[ad_1]

Monitoring the modifications within the provide held by entities with varied Bitcoin balances gives perception into investor conduct and potential worth actions. Every class of holder—from particular person retail buyers to massive establishments—performs a definite function within the crypto ecosystem, and their collective actions can considerably affect the general market.

Adjustments within the provide distribution amongst totally different pockets sizes is usually a robust indicator of market sentiment. As an illustration, small entities accumulating BTC typically suggests elevated retail curiosity and probably a bullish sentiment amongst particular person buyers who might view present costs as engaging for entry or funding enlargement. Redistribution by bigger entities might characterize varied methods or responses to the market, together with profit-taking, portfolio rebalancing, or reactions to regulatory or financial modifications. This exercise is essential as it would characterize institutional or skilled buyers’ views, which is usually a bellwether for broader market strikes.

The focus of Bitcoin in massive wallets, or its dispersal throughout a broader vary of smaller holders, impacts the liquidity and volatility of the market. A excessive focus in a couple of wallets can result in elevated volatility if these entities resolve to maneuver massive parts of their holdings. Conversely, a extra distributed base of small and medium holders can improve market stability and liquidity, as gross sales or purchases are much less more likely to affect the value drastically.

Understanding which market segments are rising or shrinking can present insights into how exterior components affect several types of buyers.

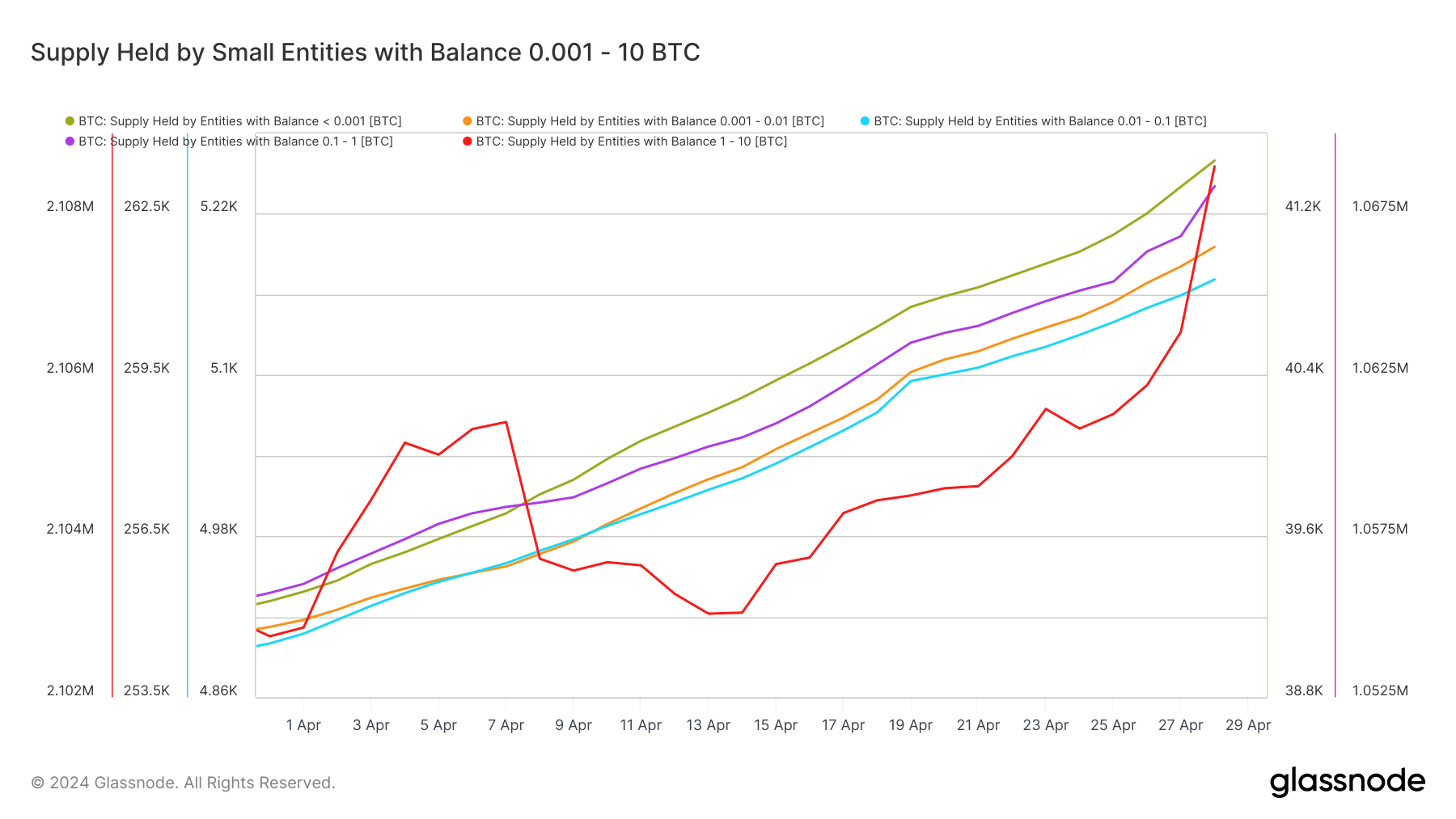

Knowledge from Glassnode confirmed a rise within the provide of Bitcoin held throughout all classes of smaller entities, starting from entities with a stability of lower than 0.0001 BTC to balances as much as 10 BTC. Entities with a stability between 0.01 – 0.1 BTC noticed the most important improve of their Bitcoin holdings. This group’s provide elevated from 254,503.7 BTC to 261,281.4 BTC. It represents a rise of 6,777.7 BTC, the best absolute improve among the many smaller entity teams noticed over the previous 30 days.

This vital improve might point out a rising confidence amongst what could be thought of “informal” buyers—people who aren’t simply dipping their toes within the Bitcoin market however are probably utilizing it as a minor but significant part of their crypto holdings. The rise throughout all of those entities signifies they’re accumulating. With Bitcoin’s worth dropping from $73,000 to $63,000 over the previous month, the timing helps the notion that these buyers are shopping for the dip, probably viewing decrease costs as a gorgeous entry level. This conduct is attribute of retail buyers and smaller market contributors who might understand long-term worth at lower cost factors.

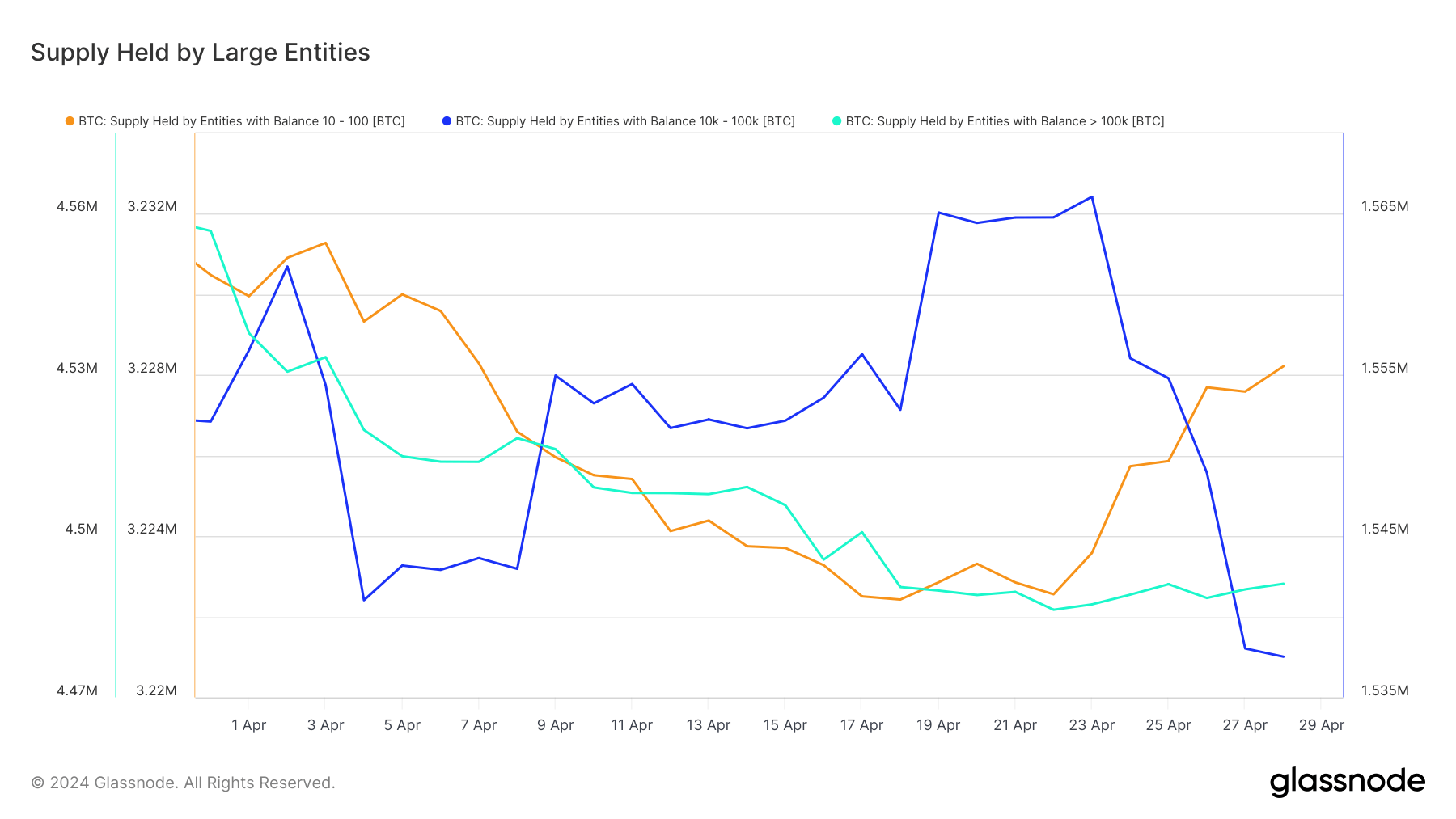

Conversely, bigger entities confirmed combined modifications of their balances, with most exhibiting decreases over the previous 30 days.

The discount in holdings among the many largest entities could possibly be attributed to a number of components, together with the promoting pressures from ETF outflows, notably from merchandise like GBTC, and miners promoting their holdings to understand earnings or cowl operational prices amidst a lower-price atmosphere. The motion in massive balances aligns with institutional conduct, the place changes in holdings could be strategic or a response to market circumstances.

The put up Small Bitcoin holders are accumulating at the same time as costs fall appeared first on CryptoSlate.

[ad_2]

Supply hyperlink

Leave a Reply