[ad_1]

1. Introduction

That is the continuation on Sapphire Strat Maker and Sapphire Strat Maker Alt (Free) professional advisor (benefit from the value low cost whereas it’s nonetheless lively!) – an EA which lets you create your individual technique with out coding. That is the great thing about this Skilled Advisor: create your individual methods – be artistic – and do not be locked to a single technique anymore. Optimize the parameters you need to discover the perfect units and also you’re able to go!

Please, notice that a few of these options could solely be accessible within the full model.

Earlier than persevering with, try the opposite weblog posts:

As we speak we’re gonna have a look on completely different classes which will make it easier to create your individual technique with Sapphire Strat Maker (or at the least assist the method of growing your individual EA).

2. Sorts of methods

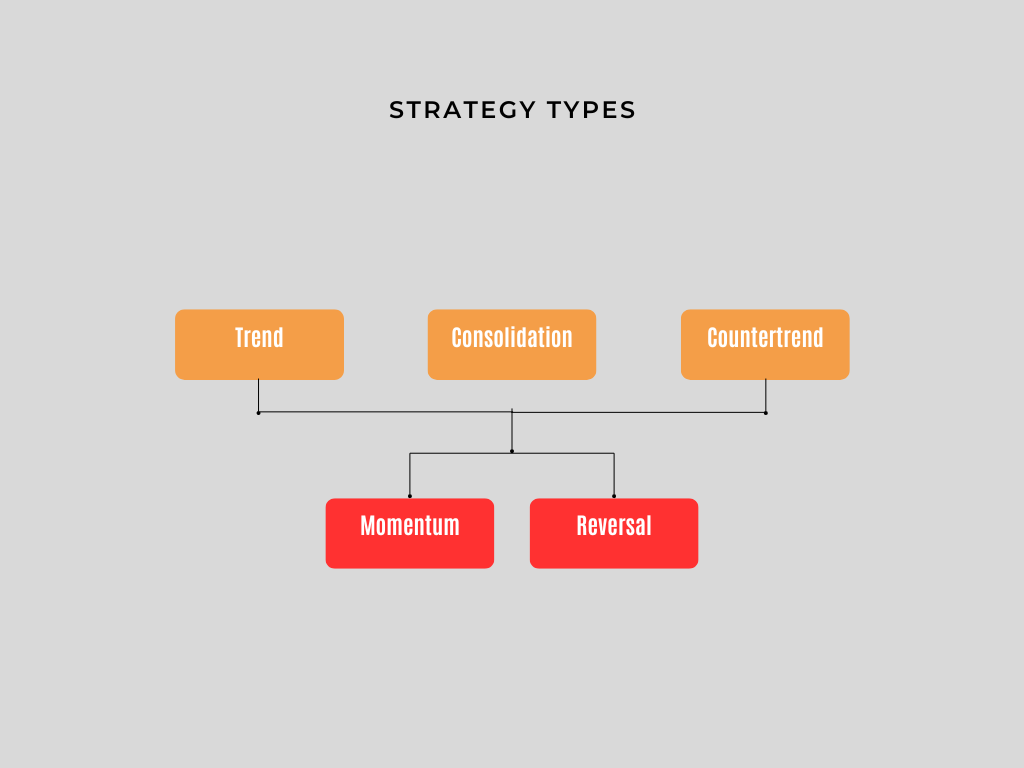

Within the strategy of pondering a brand new technique, I often outline three important classes, two of which subdivide into two different sections:

As we are able to see, we now have three important varieties: pattern methods, countertrend methods and consolidation methods.

Development methods and countertrend methods will also be subdivided into momentum and reversal methods.

Momentum methods attempt to catch the present motion – if it is a pattern, it goes on the pattern course; if it is a countertrend, it tries to observe the alternative pattern course (thus, countertrend).

Reversal is sort of the alternative, that’s, it expects that the present motion will fail to proceed and can reverse – thus, if utilized in a pattern technique, it expects the motion to go towards the pattern; if utilized in a countertrend technique, it expects the pattern to come back again and go on.

This definition may be visualized in a desk like this:

| – | Momentum | Reversal |

|---|---|---|

| Consolidation | – | – |

| Development | Observe the present pattern motion | Expects the pattern to reverse (often on an overbought/oversold stage) |

| Countertrend | Observe the present countertrend motion | Expects the countertrend to reverse (often on an overbought/oversold stage) |

By dividing your methods like this, you’ll be able to create robots that work on completely different market circumstances and which will cut back your losses. Think about a place that buys on an uptrend and promote on the identical uptrend. Relying on the way you configure your EA, each of them could also be worthwhile (however notice that each could lose aswell; a great portfolio of robots, nevertheless, can deal with this).

Let’s make a technique and see how we are able to outline the perfect indicators/parameters for it.

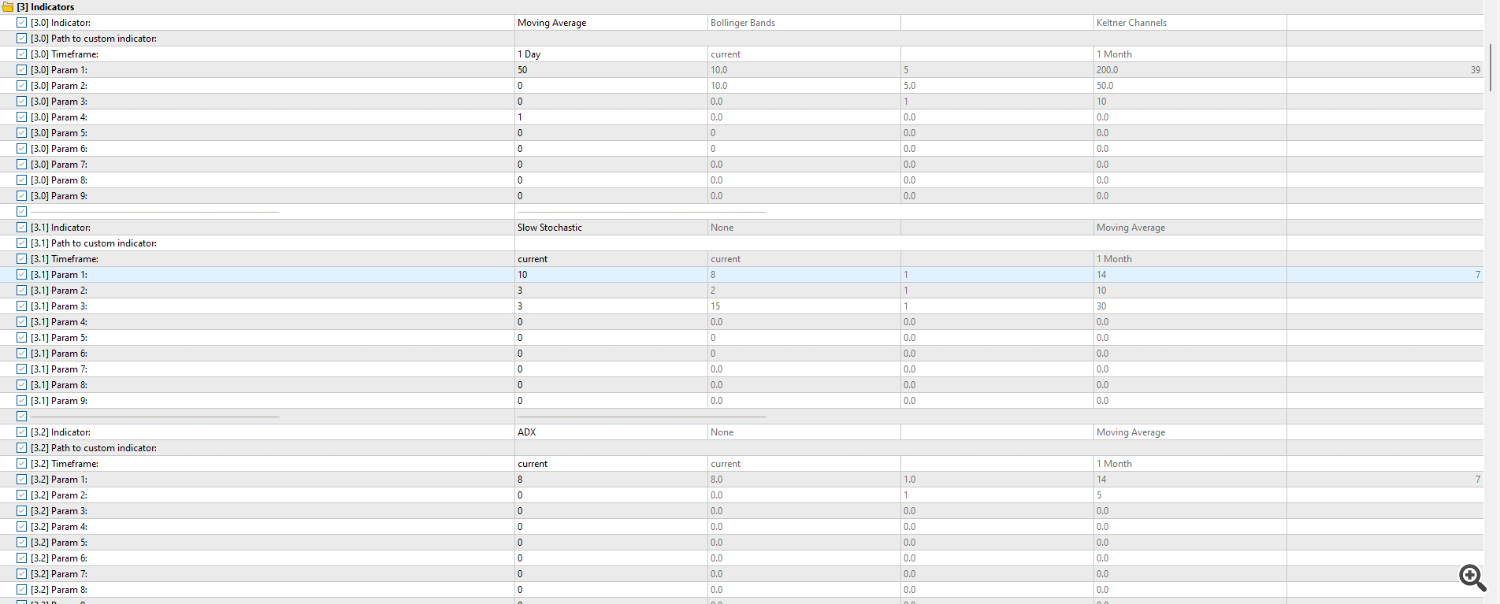

On this instance, I need to create a countertrend reversal technique. Since it’s a countertrend, I need to outline a solution to examine to which course the pattern goes. Subsequent, since it is a reversal, I need to examine for an indicator that tells me a great level at which this countertrend has gone too far.

There’re two fairly attention-grabbing indicators that do these stuff: transferring averages and sluggish stochastic.

For this technique goal, I will assume that we’re in an uptrend if the value is above the transferring common and in a downtrend if the value is under it. Additionally, we should purchase when the asset is oversold and promote when it’s overbought – these situations can simply be detected if the stochastic is under 20 and above 80, respectively.

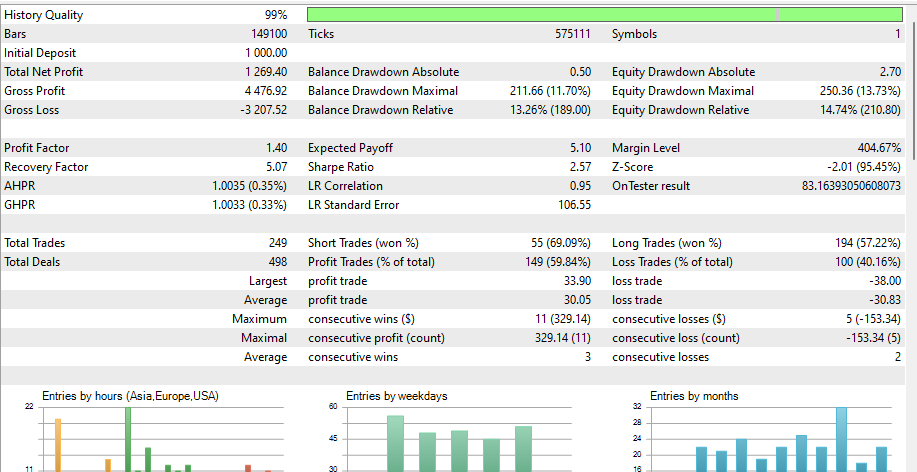

I will additionally add an ADX to examine the present pattern power and can optimize it is parameters to examine the way it higher performs (that’s, I need to know the perfect interval, the worth to match towards ADX and whether or not is healthier if ADX is under or above this stage). An optimization was additionally finished on the transferring common and stochastic durations. All different indicator parameters had been left as default.

After optimizing, these had been the chosen parameters for the symptoms:

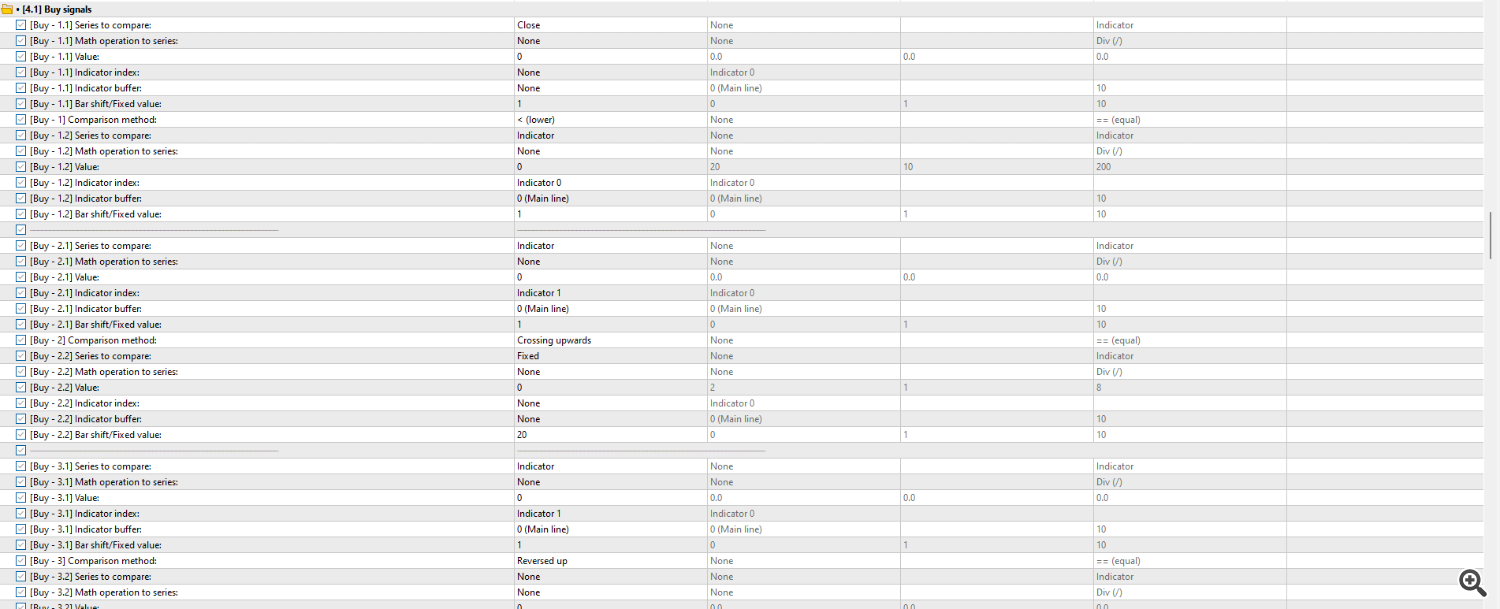

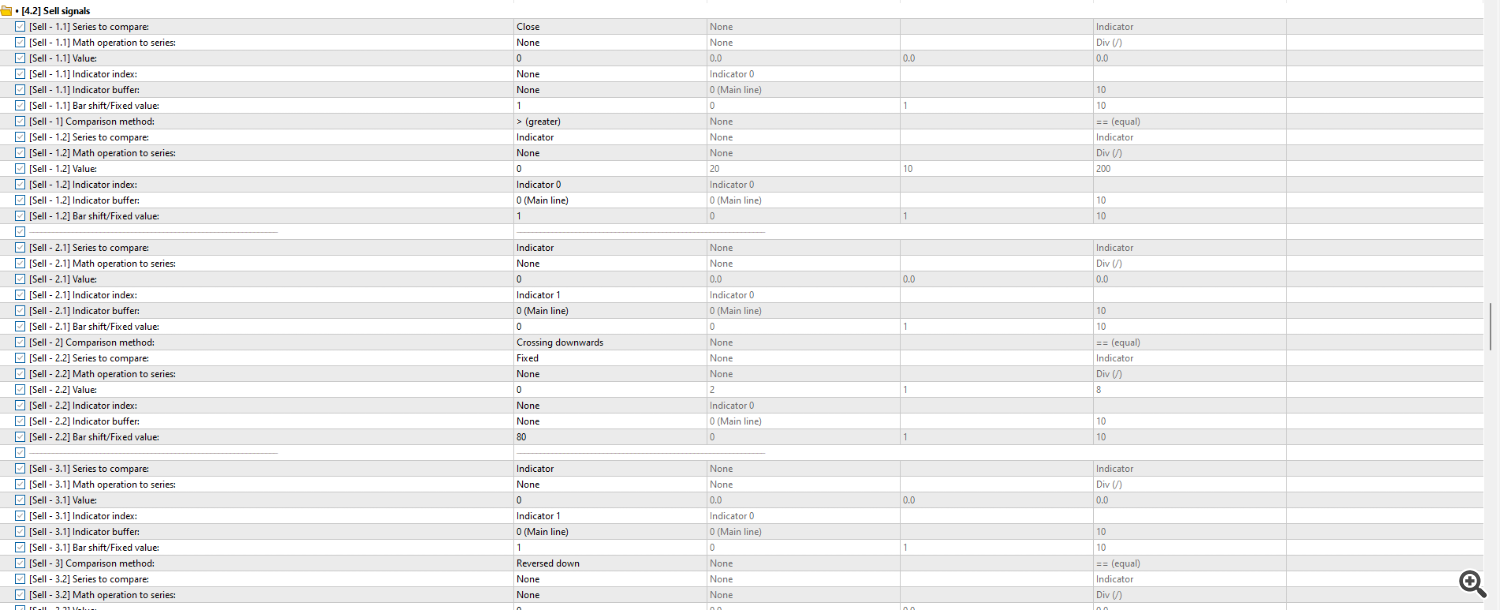

The entry alerts had been outlined as following: a purchase place should be opened when the present shut value is under the transferring common (countertrend), when the sluggish stochastic is under the oversold stage and in addition when it’s under the extent 20 (indicating a reversal). A promote place should be opened when the present shut value is above the transferring common (countertrend), when the sluggish stochastic is above the overbought stage and in addition when it’s above the extent 80 (indicating a reversal).

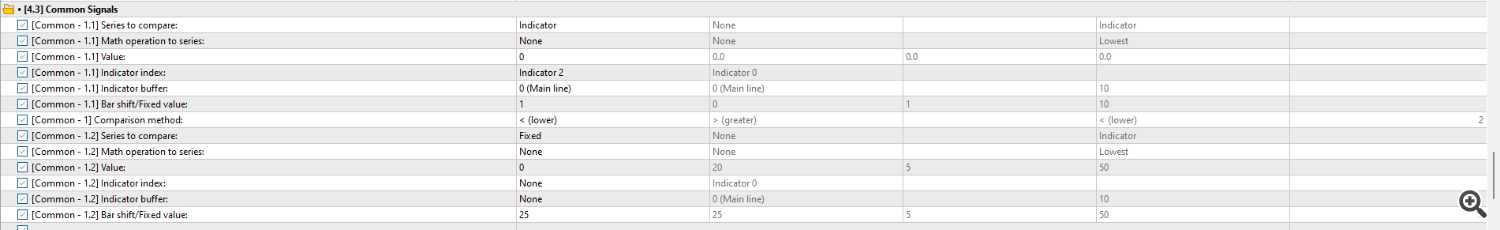

To open each sorts of positions, after optimizing, we came upon that the ADX should be under the extent 25.

That is how the situations had been set:

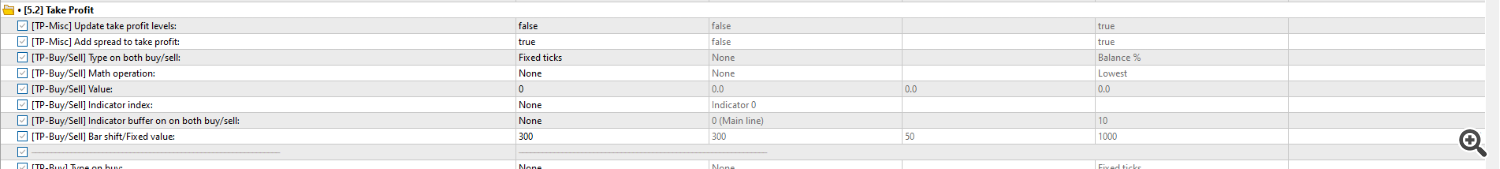

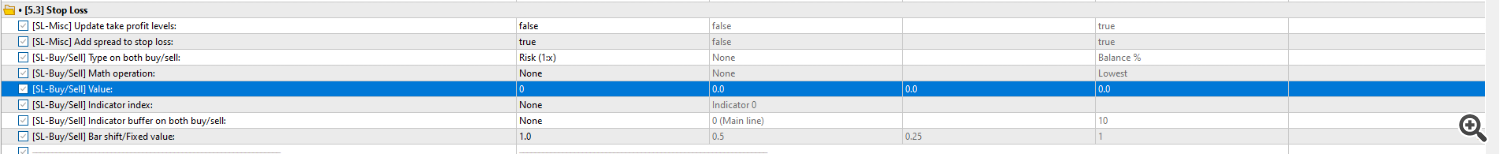

There’re many choices to decide on for tp/sl. I will take the best: take revenue by a certain quantity of ticks. The cease loss would be the tp worth multiplied by one other worth. Each will likely be optimized.

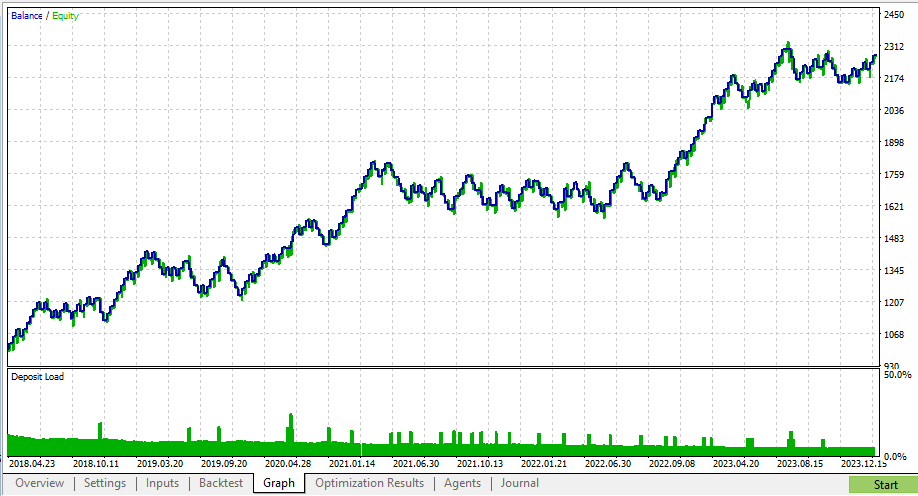

These are the outcomes after optimization:

To maintain it easy, I will not set another choice, like the danger administration, trailing cease loss/take revenue, breakeven, and so on.

The amount is ready to 0.1; the timeframe is M15; the testing interval is from 2018.04.01 to 2024.04.01; my steadiness is $1,000.00; modelling is Open costs solely.

Now that we’re able to go, these are the outcomes:

Fairly good!

Discover that I may use Sluggish Stochastic to additionally purchase/promote on for a pattern technique (like, it crosses the 50 stage upwards or downwards) and the various different (30+ or customized) indicators included within the EA.

ps.: listen this doesn’t assure a future revenue.

ps2.: notice that these checks had been carried out on a dealer that gives a 0 unfold by-product of EURUSD for a small fee . The outcomes already embody this fee. Thus the outcomes could also be completely different from yours – in that case, optimize the technique so it fits your wants.

[ad_2]

Supply hyperlink

Leave a Reply