[ad_1]

Even after the upswing mid-this week, Bitcoin costs stay wavy, contemplating worth motion in decrease time frames. The coin is retesting $66,000 at spot charges, however merchants count on the breakout to have been confirmed, pushing BTC costs towards $70,000.

For the reason that surge to all-time highs in March, the coin has been on a gentle downtrend, as proven within the formation on the each day chart.

BTC Liquidity Is Excessive Regardless of Accumulation: Analyst

Due to this fact, as doubt creeps in, Willy Woo, a Bitcoin on-chain analyst, is calming down market contributors, saying the coin is getting ready for sharp positive aspects within the days forward.

Associated Studying

Although costs are flat-lining within the each day chart, what’s necessary to notice, Woo says, is the extent of liquidity.

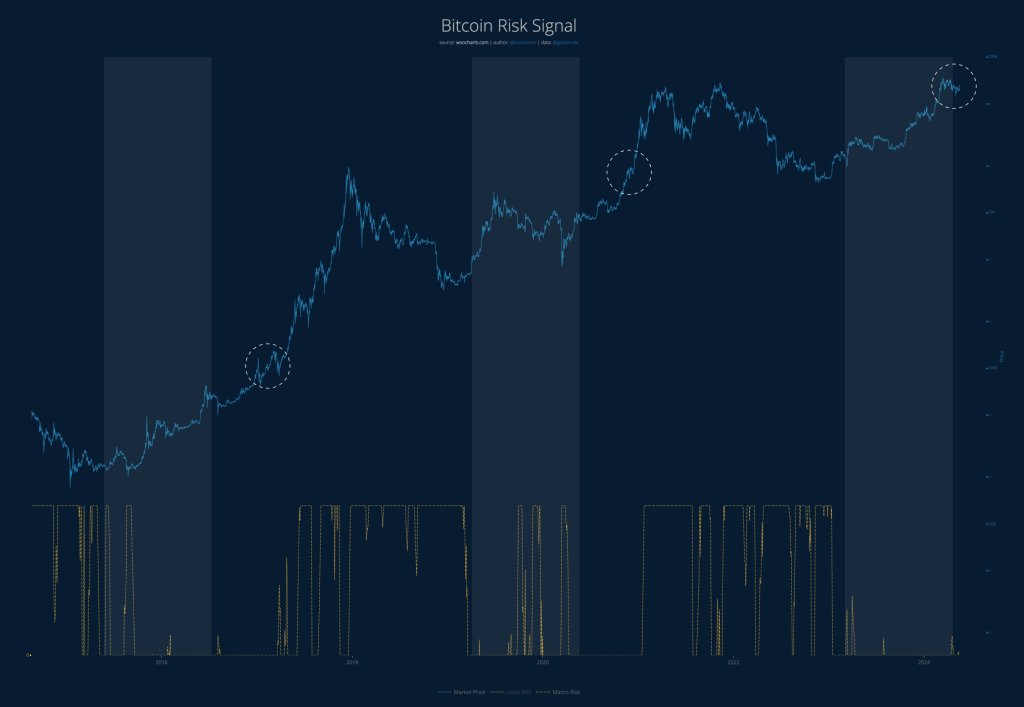

Sharing a chart on X, Woo emphasised Bitcoin’s place inside its liquidity cycle. The Bitcoin liquidity cycle is solely a chart exhibiting the growth and bust durations of the world’s most precious coin. Each cycle in historical past is extremely influenced by the provision and stream of capital out and in of the asset.

The analyst is upbeat, arguing that although costs are down from all-time highs and seem caught in a consolidation, the coin remains to be in a “warm-up” part. Woo provides that the present consolidation interval means the long-term danger is low in mild of the comparatively excessive liquidity.

Evaluating the present state of affairs to previous worth motion, the analyst predicts that Bitcoin costs will seemingly surge. When “the floodgates open” and new capital enters the market, costs will shoot larger, however so will danger.

Bitcoin Uptrend Simply Getting Began?

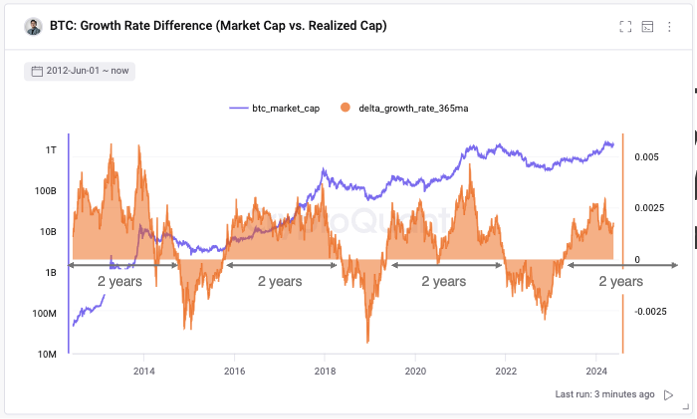

Ki Younger Ju, the founding father of CryptoQuant, a crypto analytics platform, has supported Woo’s place. To X, Ju mentioned Bitcoin is in the midst of a bull cycle.

To clarify this view, the founder famous that Bitcoin’s capitalization has been rising quicker than the realized cap. The realized cap is a metric that goals to gauge the full worth of all cash in circulation based mostly on the worth at which they have been final moved.

This development has continued for roughly two years traditionally. If this sample holds, the bull cycle might finish by April 2025.

Associated Studying

Amid this, curiosity in spot Bitcoin exchange-traded funds (ETFs) seems to be swelling. An ETF analyst, Eric Balchunas, mentioned these by-product merchandise have attracted a web influx of over $1.3 billion within the final two weeks alone. This uptick successfully offset the unfavourable flows seen in April.

Characteristic picture from DALLE, chart from TradingView

[ad_2]

Supply hyperlink

Leave a Reply