[ad_1]

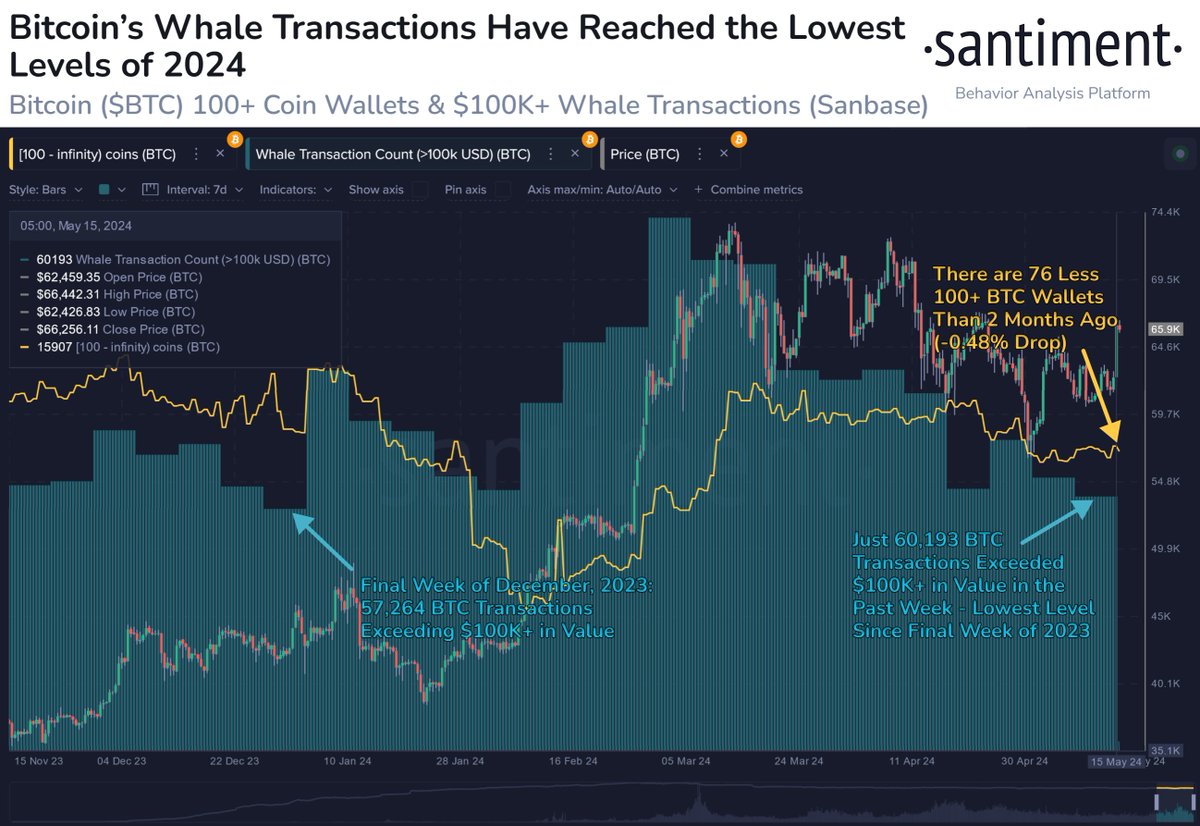

Latest information from Santiment signifies a noticeable lower in Bitcoin whale exercise, reaching the bottom ranges seen in 2024. This development reveals that holders of huge quantities of Bitcoin, often known as whales, are drifting away from energetic buying and selling.

Whereas this might sign a unfavourable development, the scenario presents a posh image of the cryptocurrency’s market dynamics.

Regardless of the autumn in whale exercise, the whole variety of Bitcoin wallets with at the very least 100 BTC stays excessive, at 11.79 million BTC throughout 15,907 wallets.

Traditionally, elevated exercise from these massive holders has usually preceded vital worth actions in Bitcoin, suggesting that their present quiet may result in numerous market outcomes. The query stays: What does this lowered exercise imply for the market’s future?

Associated Studying

Analyzing Whale Exercise: What This Means For Bitcoin

A decline in whale exercise may initially be interpreted as an indicator of decrease market volatility. Vital strikes by these massive holders can profoundly have an effect on Bitcoin’s worth, usually leading to abrupt and unexpected fluctuations.

🐳 Whereas #Bitcoin‘s 100+ $BTC whale wallets proceed to carry a excessive stage of cash (11.79M), whale exercise has dropped to its lowest stage of 2024. There are at present 15,907 wallets holding at the very least 100 cash. It could be a #bullish signal if this rises. https://t.co/nldtOms3aT pic.twitter.com/Lyj4Epfp9a

— Santiment (@santimentfeed) Might 16, 2024

Consequently, a diminished presence of whales would possibly result in a lot market stability and predictability within the close to time period. Nevertheless, this stability would possibly contradict the everyday buying and selling habits related to crypto, the place volatility usually presents buying and selling alternatives.

Furthermore, if these whales maintain onto their Bitcoin reasonably than promote, this habits could possibly be interpreted as a long-term bullish sign. It means that these influential market gamers see the potential for future worth will increase and are selecting to carry their positions.

This attitude is bolstered by the present buying and selling worth of Bitcoin, which is above $66,000, marking a virtually 5% enhance over the previous week.

Indicator Reveals Additional Surge Forward

Including to the evaluation, Willy Woo, a outstanding crypto analyst, mentioned the most recent developments within the BTC volume-weighted common worth (VWAP) Oscillator. The VWAP is a buying and selling benchmark that measures an asset’s common worth based mostly on worth and quantity over a particular interval.

This metric prioritizes worth ranges with greater buying and selling volumes, providing a extra complete view of market developments.

Woo’s evaluation revealed that the Bitcoin VWAP Oscillator has been in unfavourable territory for a number of months however has not too long ago began to rise. The oscillator may quickly attain a impartial level if this upward development continues.

Associated Studying

This shift usually indicators {that a} bullish section is on the horizon, based mostly on historic patterns the place the oscillator’s rise from unfavourable to impartial has coincided with substantial worth features for Bitcoin.

Nonetheless loads of room to run earlier than reversal or consolidation.

Hate to be a trapped #Bitcoin bear proper now. https://t.co/LGet9XVoQY pic.twitter.com/EgJ47mzNLG

— Willy Woo (@woonomic) Might 16, 2024

Featured picture created with DALL·E, Chart from TradingView

[ad_2]

Supply hyperlink

Leave a Reply