[ad_1]

Within the absence of financial studies or different information that might have an effect on the market, traders lastly paid consideration to the greenback’s overbought situation. So, there was nothing to forestall the native correction, which, by the way in which, continues to be removed from over. The market imbalances, though lowered, haven’t disappeared altogether. And aside from the info on unemployment claims in the USA, at present’s financial calendar is empty. And with the US greenback nonetheless overbought, these studies are usually not significantly essential. Furthermore, claims are anticipated to extend by 4,000, and that is extremely small. So we are able to principally say that nothing will change. Such minor adjustments are usually not able to influencing investor sentiment. In different phrases, the pair will doubtless appropriate increased on Thursday.

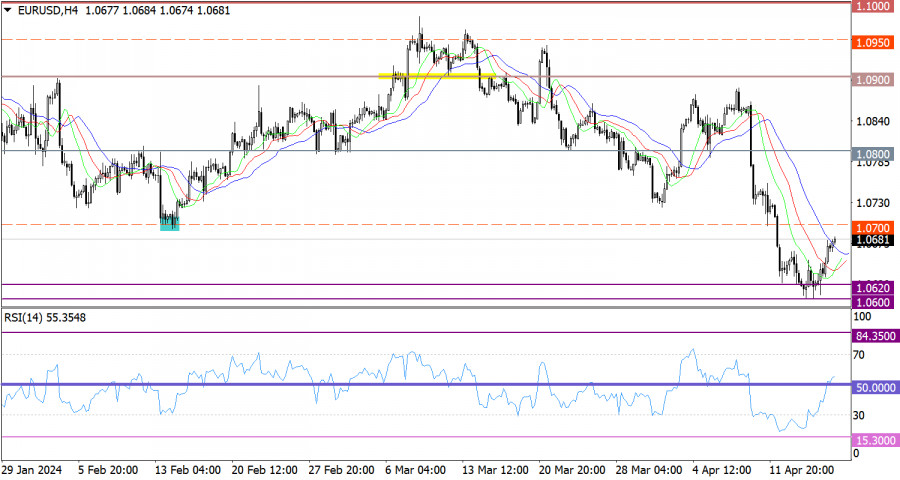

The EUR/USD pair has began a long-awaited corrective motion. The help stage at 1.0600 performed a job, which the quote just lately approached.

The RSI has left the oversold zone on the 4-hour chart, and it has upwardly crossed the 50 shifting common. This means a rise within the quantity of lengthy positions within the euro.

On the identical timeframe, two out of three of the Alligator’s MAs are intertwined, similar to an indication of a slowdown within the downtrend cycle.

Outlook

Contemplating the extent of the euro’s weak point, we are able to assume that there’s nonetheless room for extra motion. Because of this, the pair is predicted to rise to the extent of 1.0700.

[ad_2]

Supply hyperlink

Leave a Reply