[ad_1]

KEY

TAKEAWAYS

- Salesforce inventory will possible commerce throughout the $210 to $220 space.

- A bear put unfold is a method to contemplate if you wish to make the most of the inventory buying and selling between $210 and $220.

- With CRM’s earnings about three weeks away, a bear put unfold might decrease your value of a bearish publicity.

As soon as a darling of the tech {industry}, Salesforce (CRM) had fallen out of favor till not too long ago, when it hit a brand new all-time excessive earlier this 12 months. Since then, although, buyers have continued to shrink back from this cloud computing inventory as they give attention to extra pure AI-related corporations, and Salesforce is liable to turning decrease once more. As CRM matures and progress charges average, it merely can not proceed to command the industry-leading valuations it as soon as did, and has to face the fact of its fundamentals.

As soon as a darling of the tech {industry}, Salesforce (CRM) had fallen out of favor till not too long ago, when it hit a brand new all-time excessive earlier this 12 months. Since then, although, buyers have continued to shrink back from this cloud computing inventory as they give attention to extra pure AI-related corporations, and Salesforce is liable to turning decrease once more. As CRM matures and progress charges average, it merely can not proceed to command the industry-leading valuations it as soon as did, and has to face the fact of its fundamentals.

Analyzing Salesforce

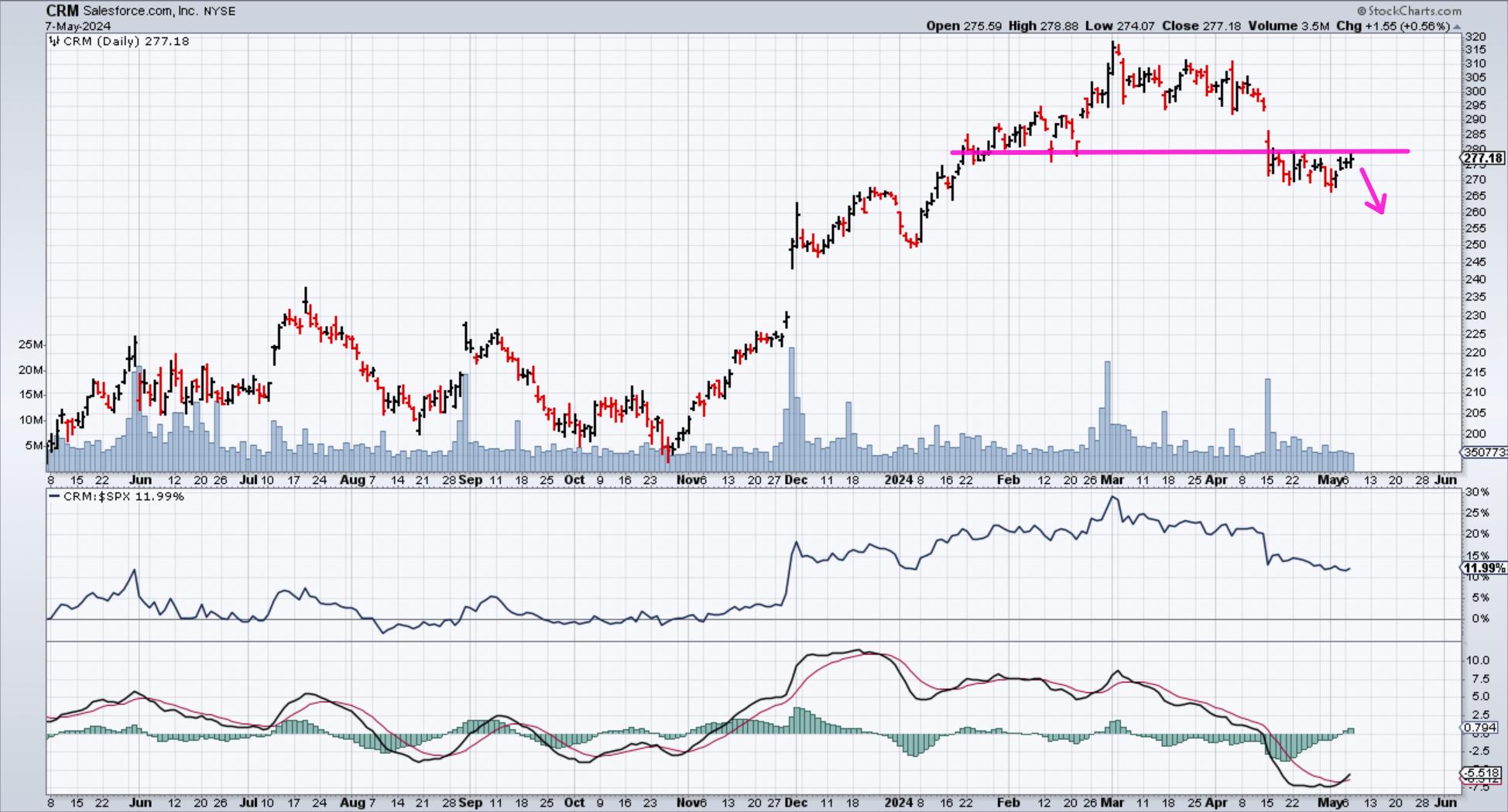

When you have a look at a five-year chart of CRM, you will notice that the inventory has traded inside a considerably big selection of $130 to $310. Earlier this 12 months, it revisited the higher certain of the vary and tried to interrupt out increased to a brand new all-time excessive (see chart under). This rapidly failed, and the inventory reversed again into the vary, with momentum not too long ago turning unfavorable. This implies that CRM will possible proceed to commerce again in the direction of the midpoint of the vary, i.e., within the $210–220 space.

CHART 1. DAILY CHART OF SALESFORCE (CRM) STOCK. CRM’s inventory value examined a resistance degree and turned decrease. Momentum can be unfavorable, which implies the inventory is more likely to transfer decrease.Chart supply: StockCharts.com. For academic functions.

CRM at the moment trades at over 28x ahead earnings, which flies within the face of progress charges which have moderated considerably over the previous 12 months. After averaging EPS progress of over 45% over the previous three years, future EPS progress is predicted to gradual to only a third of that at 16%. Income progress is predicted to drop to underneath 10%. This makes a valuation that’s 40% increased than the S&P 500 tougher to justify when progress charges are slowing down considerably.

A Bear Put Vertical Unfold For Salesforce

When you will have a bearish outlook on a inventory, a bear put unfold could be a viable choices technique to implement. The technique includes shopping for a put possibility with a strike value on the present inventory, after which promoting a put possibility with a decrease strike value with the identical expiration. Your most threat is the web premium paid between the 2 legs. The chance graph under illustrates the revenue and loss state of affairs of a bear put vertical unfold.

RISK GRAPH OF A BEAR PUT SPREADIf the inventory declines under the decrease strike value, the technique will understand the utmost revenue potential of the space between the 2 strikes minus the premium paid. Additionally, if the inventory had been to remain above the upper strike value, you’ll understand the utmost loss potential.

RISK GRAPH OF A BEAR PUT SPREADIf the inventory declines under the decrease strike value, the technique will understand the utmost revenue potential of the space between the 2 strikes minus the premium paid. Additionally, if the inventory had been to remain above the upper strike value, you’ll understand the utmost loss potential.

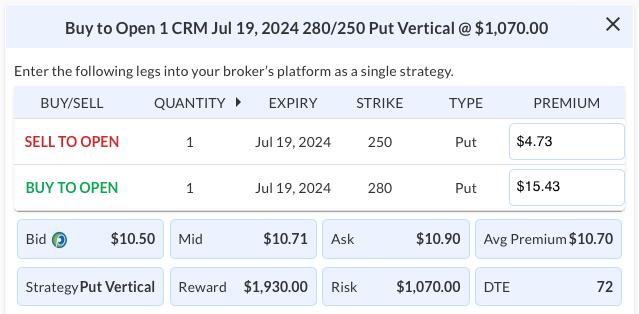

With earnings in three weeks, CRM choices costs are barely elevated and warrant utilizing a ramification to decrease the price of looking for bearish publicity. I am going out to the July expiration and shopping for the $280/$250 put vertical @ $10.70 debit. This entails:

- Shopping for July $280 places @ $15.43

- Promoting July $250 places @ $4.73

This might threat $1070 per contract if CRM is above $280 at expiration, whereas doubtlessly making $1930 per contract if CRM is under $250 at expiration.

The Takeaway

If you wish to revenue from a possible decline in a inventory’s value, you might commerce a bear put unfold. It limits your threat, has cheap revenue potential, and is cost-effective.

Tony Zhang is the Chief Strategist at OptionsPlay.com, the place he has assembled an agile workforce of builders, designers, and quants to create the OptionsPlay product suite for buying and selling and evaluation. He has additionally developed and managed lots of the agency’s partnerships extending from the Choices Business Council, Nasdaq, Montreal Trade, Merrill, Constancy, Schwab, and Raymond James. As a confirmed thought chief and contributor on CNBC’s Choices Motion present, Tony shares concepts on utilizing choices to leverage achieve whereas lowering threat.

Be taught Extra

[ad_2]

Supply hyperlink

Leave a Reply