Bitcoin is quick promoting off. At spot charges, the world’s most useful coin dropped by over 5% on the final day of buying and selling and continues to spiral decrease, simply breaking $60,000. The psychological spherical quantity has been degree to be careful for over the previous couple of days, particularly following good points over the weekend.

Bitcoin Is Down: Is It Time To Purchase?

Whereas Bitcoin is edging decrease and sellers are relentless, one analyst thinks that is the precise time to stack up. In a put up on X, the analyst argues that Bitcoin is on the cusp of the “Spring” part throughout the Wyckoff re-accumulation mannequin.

The Wyckoff mannequin is a technical evaluation instrument utilized by merchants and chartists. Historically, it makes use of worth and quantity patterns to establish potential worth actions.

Associated Studying

Whereas Wyckoff describes a number of phases in the case of worth patterns, the “Spring” stage is what most merchants at all times monitor. When costs “spring” increased from this stage, the coin tends to interrupt out from the present vary in the back of rising buying and selling quantity.

Wanting on the Bitcoin every day chart, it’s evident that costs have been consolidating. So far, the first assist is across the Could and June 2024 lows. Then, costs broke decrease, sinking under $57,000 and bottoming at round $56,500 in Could. Resistance lies between $72,000 and March 2024 highs on the higher finish.

As it’s, Bitcoin is retesting the first assist, with the July 4 bar piercing $60,000 and dropping to as little as $56,900 earlier right this moment. Based mostly on the Wyckoff mannequin, costs are priming for the spring part. This preview will maintain, particularly if there is no such thing as a affirmation of right this moment’s losses.

Miner Capitulating Although Lengthy-Time period Holders Are Not Promoting

Although the analyst is upbeat, not everyone seems to be bullish. Based on Willy Woo, an on-chain analyst, the present sell-off is primarily pushed by miner capitulation. Wanting on the Bitcoin Hash Ribbons, the drop seems to be getting began because the market culls off “weak” miners.

For the reason that April 20 Halving, the Bitcoin community robotically slashed BTC rewards by half to three.125 BTC. This automated transfer heaped extra strain on miners, who should make investments capital to purchase gear and function effectively. With falling income, solely probably the most environment friendly miners stand an opportunity to function profitably.

Associated Studying

Consequently, those that can’t improve their gear are pressured to exit the scene. In the event that they don’t, they stand working with out a likelihood of persistently profitable block rewards. During the last eight months, on-chain knowledge reveals that miners have been offloading BTC, countering the uptrend of Q1 2024 and worsening the correction from April.

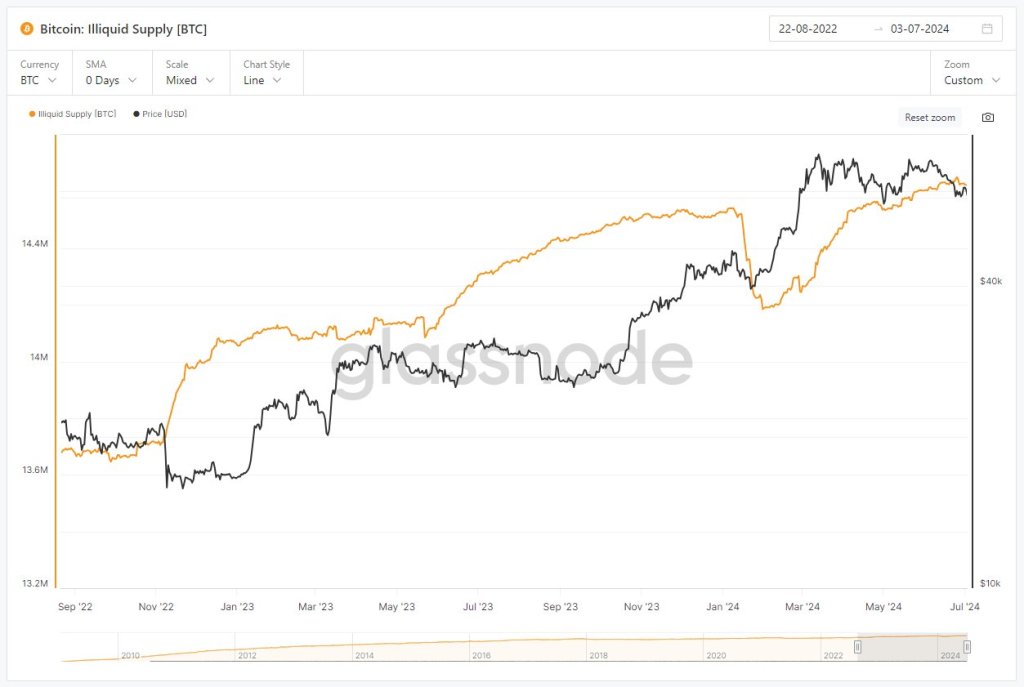

Amid this, long-term holders, largely establishments and whales, stopped promoting in mid-January 2024. Then, america Securities and Alternate Fee (SEC) permitted the primary spot for the Bitcoin exchange-traded fund (ETF).

As proof, the Bitcoin “illiquid provide,” which reveals the variety of cash that haven’t been moved for over two years, is at a close to all-time excessive.

Characteristic picture from DALLE, chart from TradingView

Leave a Reply