KEY

TAKEAWAYS

- The Nasdaq Composite is buying and selling above its final swing excessive, which might a the primary signal of a reversal to the upside

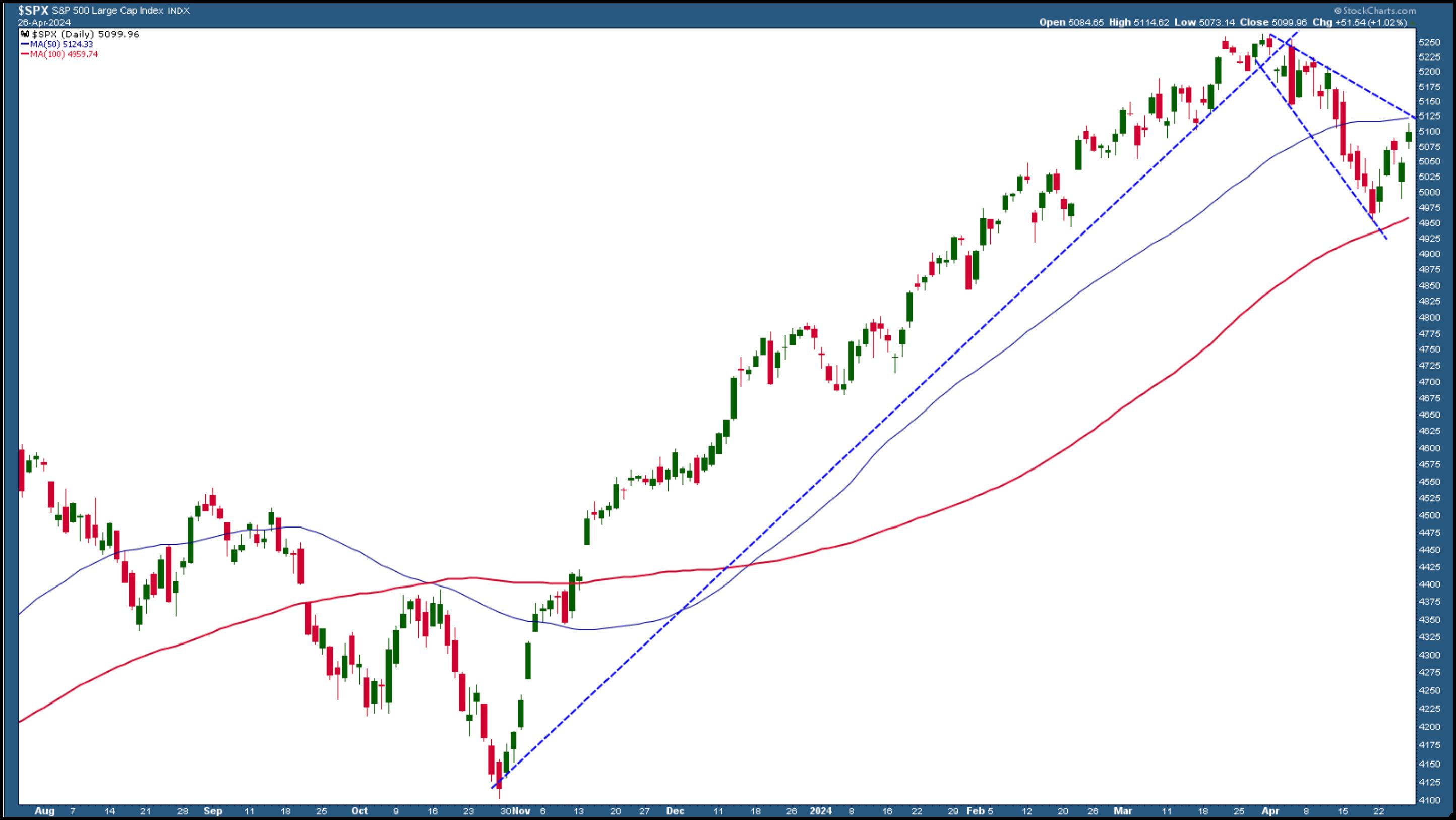

- The S&P 500 is up towards resistance from its 50-day shifting common and a downward sloping trendline

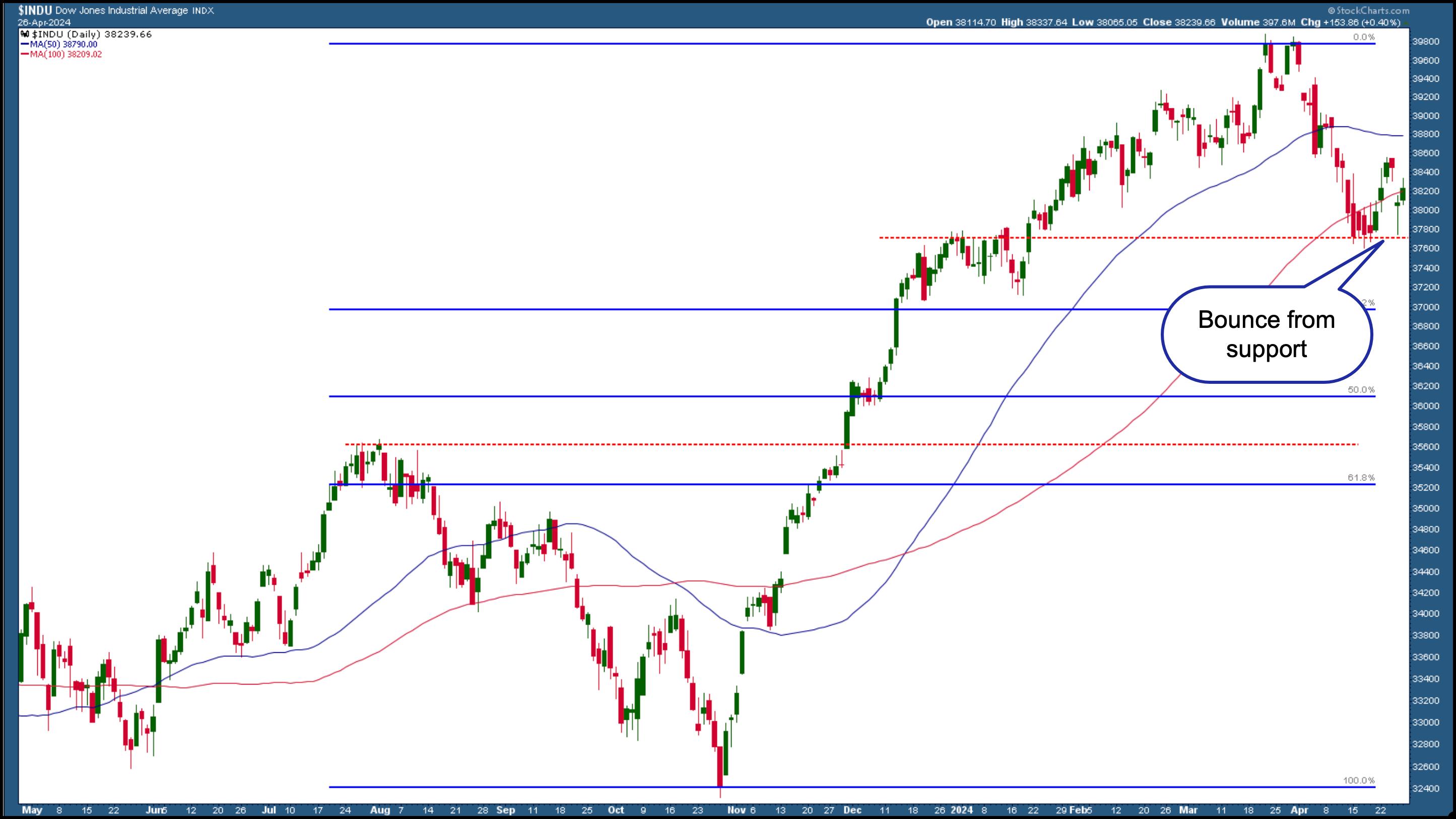

- The Dow Jones Industrial Common has reversed from a assist stage and is above its 50-day shifting common

A tug-of-war with no clear winner—that is what the inventory market appeared to be taking part in this week. With a Fed assembly, key financial information, and extra earnings on high, will a winner emerge subsequent week?

It was an fascinating week within the inventory market. Financial information reveals that progress is slowing, whereas inflation is not exhibiting indicators of slowing down. This potential “stagflation” situation paves a path in the direction of extra uncertainty, particularly with regards to rates of interest. And with subsequent week’s Fed assembly, buyers have gotten much more cautious about making any buying and selling or investing choices.

Trying again ultimately week, we will see how Tesla (TSLA) bounced larger after it missed earnings. Meta Platforms (META) beat earnings estimates, however its inventory worth gapped decrease on weak Q2 steering. That was a priority, since META has been having fun with a bullish rally for the reason that finish of 2022. It stays to be seen if the hole up in META’s inventory worth on February 2, 2024 will get crammed. The inventory is buying and selling at its 100-day easy shifting common (SMA), which may very well be a assist stage the inventory bounces from; nevertheless, META might additionally find yourself breaking under it and sliding additional.

Traders have been involved by META’s weak steering, as they have been searching for Tech earnings to be the catalyst that pushes the market larger. After META took a lot of the market decrease, the following fear was whether or not the opposite Tech shares would comply with the identical path. Thankfully, that did not happen. Microsoft (MSFT), Alphabet (GOOGL), and Snap (SNAP) all beat earnings, and their inventory costs moved larger, reversing the downtrend.

Is that this Reversal Sustainable?

The constructive earnings excited the bulls, however it felt like they hit a wall. There wasn’t sufficient follow-through to push the inventory market indexes larger, and the bears did not appear to be focused on placing up a lot of a battle.

Whereas the S&P 500 ($SPX), Dow Jones Industrial Common ($INDU), and Nasdaq Composite ($COMPQ) traded larger on Friday, the weekly chart reveals the S&P 500 and Nasdaq did not shut above final week’s excessive. The Dow did shut barely larger, although.

The day by day charts are extra enticing. Under is the day by day chart of the Nasdaq Composite, which reveals that, after final Friday’s low, the index moved larger, then fell on Thursday earlier than recovering these losses on the shut of the buying and selling day. Immediately (Friday, April 26), the Nasdaq gapped larger and closed above Wednesday’s swing excessive.

CHART 1. DAILY CHART OF NASDAQ COMPOSITE. After closing larger than the final swing excessive, there’s hope the Nasdaq might rally larger relying on what unfolds subsequent week. Chart supply: StockCharts.com. For instructional functions.

The Nasdaq Composite is getting near its 50-day SMA, which might be a powerful resistance stage for the index.

Transferring on to the S&P 500, the index is up towards resistance from its 50-day SMA, which coincides with a downward-sloping trendline.

CHART 2. DAILY CHART OF S&P 500 INDEX. If the S&P 500 breaks above the downward sloping trending on the highest of the channel and its 50-day shifting common, there may very well be upside follow-through. Chart supply: StockCharts.com. For instructional functions.

The Dow is probably the most bullish of the three broad indexes. It has seen a transparent reversal from a assist stage (purple dashed line), and any bullish information subsequent week will possible transfer the index larger.

CHART 3. DAILY CHART OF THE DOW JONES INDUSTRIAL AVERAGE. A transparent bounce from a major assist stage might imply the Dow has extra shopping for than promoting strain. Chart supply: StockCharts.com.

Which Means Will the Inventory Market Transfer?

It seems just like the bulls are hungry to be the extra dominant participant. If any information blocks the bulls from taking this market any larger, the bears might be fast to take over. Keep in mind, the market takes the steps up and the elevator down. The market will most likely proceed to see some choppiness till Wednesday afternoon, when the Fed makes its rate of interest choice. That can most likely be what’s going to take the inventory market down or up.

Finish-of-Week Wrap-Up

- S&P 500 closes up 1.02% at 5,099.96, Dow Jones Industrial Common closes up 0.4% at 38,239.66; Nasdaq Composite closes up 2.03% at 15,927.90

- $VIX down 2.28% at 15.02

- Greatest performing sector for the week: Know-how

- Worst performing sector for the week: Supplies

- High 5 Giant Cap SCTR shares: Tremendous Micro Laptop, Inc. (SMCI); Coinbase International Inc. (COIN); Vertiv Holdings (VRT); MicroStrategy Inc. (MSTR); Vistra Power Corp. (VST)

On the Radar Subsequent Week

- April ISM Manufacturing PMI

- Fed rate of interest choice

- Fed Chairman Powell’s Press Convention

- March JOLTS Job Openings report

- April Non Farm Payrolls (Jobs) Report

- April ISM Providers

- Earnings season continues with Amazon (AMZN), Superior Micro Units (AMD), Eli Lilly (LLY), Barrick Gold (GOLD) and Reserving Holdings (BKNG) reporting.

Disclaimer: This weblog is for instructional functions solely and shouldn’t be construed as monetary recommendation. The concepts and techniques ought to by no means be used with out first assessing your individual private and monetary state of affairs, or with out consulting a monetary skilled.

Jayanthi Gopalakrishnan is Director of Website Content material at StockCharts.com. She spends her time developing with content material methods, delivering content material to teach merchants and buyers, and discovering methods to make technical evaluation enjoyable. Jayanthi was Managing Editor at T3 Customized, a content material advertising company for monetary manufacturers. Previous to that, she was Managing Editor of Technical Evaluation of Shares & Commodities journal for 15+ years.

Study Extra

Leave a Reply