[ad_1]

As buyers flock to Omaha, Nebraska of their annual pilgrimage to study from the good Warren Buffett, it appears an opportune time to replicate on the technical proof for Berkshire’s largest holding, Apple (AAPL).

Right now, we’ll think about AAPL utilizing “a number of time-frame evaluation”, through which we analyze the identical inventory from three totally different time frames. This enables us to consider how the short-term fluctuations relate the medium-term pattern, and the way the medium-term pattern matches into the longer-term secular developments at play.

First, let’s think about the short-term time-frame utilizing the day by day chart.

After an earnings launch this week that disenchanted buyers on weaker iPhone gross sales, but thrilled buyers on the announcement of the biggest buyback in Apple’s historical past, the inventory gapped larger on Friday above the 200-day shifting common. After the final two months of decrease highs and decrease lows, mixed with RSI ranges very in step with bearish phases, the inventory lastly seems to have reversed that downtrend with larger costs and improved momentum.

For now, remaining above the 200-day shifting common after the hole larger on Friday stays crucial issue on the day by day chart. It will likely be very telling within the days and weeks to come back if extra consumers are prepared to step in and pay much more for this long-term market outperformer!

For the medium-term time-frame, let’s think about the final ten months of worth motion, beginning with the July 2023 excessive round $197. After reaching that peak, AAPL pulled again to a 38.2% retracement of the 2023 rally section, discovering help proper round $169. Over the following seven-to-eight months, Apple has been rangebound, bouncing between retests of the all-time excessive earlier than returning down to check help within the $165-169 vary.

This week’s hole larger seems to substantiate that help in that vary has as soon as once more held robust, giving a transparent flooring to the worth motion for the final 12 months. With enhancing momentum, within the type of the RSI pushing above 60 on this rally, the inventory seems to be strengthening. However till we see a confirmed break above the earlier excessive round $197, I am inclined to label the medium-term time-frame as “impartial.”

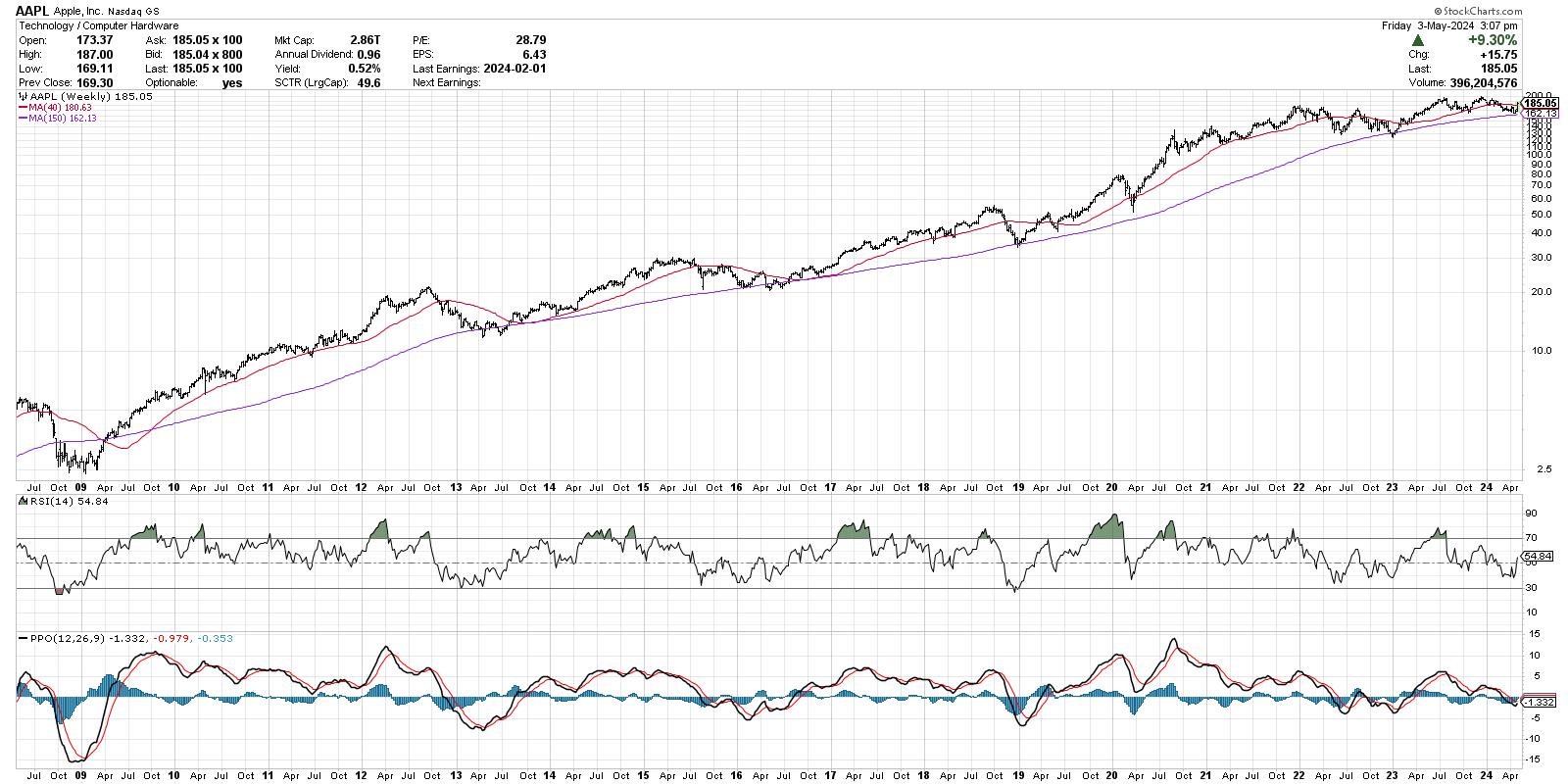

Now let’s think about the long-term pattern utilizing the weekly chart.

Fairly merely, the long-term image for AAPL is exceptionally robust. Because the 2009 market low, the inventory has skilled quite a few checks of an ascending 150-week shifting common. And in 100% of these checks, the inventory has rebounded larger, finally making a brand new all-time excessive quickly after.

Notice the RSI ranges on the weekly chart, displaying that the momentum stays within the bullish vary since late 2018. This implies that the long-term momentum is constructive, and that pullbacks to shifting common help ought to be thought-about alternatives to capitalize on short-term market weak point.

Do you suppose Apple offers a good alternative in Q2, after pulling again to check long-term shifting common help? Watch the video beneath, after which drop a remark there together with your vote!

RR#6,

Dave

P.S. Able to improve your funding course of? Take a look at my free behavioral investing course!

David Keller, CMT

Chief Market Strategist

StockCharts.com

Disclaimer: This weblog is for instructional functions solely and shouldn’t be construed as monetary recommendation. The concepts and methods ought to by no means be used with out first assessing your personal private and monetary scenario, or with out consulting a monetary skilled.

The creator doesn’t have a place in talked about securities on the time of publication. Any opinions expressed herein are solely these of the creator and don’t in any method symbolize the views or opinions of some other particular person or entity.

David Keller, CMT is Chief Market Strategist at StockCharts.com, the place he helps buyers decrease behavioral biases by means of technical evaluation. He’s a frequent host on StockCharts TV, and he relates mindfulness methods to investor resolution making in his weblog, The Conscious Investor.

David can be President and Chief Strategist at Sierra Alpha Analysis LLC, a boutique funding analysis agency targeted on managing threat by means of market consciousness. He combines the strengths of technical evaluation, behavioral finance, and information visualization to determine funding alternatives and enrich relationships between advisors and purchasers.

Be taught Extra

[ad_2]

Supply hyperlink

Leave a Reply