giant deal about them, however they’re a giant deal. They’ll take us to $100k+ in due time. Tick tock!” said standard Bitcoin analyst Bitcoin Munger (@bitcoinmunger). He refers back to the regional yearly year-over-year provide change from West to East.

Stack Hodler (@stackhodler) additional emphasised the urgency amongst Chinese language traders to seek out safe funding avenues exterior the standard system, “Chinese language traders had been panic-buying a Gold fund at a 30% premium this month as they try to get their wealth into one thing exterior the Chinese language system. The approval of Hong Kong spot ETFs may very well be the turning level, providing a sanctioned avenue for wealth preservation amidst the crumbling actual property market.”

General, the potential approval of spot Bitcoin ETFs in Hong Kong is poised to be a landmark growth, not only for the area however for the worldwide market. By providing a safe and controlled channel for funding, it may function a catalyst for important capital influx into Bitcoin, reinforcing its standing as a viable retailer of worth.

“As we stand on the cusp of this historic growth, the implications for Bitcoin and the broader cryptocurrency market may very well be profound. The approval of spot Bitcoin ETFs in Hong Kong may certainly be the harbinger of a brand new period, probably driving Bitcoin’s worth to new heights,” concluded Bernard.

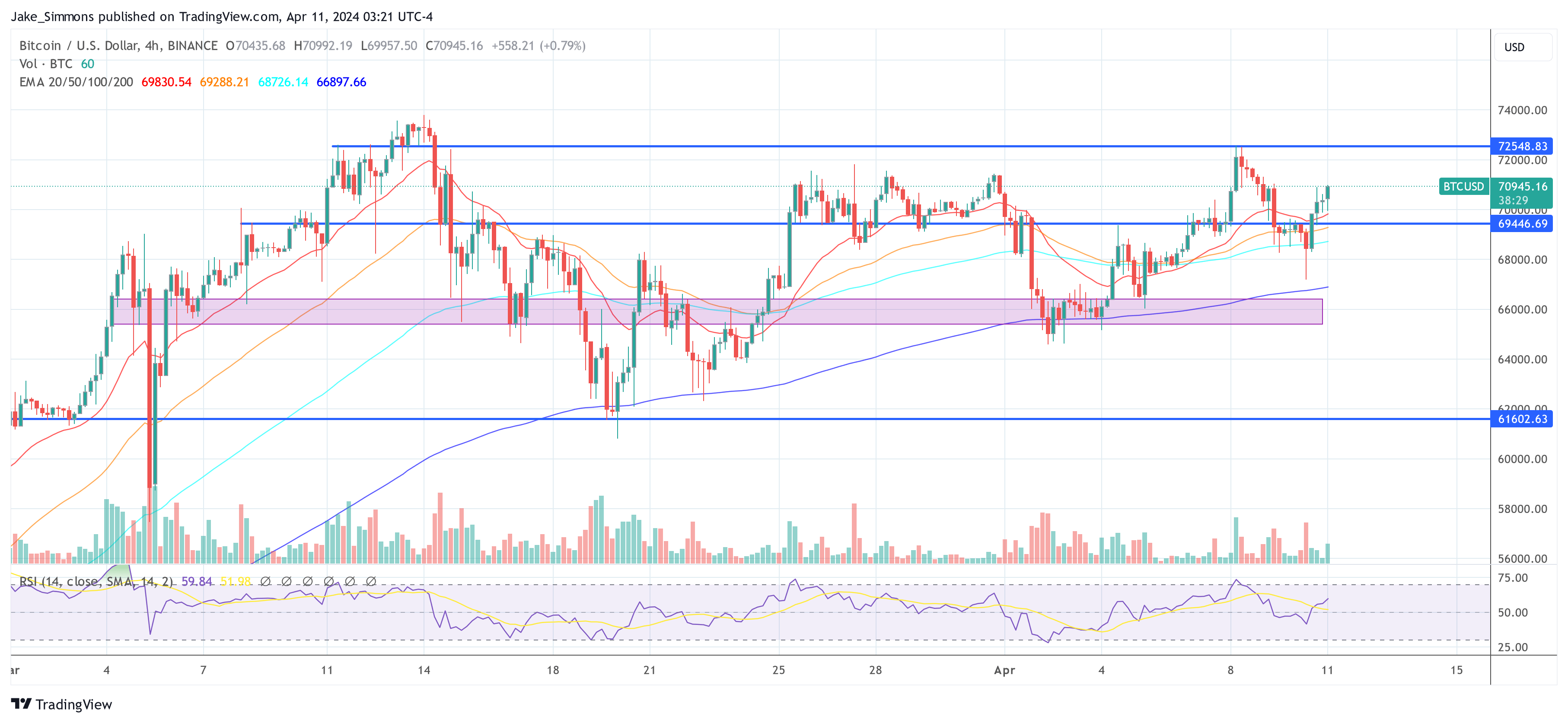

At press time, BTC traded at $70,945.

Featured picture created with DALL·E, chart from TradingView.com

Disclaimer: The article is offered for academic functions solely. It doesn’t signify the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You might be suggested to conduct your individual analysis earlier than making any funding selections. Use info offered on this web site totally at your individual danger.

[ad_2]

Supply hyperlink

Leave a Reply