[ad_1]

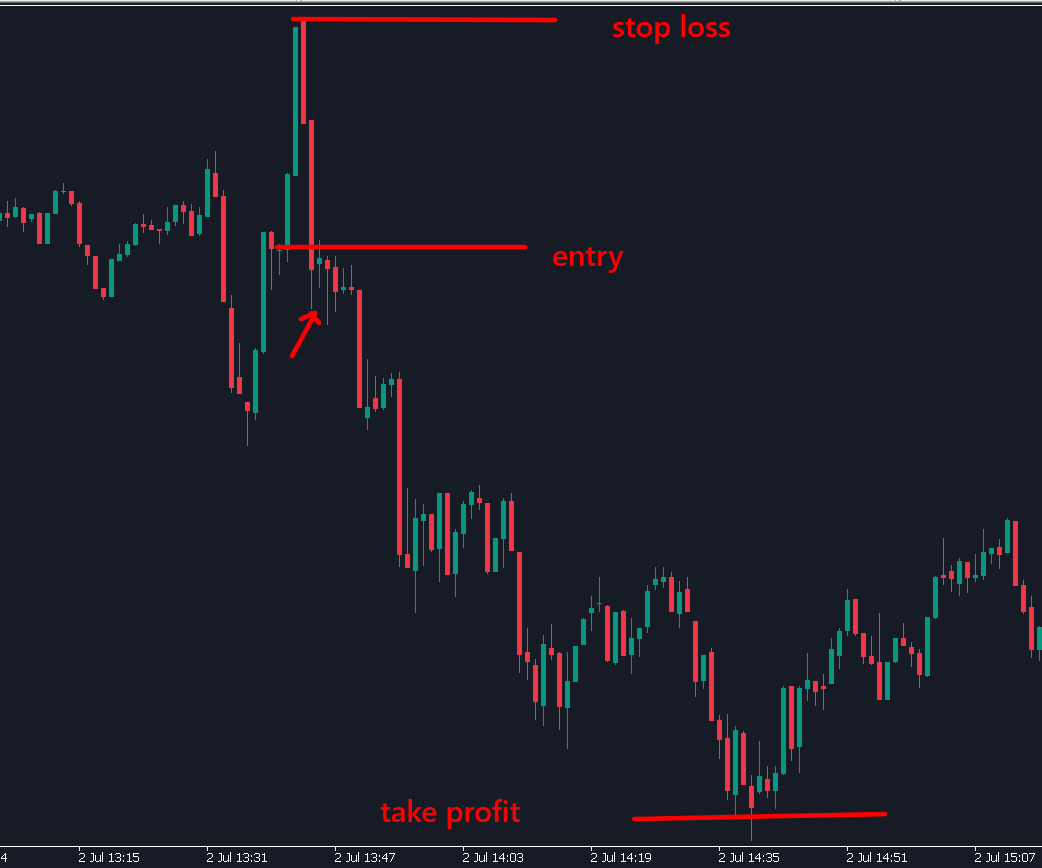

1. Entry – On any situation e.g. Bullish Engulfing and its breakout

2. SL – at low or excessive with sustaining a threat reward of minimal 1:2 If Danger Reward is lower than 1:2 entry shouldn’t be taken as for a dealer Danger administration and capital safety ought to be first precedence and making income ought to be much less prioritized

3. TP : Take revenue is rarely associated with Entry or TP, Its primarily based on market conduct. All strategies which derives fastened TP, normally fails with excessive possibilities making it much less dependable for scalping

We will perceive level 1 and a couple of. Taking entries isn’t a significant job the place you might want to use your thoughts, however at reserving revenue you might want to do main evaluation about market conduct

My notice to all merchants who’re utilizing a system which has fastened TP ought to keep away from utilizing the system if its not giving excessive accuracy as a result of you might want to perceive TP is rarely linked with Entry logic.

It doesn’t matter no matter Entry logic you might have, Your Take Revenue stage depends upon market conduct solely as a result of market conduct is what most of individuals don’t research.

They want to have an Knowledgeable advisor with set and neglect strategies which by no means works and really unreliable.

In case your EA is following market conduct and never sitting idle after entry then your EA could also be very problematic EA which won’t have very excessive win charge.

What merchants anticipate

making use of fibonacci to swing you may see its precisely retracing from 2.618 fibonacci stage

however development like this occurs 25% time solely. Here’s what occurs if you provoke a commerce

what you anticipate in historic again take a look at normally don’t occur if you provoke a commerce. That is true for each technique a learner might discover

For those who research what’s the distinction between earlier chart and this chart?

Its the market motion. In earlier chart you may see value went to 2.618 stage easily

however within the later chart, you may see value retraced again to virtually 0% space of fibonacci to create worry amongst those that had been holding a purchase facet place.

This made them change their determination of reserving revenue from stage 2.618 to stage 1.618

Fortunately this time value additionally touched 2.618 however its no logic. As a result of since merchants already booked revenue at 1.618 stage, value didn’t react on stage 2.618 as I marked on screenshot

Now should you plan to do reversal buying and selling on stage 2.618 your Cease loss will hit. I hope you understand the rationale now.

Now you may additionally discover the low was damaged so should you apply fibo accurately you may see the response at 2.618 stage

So on this weblog you study that how psychology can be essential for merchants to grasp and alter their take revenue stage primarily based on market conduct. Market could have no that means if folks don’t take part and take entry and sit idle ready for his or her take revenue. This can be true for traders however intraday scalpers must act primarily based on market conduct on decrease timeframe and will use variable take revenue ranges primarily based on what market do after your entry.

[ad_2]

Supply hyperlink

Leave a Reply