[ad_1]

CryptoQuant CEO Ki Younger-Ju immediately identified important similarities in Bitcoin’s market conduct between the present state and mid-2020, a interval marked by stagnant costs however excessive on-chain exercise. Younger-Ju’s insights had been illustrated with two key charts and shared through a submit on X, drawing parallels that counsel a strong undercurrent of huge quantity transactions, probably outdoors the general public alternate networks.

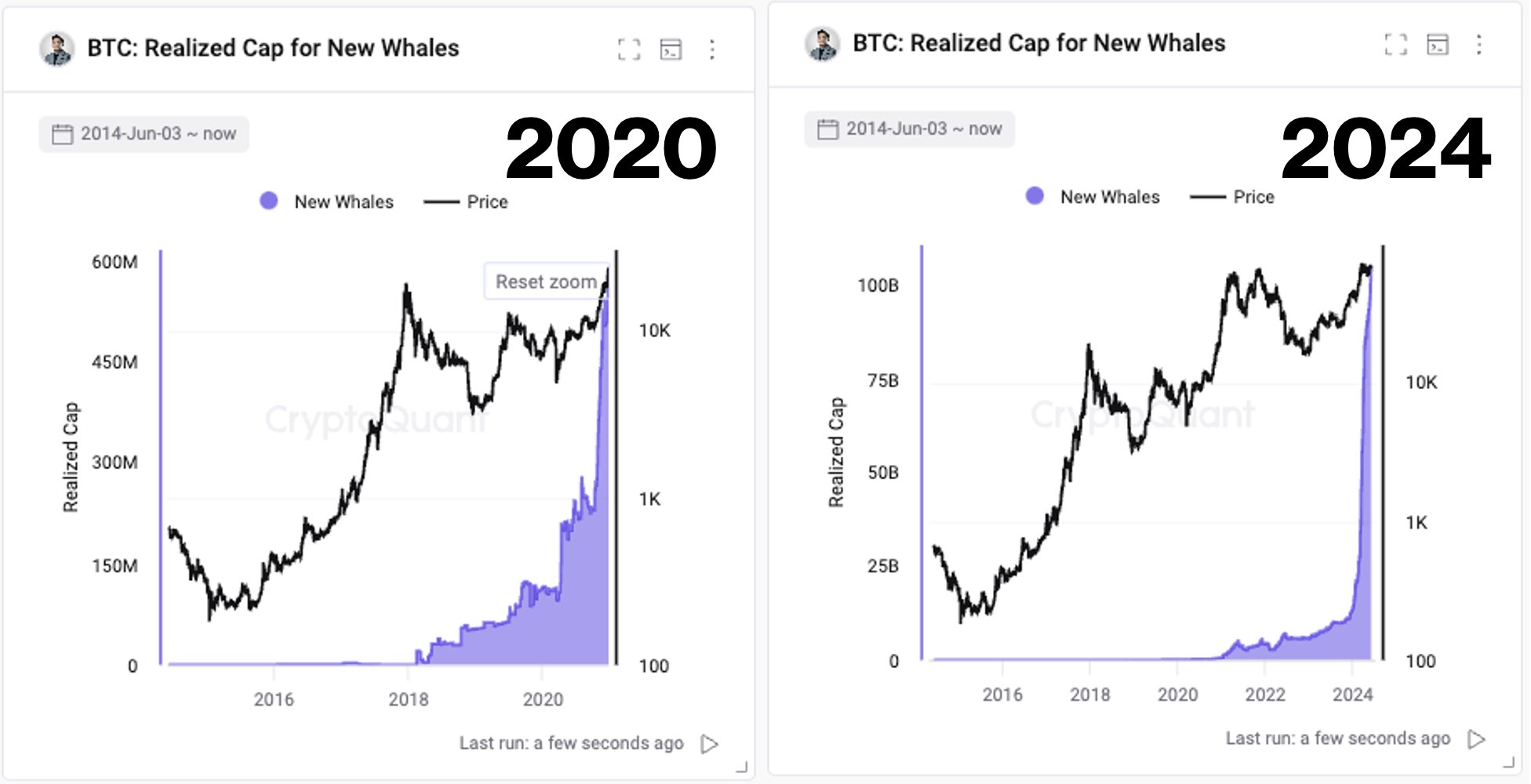

The primary chart, representing information up till 2020, exhibits Bitcoin’s value alongside the realized cap for brand new whales – a metric that tracks the mixture worth at which the newly acquired Bitcoin by giant traders was final moved. It’s a unique type of market capitalization that assesses every UTXO on the value it final modified arms, reasonably than its current market value. This metric displays the precise realized worth of all of the cash within the community, reasonably than their present market worth.

Associated Studying

This worth skilled a pointy enhance round mid-2020, exactly when Bitcoin’s value was caught in boredom similar to in current months, persistently buying and selling across the $10,000 mark. In accordance with Younger-Ju, this era was characterised by excessive on-chain exercise which later evaluation recommended concerned over-the-counter (OTC) transactions amongst institutional gamers.

Within the second chart, extending to 2024, the same sample emerges with much more pronounced progress within the realized cap for brand new whales, regardless of Bitcoin’s value displaying a sideways motion for nearly 100 days now. The chart signifies a major addition of about $1 billion every day into new whale wallets, a time period sometimes referring to addresses holding giant quantities of Bitcoin, typically linked with institutional or extremely capitalized particular person traders.

What This Means For Bitcoin Worth

Ki Younger-Ju elaborated on these observations: “Similar vibe on Bitcoin as mid-2020. Again then, BTC hovered round $10k for six months with excessive on-chain exercise, later revealed as OTC offers. Now, regardless of low value volatility, on-chain exercise stays excessive, with $1B added every day to new whale wallets, probably custody.”

Associated Studying

He additional referenced a tweet from September 2020 that corroborated his evaluation, noting that the “variety of BTC transferred hits the year-high, and people TXs should not from exchanges. Fund Stream Ratio of all exchanges hits the year-low. One thing’s occurring. Presumably OTC offers.”

This comparability and the sustained excessive degree of the realized cap for brand new whales counsel an ongoing accumulation part amongst large-scale traders, paying homage to the exercise noticed in mid-2020. Such actions are typically not seen on conventional crypto exchanges and point out a powerful institutional curiosity that could possibly be a precursor to important market strikes. Following Younger-Ju’s tweet, BTC value rallied by 480% from September 2020 until November 2021.

If the same transfer is brewing for Bitcoin value stays to be seen, however the steady progress in Bitcoin holdings amongst new whales, together with sustained value ranges, factors to a possible buildup of strain beneath the obvious calm of the market floor. As noticed prior to now, such situations could result in substantial value actions as soon as the collected Bitcoin begins to impression the broader market by both elevated liquidity or renewed buying and selling curiosity.

At press time, BTC traded at $68,271.

Featured picture created with DALL·E, chart from TradingView.com

[ad_2]

Supply hyperlink

Leave a Reply