[ad_1]

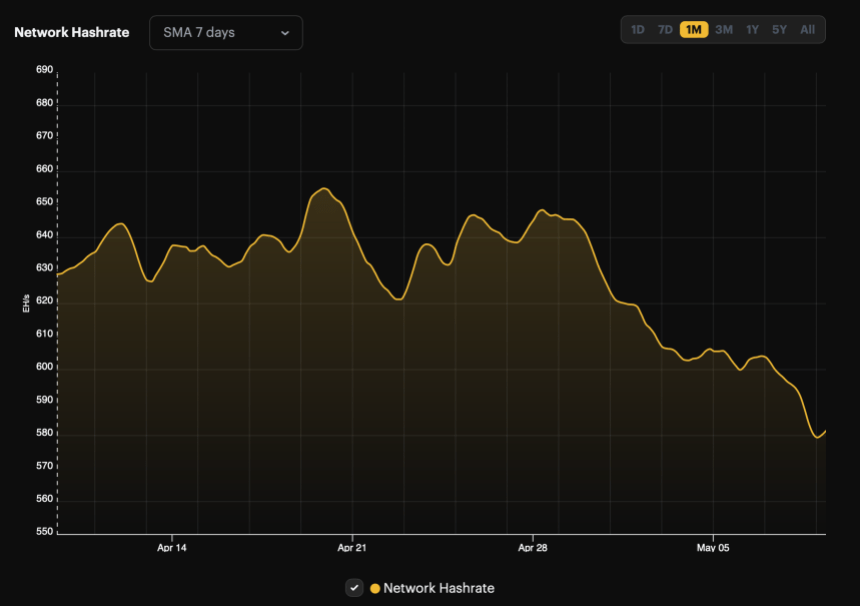

The Bitcoin mining issue has skilled a big lower, the most important drop noticed within the final 18 months. This transformation is straight tied to fluctuations within the community’s hash price, which has dipped under 600 EH/s following the latest halving occasion.

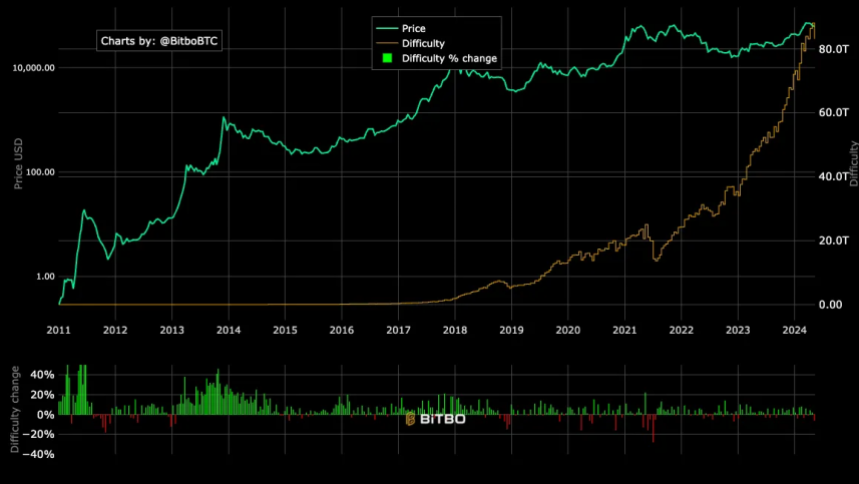

The adjustment, which marks a 5.7% fall in mining issue, brings the extent right down to 83.1 trillion, in line with information from Bitbo.

This most substantial adjustment since December 2022 displays broader shifts inside the Bitcoin mining panorama. At the moment, Bitcoin’s value hovered round $17,000, contrasting sharply with present ranges.

Notably, the mining issue, a metric that determines how difficult it’s to discover a new block, adjusts roughly each two weeks, or each 2016 blocks. This technique ensures that block discovery stays constant at round each 10 minutes, no matter the variety of miners.

Associated Studying

Impression On Miners And Market Dynamics

The latest decline in mining issue got here after a ten% drop within the community’s hash price from a seven-day transferring common of 639.58 EH/s to 581.74 EH/s.

This lower in hash price led to longer common block occasions of about 10 minutes and 36 seconds, up from the usual 10 minutes, earlier than the problem adjusted downward at block peak 842,688.

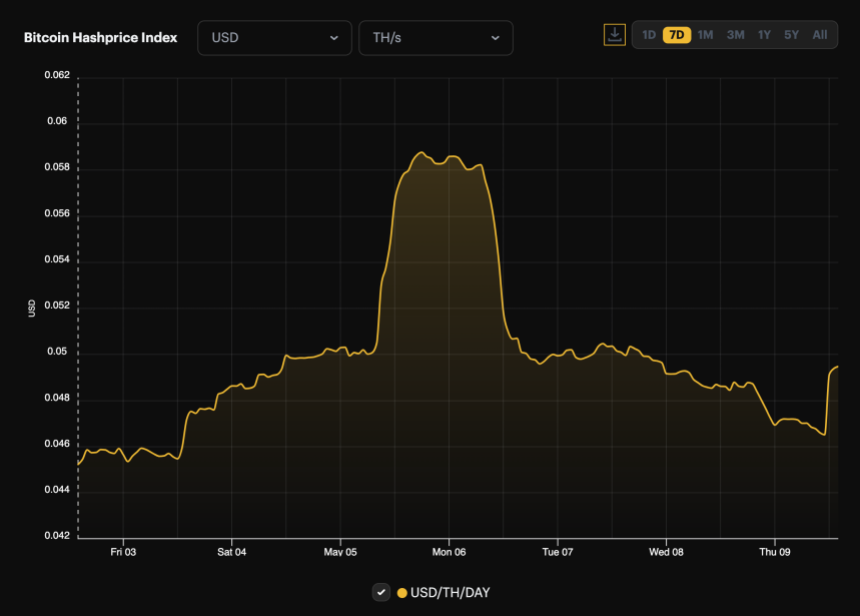

The lowered hash price additionally contributed to a brand new low within the hash value, which fell to roughly $0.049 per TH/s per day.

This decline impacts miners’ profitability, because the hash value, a time period launched by Bitcoin mining agency Luxor, represents the earnings a miner can anticipate per unit of hashing energy per day.

Nevertheless, right now’s damaging issue adjustment could present some aid for miners, making it simpler to mine blocks than within the earlier two weeks.

Bitcoin Market Reactions And Funding Traits

The changes in mining issue and hash price come when Bitcoin’s value additionally reveals indicators of volatility. After reaching a peak above $73,000 in March, the worth has fallen by 16% and is now buying and selling round $61,376.

This decline mirrors the broader development within the mining issue, suggesting a potential correlation between these metrics.

Associated Studying

Moreover, the market has noticed subdued exercise within the spot Bitcoin exchange-traded funds (ETFs). Knowledge from Soso Worth signifies minimal web inflows or outflows, with Bitwise Bitcoin ETF being the one issuer that skilled inflows yesterday.

On Could 8, the overall web influx of Bitcoin spot ETF was $11.5409 million. Grayscale ETF GBTC has no inflows and outflows. Bitwise ETF BITB noticed a single-day web influx of $11.5409 million. The entire web asset worth of Bitcoin spot ETFs is $51.504 billion. https://t.co/OkjFkXsACa

— Wu Blockchain (@WuBlockchain) Could 9, 2024

This development might signify a cooling curiosity in Bitcoin investments or a shift in investor technique following the latest value and mining changes.

Function picture from Unsplash, Chart from TradingView

[ad_2]

Supply hyperlink

Leave a Reply