[ad_1]

HodlX Visitor Publish Submit Your Publish

Within the high-stakes world of cryptocurrency, market sentiment usually swings wildly, pushed by hypothesis and the whims of influential voices.

Not like conventional monetary markets, crypto values can skyrocket or plummet based mostly on the collective temper of merchants, making it important to remain attuned to those emotional undercurrents.

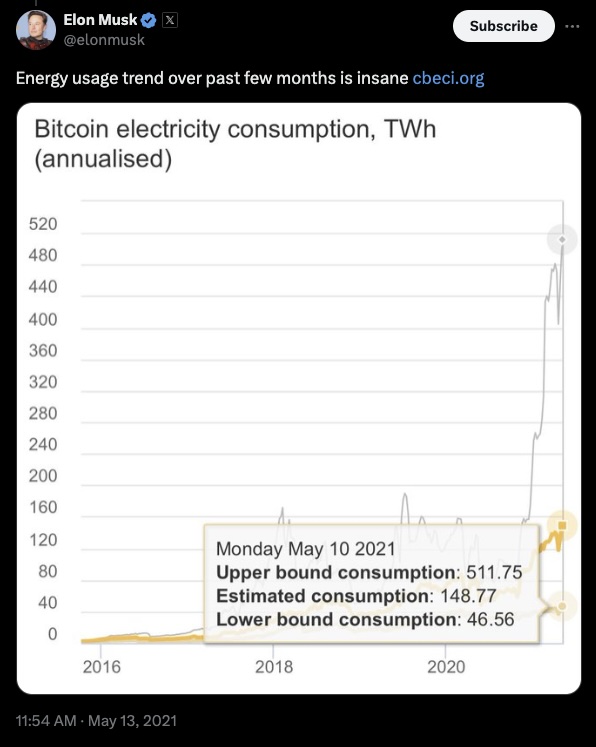

Contemplate the sway of figures like Elon Musk and Michael Saylor inheritor tweets and public statements can ship ripples by the market, inflicting dramatic shifts in worth nearly instantaneously.

As an example, Musk’s tweet about Bitcoin’s environmental impression led to a swift sell-off, underscoring how prone crypto costs are to influential opinions.

These occasions spotlight the significance of understanding market sentiment to navigate the crypto panorama successfully.

Given this risky surroundings, instruments that measure market sentiment are invaluable.

Enter the Worry and Greed Index a barometer that captures the emotional state of the market.

By decoding this index, merchants can achieve insights into the underlying temper driving worth actions and really feel the heart beat of the marketplace for extra knowledgeable selections.

The Worry and Greed Index compiles numerous indicators akin to market volatility, buying and selling quantity, social media sentiment, surveys, Bitcoin dominance and Google Tendencies knowledge.

It scores sentiment on a scale from zero (excessive worry) to 100 (excessive greed).

This scale gives a snapshot of market feelings, serving to merchants establish potential shopping for or promoting alternatives.

When worry and greed dominate

When the market is gripped by worry, indicated by a low rating, traders usually unload belongings, fearing additional losses.

This will result in undervaluation, presenting potential shopping for alternatives for merchants who acknowledge the overreaction.

Conversely, when the market is pushed by greed, mirrored in a excessive rating, traders could change into overly optimistic, driving costs as much as unsustainable ranges.

This usually indicators a very good time to take earnings or put together for a possible correction.

Skilled merchants use the Worry and Greed Index as a contrarian indicator. Excessive worry may recommend it’s time to purchase, whereas excessive greed may point out it’s time to promote.

By aligning buying and selling methods with these emotional extremes, traders can higher navigate the unpredictable waters of cryptocurrency buying and selling.

Present market sentiment

Right this moment, the Worry and Greed Index stands at 70, indicating a powerful tilt in the direction of greed. Traditionally, such excessive ranges of greed have preceded market corrections.

For seasoned merchants, this means warning. It is likely to be clever to safe earnings and reevaluate danger publicity whereas remaining vigilant for indicators of a market shift.

The Worry and Greed Index affords a strong lens to view market feelings, enabling merchants to anticipate and react to shifts extra strategically.

By mixing sentiment evaluation with conventional market indicators, traders can achieve a extra holistic view of the market, enhancing their skill to make well-informed selections within the fast-paced world of cryptocurrency buying and selling.

Understanding the interaction of worry and greed not solely aids in navigating the current market panorama but in addition gives a strategic edge, serving to merchants keep one step forward within the risky journey of cryptocurrency investments.

Esin Syonmez is a content material author at Morpher, the place she contributes to the corporate’s mission of monetary inclusion and democratizing buying and selling worldwide.

Observe Us on Twitter Fb Telegram

Disclaimer: Opinions expressed at The Day by day Hodl should not funding recommendation. Traders ought to do their due diligence earlier than making any high-risk investments in Bitcoin, cryptocurrency or digital belongings. Please be suggested that your transfers and trades are at your individual danger, and any loses it’s possible you’ll incur are your accountability. The Day by day Hodl doesn’t suggest the shopping for or promoting of any cryptocurrencies or digital belongings, neither is The Day by day Hodl an funding advisor. Please observe that The Day by day Hodl participates in internet affiliate marketing.

Featured Picture: Shutterstock/4K_HEAVEN/Plasteed

[ad_2]

Supply hyperlink

Leave a Reply