[ad_1]

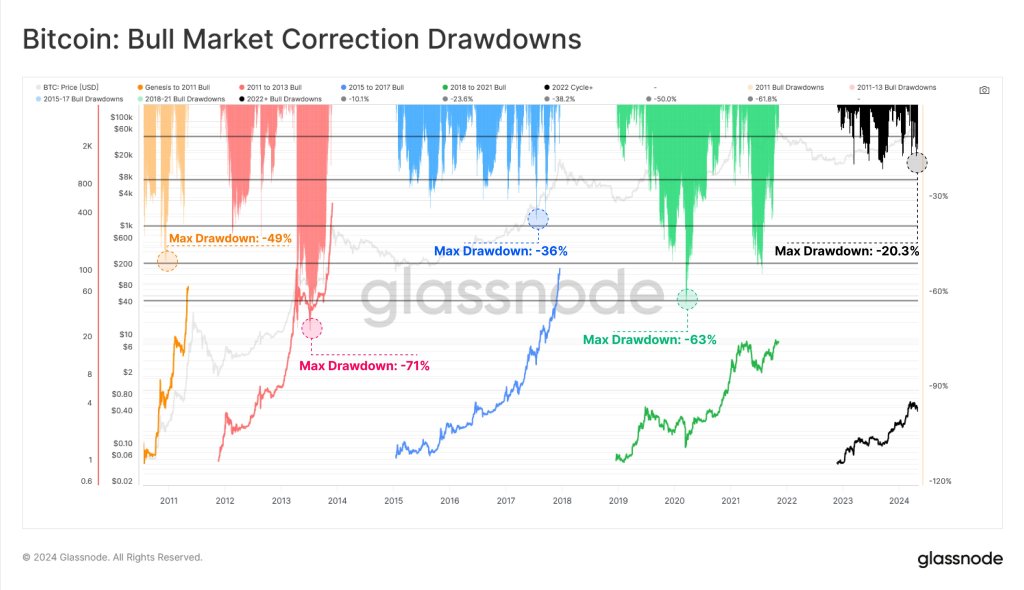

Bitcoin may need posted the deepest correction for the reason that FTX crash in November 2022, dipping over 20% from its all-time excessive of round $74,000. Nonetheless, Glassnode analysts, whereas sharing their preview on X, stay cautiously optimistic.

Bitcoin Drops 20% From March Excessive, However Glassnode Is Bullish

Glassnode notes that the Bitcoin “macro uptrend nonetheless seems to be one of many extra resilient in historical past” and that although corrections have been made, they’re comparatively shallow. With this place, the blockchain analytics platform confirms that the coin has improved with liquidity rising, lowering volatility.

Associated Studying

Following the correction from March 2023 highs, Bitcoin has struggled to keep up the uptrend. To this point, BTC has help at round $60,000, however a key response stage to observe is $56,500 on the decrease aspect. On the flip aspect, if costs get well, breaking above $66,000, BTC may rally, even breaching $72,000 and later $74,000.

Nonetheless, for bulls to search out help and costs to rally, triggers can be from elementary elements. Although value motion construction may supply help, value catalysts are, as historical past reveals, associated to market occasions.

As Glassnode observes, the strong macro pattern, bullish for Bitcoin, has tapered volatility, serving to preserve the uptrend. The more and more shallow corrections, because the blockchain analytics platform notes, level to a extra mature market backed by extra establishments.

Whales Accumulating As Establishments Eye BTC

Confidence stays excessive. On-chain information reveals that one whale has taken benefit of the comparatively low costs and the correction to stack cash.

Within the final week, the whale purchased over 100 BTC, pushing the quantity of cash purchased this month to over 7,257 BTC. This aggressive accumulation means that the whale, even on the present multi-year excessive, Bitcoin might be undervalued.

There might be extra Bitcoin tailwinds incoming. As an example, this week, former United States president Donald Trump began accepting crypto donations within the ongoing marketing campaign. This shift of stance has been bullish since Trump dismissed Bitcoin earlier.

Whereas this occurs, European regulators seem open to approving Bitcoin as an investable asset inside Undertakings for Collective Funding in Transferable Securities (UCITS) funds. If this goes by means of, it may unlock extra billions into Bitcoin from European establishments.

This transfer is huge, contemplating that banking giants like Morgan Stanley and BNP Paribas are already exploring methods for his or her shoppers to spend money on BTC.

Associated Studying: Bitcoin Quick Time period NUPL Worth Turns Unfavourable, What This Means For Worth

From a macro stage, the rising M2 cash provide in the USA amid issues from the USA Federal Reserve that inflation is excessive may additional buoy Bitcoin demand. BTC, like gold, is taken into account a protected haven, a hedge towards inflation since its provide is designed to be deflationary.

Function picture from DALLE, chart from TradingView

[ad_2]

Supply hyperlink

Leave a Reply