[ad_1]

Goldman’s push into client finance continues to be a catastrophe. Whereas CEO David Solomon had grand plans, your complete transfer has confirmed to be an unmitigated catastrophe.

The foray value the corporate about $6 billion from 2020 by means of the primary quarter of this yr. So, the nice unwinding continues.

We discovered yesterday that Barclays is the main contender to take over the GM bank card enterprise that Goldman acquired in 2020. Apparently, its most important competitor in that course of was Barclays.

GM’s bank card enterprise has about $2 billion in excellent balances, down from $3 billion in 2020. The deal has not closed but, and it might come undone as an settlement on value has not but been reached.

Subsequent on the chopping block will doubtless by the Apple Card which Goldman has additionally indicated it’s excited by offloading.

It has been fascinating to observe the journey of Goldman’s client enterprise since 2016. At some point, it can present a wealthy case research for enterprise faculty college students.

Featured

> GM in Talks to Transfer Credit score-Card Enterprise From Goldman to Barclays

Deal together with roughly $2 billion of card balances might be struck by summer time.

From Fintech Nexus

> General U.S. buyer satisfaction with BNPL grows: research

By Craig Ellingson

As scrutiny of Purchase Now Pay Later will increase, so too do satisfaction scores amongst prospects utilizing the short-term financing mechanism structured like an installment mortgage.

> SoFi experiences sturdy Q1 income and income

By Fintech Nexus Employees

SoFi is the primary publicly traded fintech to report earnings and it was a powerful report with income, revenue and member development.

Podcast

Mitch Jacobs, Founder & CEO of Plink on transaction personalization

The CEO and founding father of Plink explains why even right this moment banks are unable to completely make the most of the cardboard transaction information that exists…

Webinar

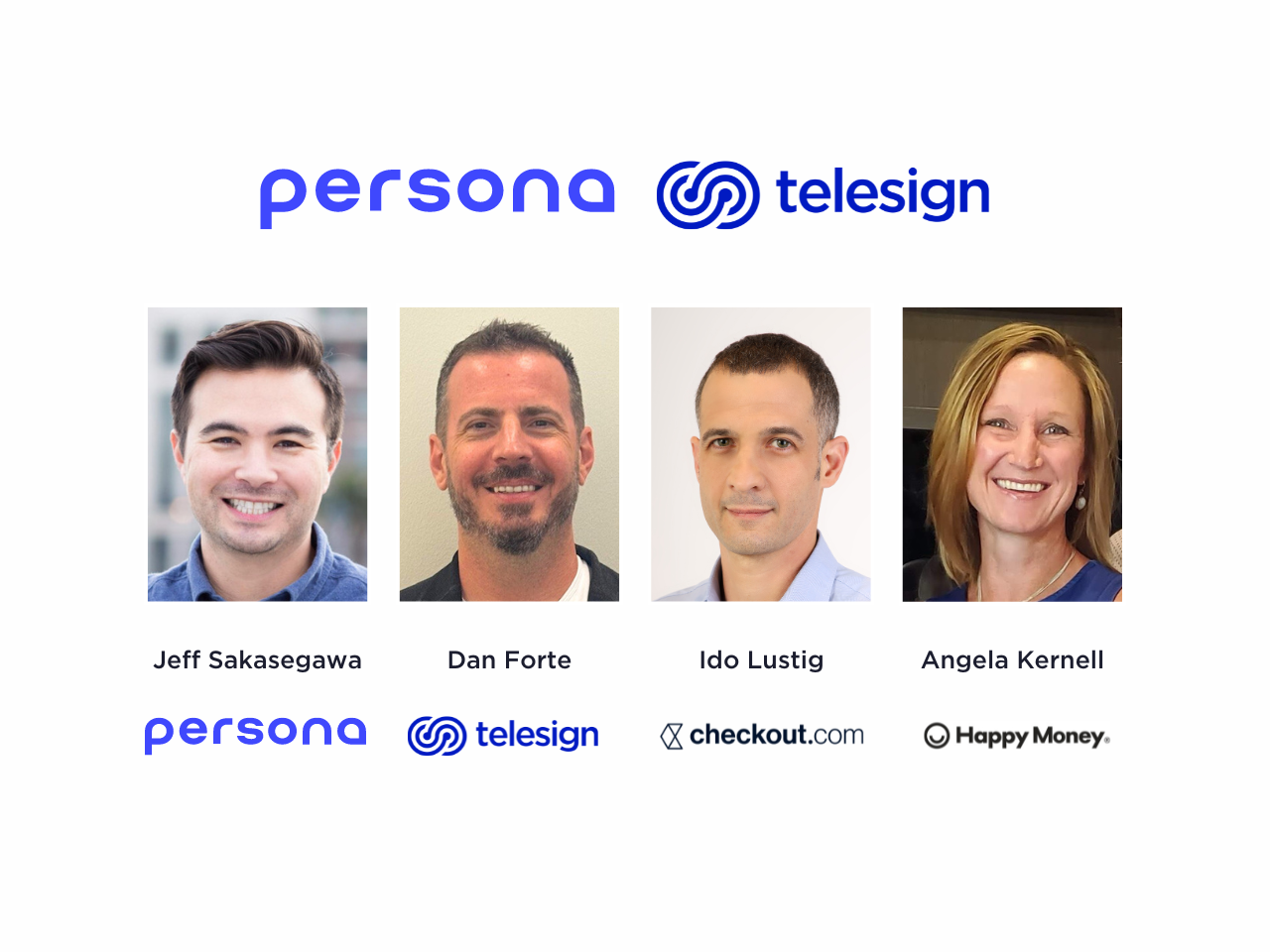

Maximize Conversions, Reduce Fraud at Account Opening

Might 2, 2pm EDT

Each banks and fintech need onboarding new prospects to be safe, easy and quick. However there’s a delicate steadiness. Make…

Additionally Making Information

- USA: SBA’s push to revive an previous thought

Isabel Casillas Guzman, administrator of the Small Enterprise Administration, needs the company to become involved in direct lending, a observe that was discontinued throughout the Clinton administration. Congress has not embraced the concept, to place it mildly.

To sponsor our newsletters and attain 180,000 fintech fanatics along with your message, contact us right here.

[ad_2]

Supply hyperlink

Leave a Reply