[ad_1]

KEY

TAKEAWAYS

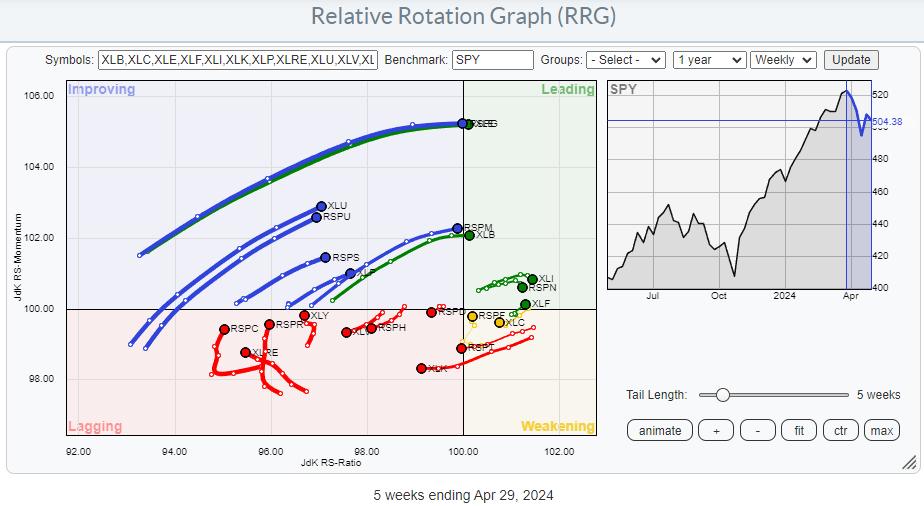

- Evaluating equal weighted and cap weighted sectors on a Relative Rotation Graph can provide fascinating insights

- When the trajectory of the tails and their place on the chart differ considerably it warrants an additional investigation

- For the time being two sectors are exhibiting such divergences

All On The Similar Observe …. or?

The distinction between equal-weighted sectors and cap-weighted sectors is apparent. The cap-weighted variant is way heavier and is impacted by the adjustments in some heavy-weight, typically mega-cap, shares.

However, while you plot these sectors on Relative Rotation Graphs, you’ll typically discover that their tails usually transfer in the identical course and/or observe the identical path.

When that doesn’t occur, when the tails of the 2 variations of the identical sector are on totally different paths or in utterly totally different positions on the RRG, it is time to examine.

The RRG above exhibits the 2 universes, cap-weighted and equal-weighted, plotted on the identical RRG and in opposition to SPY because the benchmark. Wanting carefully, you will discover most sector pairs on the identical trajectory. In case you have a SC account, you possibly can click on on the graph, open the RRG in your personal account, and do a better inspection.

*It can save you RRGs as bookmarks in your browser. By doing that, you possibly can create your personal customized RRGs and save them for later retrieval. Scroll to the underside of the web page, click on “permalink,”

Zooming in

then save this hyperlink as a bookmark in your browser.

then save this hyperlink as a bookmark in your browser.

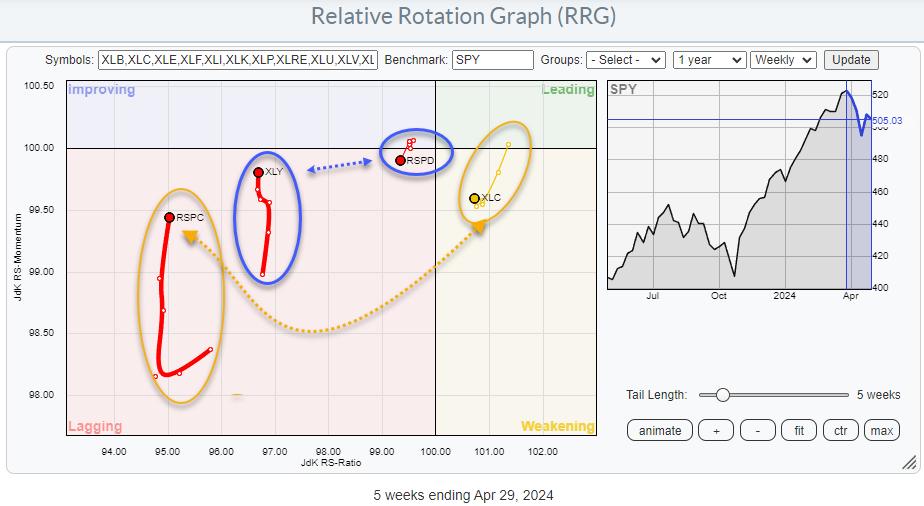

To get a greater deal with and a clearer image, I’ve eliminated the sectors the place bot tails are on comparable trajectories and positions and solely left the tails on the graph the place they differ.

Two sectors stay. Shopper Discretionary and Communication Companies.

Shopper Discretionary

Each tails are contained in the lagging quadrant. Nevertheless, that’s so far as the comparability goes. XLY is shifting larger on the RS-Momentum scale, indicating an enchancment in relative momentum, whereas RSPD is shifting decrease and is on a detrimental RRG-Heading. Additionally, the tail on XLY is considerably longer than on RSPD, indicating the ability behind the transfer.

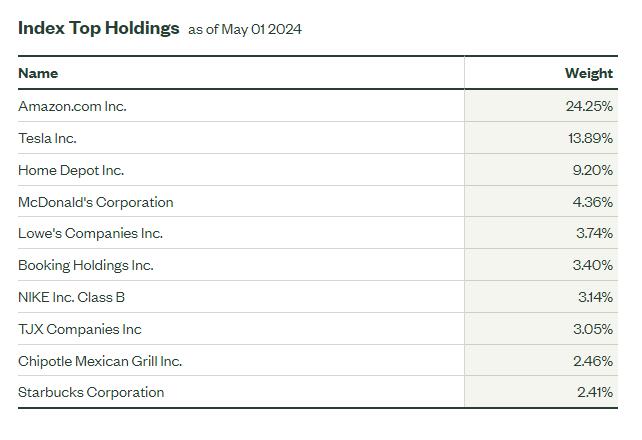

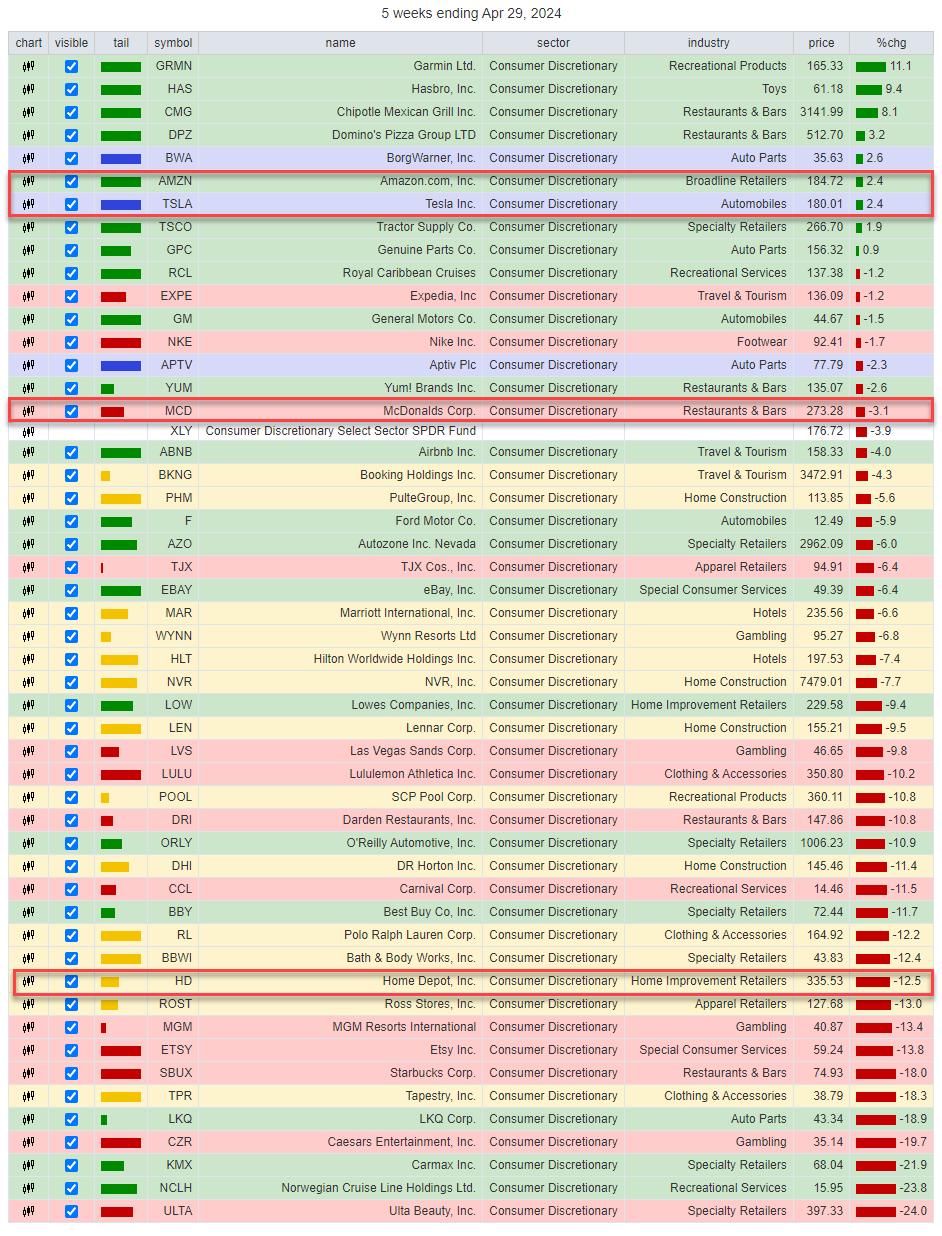

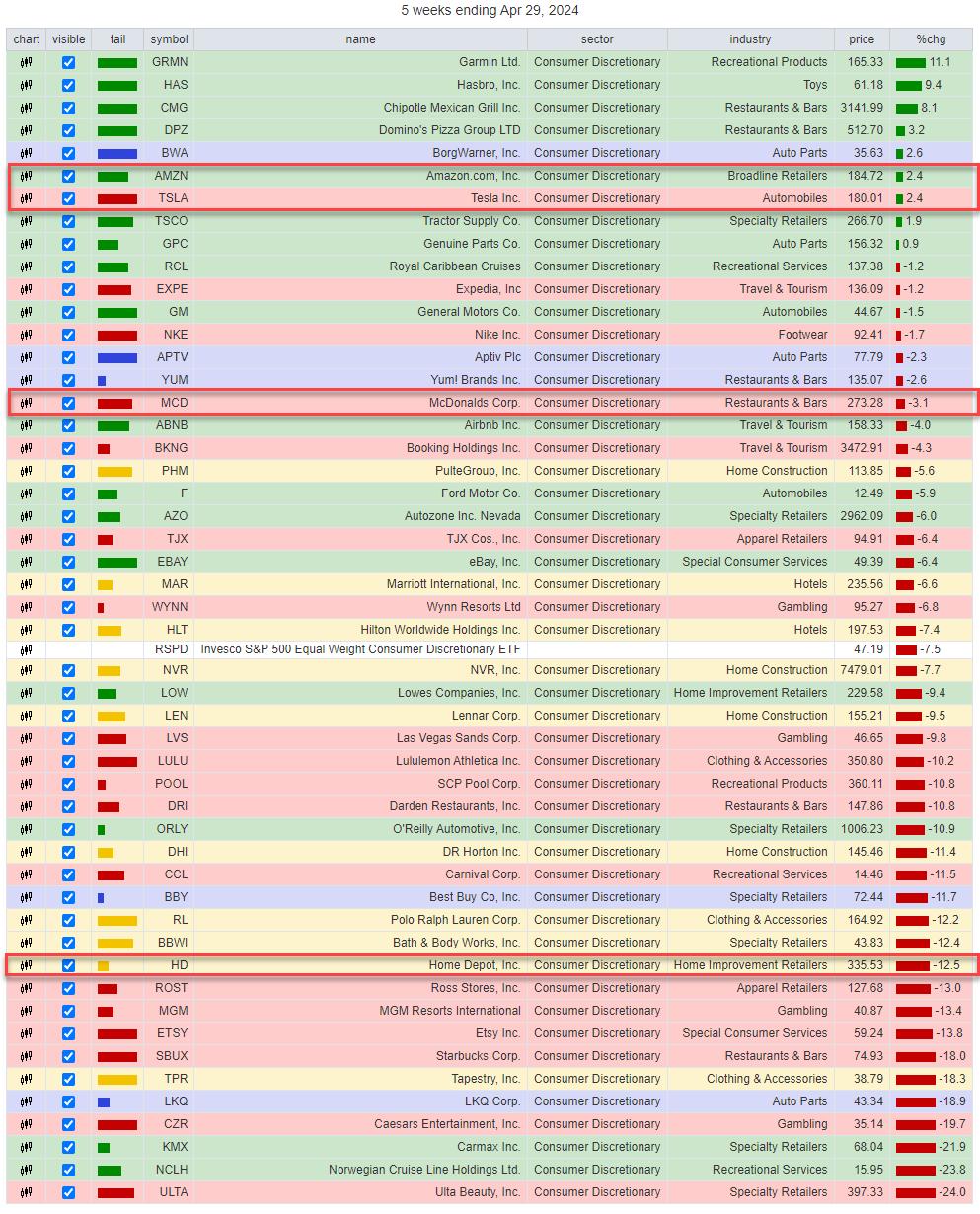

Wanting on the composition of the sector, it is apparent which shares inside Shopper Discretionary are inflicting the distinction.

AMZN, TSLA, HD, and MCD comprise 50% of the index, whereas AMZN and TSLA are already 38%.

Wanting on the efficiency over the past 5 weeks (tail size on the RRG), we are able to see how the sector’s efficiency has shifted to the big names. The desk above exhibits the highest 50 shares within the discretionary sector. AMZN and TSLA are within the higher finish of the vary, and MCD is simply above XLY, which is at place 17 out of fifty…

This means that almost all shares are performing worse than that sector index. Roughly the underside half is at double-digit declines. And nonetheless, whereas AMZN and TSLA are “solely” up 2.4%, they drag the sector index as much as round 1/3 of your complete universe, even with HD exhibiting a 12.5% decline over that interval.

Now, take a look at the identical desk. As an alternative of utilizing XLY because the benchmark, we at the moment are utilizing RSPD because the benchmark.

RSPD is exhibiting up at place 27 / 50. Proper, the place you’d anticipate an equal weight benchmark. In the midst of the universe, balancing out all of the performances.

The underside line is that XLY has been selecting up lately solely due to TSLA, AMZN, and MCD. However below the hood, most discretionary shares are going by way of a horrible correction.

From a buying and selling perspective, such observations can provide nice pair buying and selling concepts, XLY:RSPD

Communication Companies

The tails for XLC and RSPC are additionally far aside on the RRG. XLC continues to be contained in the weakening quadrant and has simply began to point out the primary indicators of curling again up. RSPC is deep contained in the lagging quadrant at a extremely low studying on the RS-Ratio scale total and is selecting up relative momentum however no relative pattern (RS-Ratio) but.

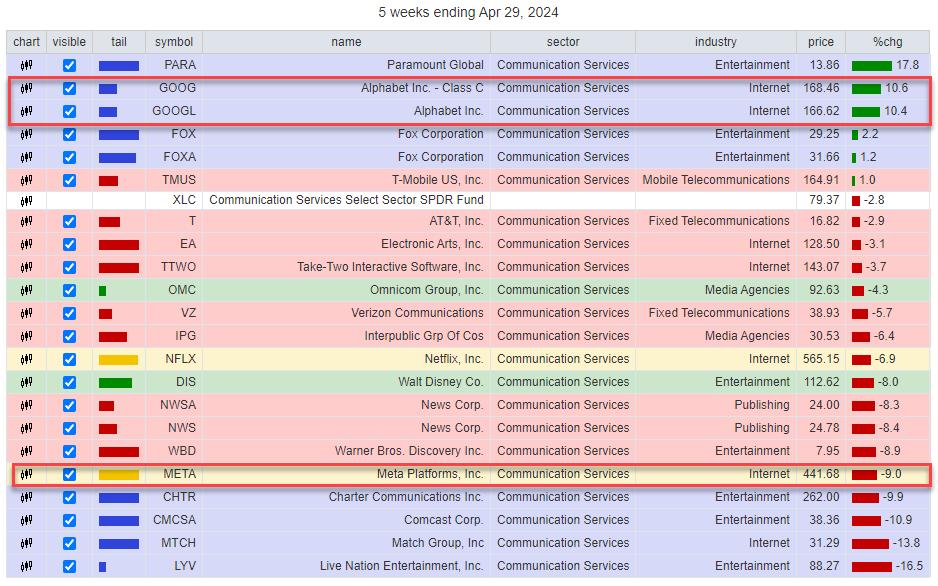

Over the five-week interval, XLC misplaced 2.8%, whereas RSPC misplaced 4.3%

The composition for this sector is much more top-heavy than Shopper Discretionary

META is listed as the highest holding in XLC at 21%. However after we add up the weights for Alphabet A and B it comes out at 26%. So collectively the highest two shares in XLC are a whopping 47% of the sector.

Wanting on the identical desk for XLC we discover Alphabet on the high of the record over the past 5 weeks. Meta is within the decrease half at -9%. The sector (XLC) is available in at -2.8% which signifies that META is UNDERperforming (-9% + 2.8% =) -6.2%.

However Alphabet Class A is OUTperforming (10.4% + 2.8% = ) 13.2% and Alphabet Class C is OUTperforming (10.6% + 2.8% = ) 13.4%. This can be a method stronger upward pull for the index than the drag brought on by META.

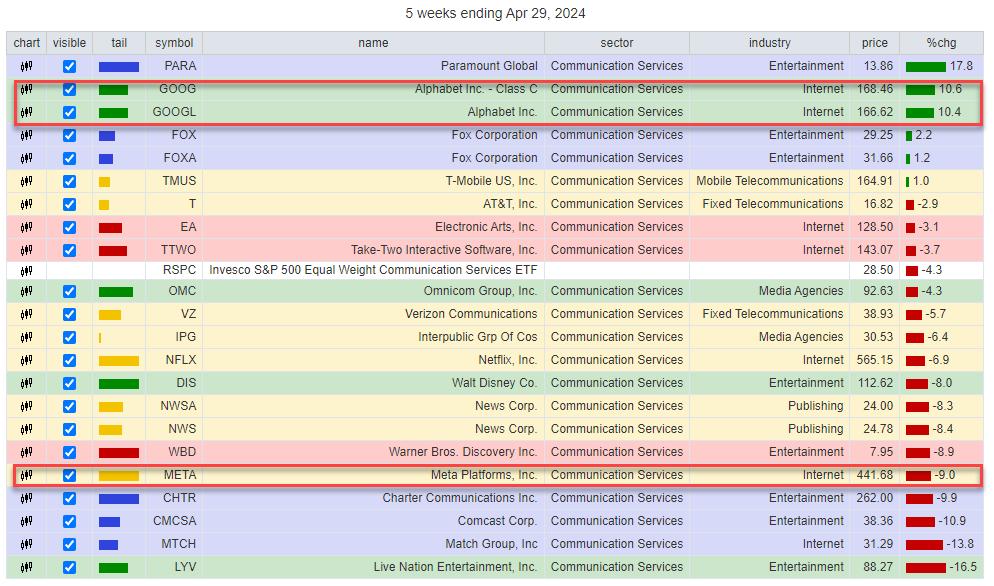

Altering the benchmark to the EW model of Communication Companies exhibits this desk

Once more we see the equal weight benchmark (RSPC) dropping to close the center of the record, balancing out the return extra evenly.

All in all, this gives an identical pair buying and selling alternative. XLC:RSPC

This relative pattern is far more mature than the XLY:RSPD pair, however so long as the rhythm of upper highs and better lows continues, shopping for the dips on this relative line presents alternatives.

More often than not the cap-weighted and equal-weighted variations of a sector will transfer kind of in tandem. However once they do not they’re value investigating as they might provide fascinating buying and selling alternatives.

#StayAlert and have an amazing weekend, –Julius

Julius de Kempenaer

Senior Technical Analyst, StockCharts.com

Creator, Relative Rotation Graphs

Founder, RRG Analysis

Host of: Sector Highlight

Please discover my handles for social media channels below the Bio under.

Suggestions, feedback or questions are welcome at Juliusdk@stockcharts.com. I can’t promise to reply to each message, however I’ll definitely learn them and, the place fairly potential, use the suggestions and feedback or reply questions.

To debate RRG with me on S.C.A.N., tag me utilizing the deal with Julius_RRG.

RRG, Relative Rotation Graphs, JdK RS-Ratio, and JdK RS-Momentum are registered logos of RRG Analysis.

[ad_2]

Supply hyperlink

Leave a Reply