KEY

TAKEAWAYS

- The opportunity of just one rate of interest minimize and escalation of geopolitical tensions will increase uncertainty ranges for traders

- The 100-day easy shifting common may very well be the S&P 500’s subsequent help degree

- Huge selloff in Tech shares sends the Nasdaq Composite beneath its 100-day shifting common

What a distinction every week makes.

Final week, the inventory market modified its tune from up, up, up,… to up, down, up, down. That made it really feel like traders have been unsure, but the CBOE Volatility Index ($VIX) wasn’t excessive sufficient to substantiate the worry. This week, the market’s singing one other tune emphasizing the phrase “down.” This week, the promoting strain was extra dominant, particularly within the Tech sector. Does this imply the bear is popping out of hibernation?

The Macro Surroundings

We heard feedback from two Federal Reserve Presidents, John Williams and Austan Goolsbee, who left open the potential of a price hike. Fed Chair Jerome Powell steered rates of interest may stay larger for longer. Subsequent week, we’ll get the March PCE knowledge, and, in gentle of the Fed feedback, it may very well be larger than estimates.

We’ll additionally get the Q1 GDP, which is able to in all probability reveal the continued energy of the US economic system. If the economic system continues to be resilient, we might not see a price minimize this yr. As of now, the inventory market has priced in a minimum of one price minimize in 2024, which is totally different than the 4 that have been anticipated earlier within the yr.

In a “larger for longer” rate of interest atmosphere, two occasions that might have intensified the promoting strain on the finish of the week are:

- Escalating geopolitical tensions within the Center East, which, in the meanwhile, have tapered.

- Choices expiration day, which implies heavy buying and selling quantity.

No one needs to open new positions on a Friday, particularly after a risky buying and selling week. Something may occur over the weekend, and merchants would slightly be affected person and wait to see if the inventory market has additional to fall earlier than leaping in.

The Broader Market

You have heard the adage, “Markets take the steps up and the elevator down.” You possibly can see this play out within the charts of the broader indexes.

The S&P 500

The S&P 500 ($SPX) closed beneath 5,000, a major psychological degree. On the each day chart, the index broke beneath its 50-day easy shifting common (SMA) and is now approaching its 100-day SMA. The final six days have been an elevator journey down and, the best way the chart seems, there may very well be extra promoting subsequent week.

FIGURE 1. DAILY CHART OF THE S&P 500. Because the S&P 500 fell beneath its 50-day SMA, it is taken the elevator down. The index is now approaching its 100-day SMA, which may very well be its subsequent help degree. Will it fall beneath the help?Chart supply: StockCharts.com. For academic functions.

On the weekly chart, the S&P 500 is above its 50-week SMA, however has three consecutive down weeks, which does not paint a reasonably image. Proper now, it seems as if the index has additional to fall.

The Dow Jones Industrial Common

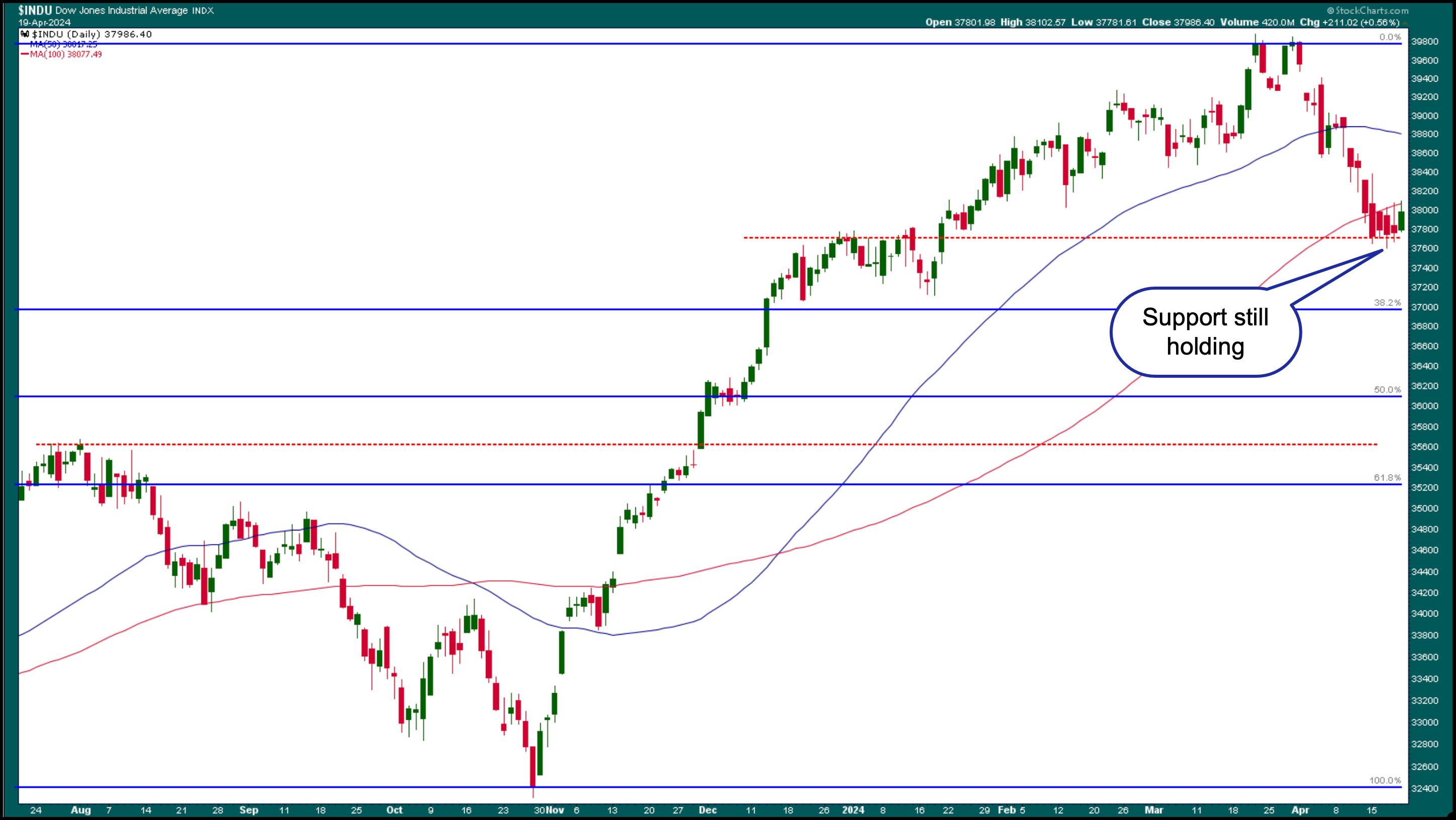

After its most up-to-date selloff, the Dow Jones Industrial Common ($INDU) is buying and selling round a help degree (December 2023 excessive). The each day chart beneath reveals that though the index closed larger on Friday, it hit resistance from its 100-day SMA.

FIGURE 2. DAILY CHART OF DOW JONES INDUSTRIAL AVERAGE ($INDU). After its elevator journey down, $INDU seems to have hit a help degree and making an attempt to reverse, which is a constructive signal.Chart supply: StockCharts.com. For academic functions.

The Nasdaq Composite

The Expertise sector was hit onerous this week. NVIDIA (NVDA) fell over 9% on Friday; Tesla (TSLA) shares continued to fall, hitting a brand new 52-week low; and Superior Micro Units (AMD) fell over 5%.

Tremendous Micro Computer systems (SMCI), which has been within the high 5 StockCharts Technical Rank (SCTR) for months, fell over 23%. The selloff was attributable to the corporate’s resolution to not preannounce its earnings outcomes because it has up to now.

Seems like traders have been taking their Tech inventory income. On account of the large Tech selloff, the Nasdaq Composite is buying and selling beneath its 100-day SMA (see chart beneath).

FIGURE 3. DAILY CHART OF NASDAQ COMPOSITE. After falling beneath its 100-day SMA, the Nasdaq Composite may slide to its 200-day SMA. The small wick on the backside is barely encouraging, however subsequent week is one other week.Chart supply: StockCharts.com. For academic functions.

Each time there is a large selloff, as was the case this week, traders query whether or not the market has hit a backside and if it is a perfect time to open lengthy positions. There was a bit of little bit of that on Friday, however each time the market rallied, it met strain from sellers and the rally fizzled. When technicals nonetheless level decrease, you might need to undertake a “wait and see” strategy earlier than getting into lengthy positions.

No one is aware of what’s going to occur subsequent week, however tech corporations will begin reporting earnings, and that might carry the inventory market.

Some Vivid Spots

After experiencing a plunge much like that of the broader indexes, the Monetary sector is exhibiting indicators of a reversal. The each day chart of the Monetary Choose Sector SPDR (XLF) beneath reveals a doable reversal, though a collection of upper highs and better lows is required earlier than an uptrend could be established. XLF would want to interrupt above.

FIGURE 4. DAILY CHART OF FINANCIAL SELECT SECTOR SPDR ETF (XLF). Seems like XLF must overcome the resistance from its 50-day shifting common earlier than its development reverses.Chart supply: StockCharts.com. For academic functions.

Shares of Financial institution of America (BAC), JP Morgan Chase (JPM), Citigroup (C), and Wells Fargo (WFC) all traded larger on Friday. WFC’s inventory worth reached a brand new all-time excessive. Valuable metals, corresponding to gold and silver, are buying and selling larger. As geopolitical tensions come up, traders flip to those safe-haven investments.

It was fascinating to see the CBOE Volatility Index ($VIX) hit a excessive of 21.36, near the 23 degree it hit in October final yr. However it pulled again and closed at 18.71. The upper volatility may have been due to choices expiration.

When you take a look at the chart of the Nasdaq Composite, you will see that this coincided with the October selloff in Tech shares. Will the broader markets comply with an identical path, given Tech earnings begin subsequent week? We’ll have to attend and see.

The Backside Line

This week’s inventory market motion wasn’t nice, and whereas it is tempting to seek out bargains in shares, it is best to train persistence. As a substitute of chasing positions, it is a superb time to investigate charts and observe the market’s actions. This could go a great distance in understanding the irrational nature of the inventory market.

Finish-of-Week Wrap-Up

- S&P 500 closes down 0.88% at 4,967.23, Dow Jones Industrial Common up 0.56% at 37,986; Nasdaq Composite down 2.05% at 15,282.01

- $VIX up 3.94% at 18.71

- Greatest performing sector for the week: Utilities

- Worst performing sector for the week: Expertise

- High 5 Massive Cap SCTR shares: MicroStrategy Inc. (MSTR); Coinbase World Inc. (COIN); Tremendous Micro Pc, Inc. (SMCI); Vistra Vitality Corp. (VST); Vertiv Holdings (VRT)

On the Radar Subsequent Week

- Q1 2024 US GDP

- March Core PCE

- March Sturdy Items Orders

- Earnings season is in full swing with Alphabet (GOOGL), Meta Platforms (META), Tesla (TSLA), Microsoft (MSFT), Intel Corp. (INTC), and Visa (V) reporting.

Disclaimer: This weblog is for academic functions solely and shouldn’t be construed as monetary recommendation. The concepts and methods ought to by no means be used with out first assessing your individual private and monetary state of affairs, or with out consulting a monetary skilled.

Leave a Reply