[ad_1]

Product defined intimately:

https://www.mql5.com/en/market/product/41731/

Unique discussion board submit is right here requested by Araknobug:

https://abiroid.com/concepts/mt4-indicators/golden-ma-mtf-tt-strategy/

Much like logic utilized in: Golden MA MTF TT

Ranges with Buffers out there right here:

Golden MA Ranges Indicator:

https://www.mql5.com/en/market/product/119515

Observe: Arrows/Scanner do not want this indicator on chart to work. They are going to use it internally. Buy this provided that it is advisable to see Ranges in your chart. Or if it is advisable to use Buffer values to your personal Indicator/EA and so on.

Options:

- Get OB/OS Ranges from Golden MA Ranges

- Look forward to Purchase/Promote Begin Degree Cross

- Elective: Ought to value cross Mid Degree in earlier bars

- Elective: Crossing bar Excessive/Medium Quantity

- Elective: MA Stacked to examine up/down pattern for present TF

- Elective: NRTR larger timeframes aligned Test

Finest Trades: Higher to commerce with a minimum of M15+. Finest timframes can be M30 and H1. Default settings are for H1. For decrease timeframes, you possibly can change the Begin Pips to decrease. Primarily based on line distances you want. And commerce pairs like Foreign exchange core-7 or 14 which may have good swings. Throughout good volatility market instances when their corresponding market is open. Be Cautious: Suppose breakout bar has already crossed too far, and has reached past Purchase/Promote cease ranges, then keep away from sign. Value in numerous circumstances would possibly proceed with the pattern. However that will not at all times occur. So watch out: Preserve shut cease losses. In order that even when commerce would not go your method, the loss wouldn’t be a lot. And TP will be 1.5 to 2 instances SL. Suppose, you might be utilizing day by day, then the vertical gray traces will present Day. If you’re utilizing Weekly HTF, then gray line will present finish of week and so on. Do not Commerce: Keep away from low volatility markets, or whipsawing, uneven or uneven markets. Or throughout information occasions when value can rise and fall crossing many ranges in a single bar. This technique is finest for swing markets. So won’t give good trades when market is in a low volatility tight vary. Settings: Candle Settings:

Prefix: Used to attract debug messages on chart

Max Previous Bars: Max variety of bars to scan for indicators

Shift: Beginning bar

Refresh After Ticks: Refresh after these given variety of ticks

Wait Bars After Sign: As soon as a sign occurs, wait a minimum of these variety of bars earlier than new sign. That is to stop a number of similar path indicators in case value crosses ranges a number of instances

GMA Settings:

Chart Interval String: You possibly can specify larger timeframe for every present timeframe. It’s going to use the Open/Shut/Excessive/Low from that larger TF.

Suppose you’ve gotten H1=W1 then for H1 timeframe, it would use the earlier bar from weekly.

Begin Pips: Used for calculations of ranges.

Look right here for detailed calculations defined:

https://www.mql5.com/en/blogs/submit/758392

Test Mid Line Earlier than Cross: Important sign is when value crosses the Purchase/Promote Begin traces. However sign is even stronger when value is coming all the way in which from mid line in a powerful method. Inside a given variety of bars. Often 5-10 bars. After which crosses the beginning ranges. As a result of if value ranges an excessive amount of after Mid stage and earlier than crossing begin ranges, then pattern is not sturdy sufficient. For similar purpose it is good to examine for medium/sturdy quantity bars for candle crossing the beginning ranges. (Subsequent few quantity settings)

For fast scalping, you possibly can maintain the beneath pattern checks off, as these will restrict indicators. You possibly can simply manually search for general HTF pattern by going to larger charts. And commerce indicators if pattern appears good.

NRTR Present and Increased TF:

It is good to commerce indicators in general pattern path of upper timeframe pattern. You need to use NRTR for that.

Ranging from present TF, you possibly can set what number of TFs to examine NRTR for. And all needs to be aligned for a sound sign.

MA Stack:

Identical method, utilizing MAs Stacked will present present TF’s general pattern. Increased MAs will imply long term pattern. Decrease MAs will imply more moderen pattern. Use the Abiroid MA Stack to see what MAs appear to be on chart:

https://www.mql5.com/en/market/product/69539

For BUY Sign, quickest MA needs to be larger and medium MA in center and slowest MA stacked at backside. And vice-versa for SELL.

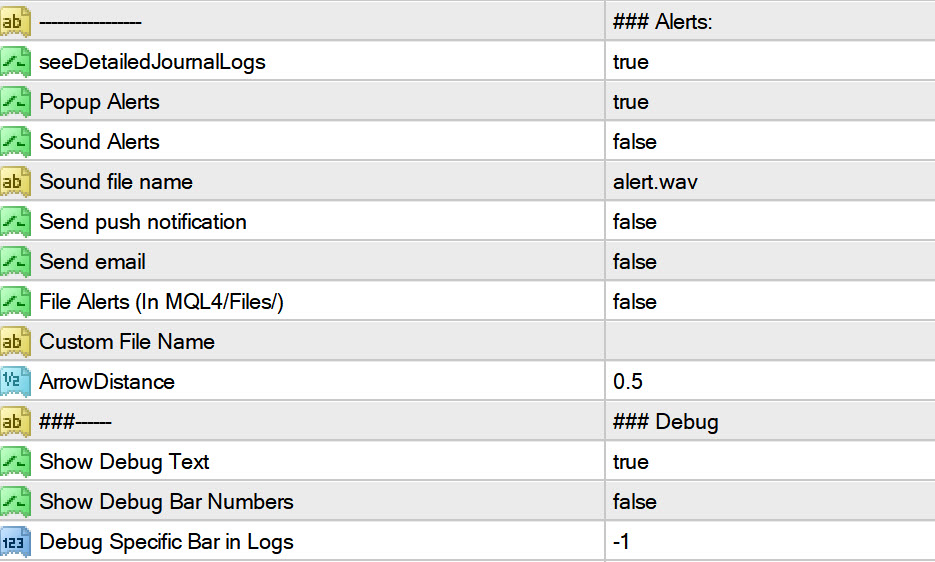

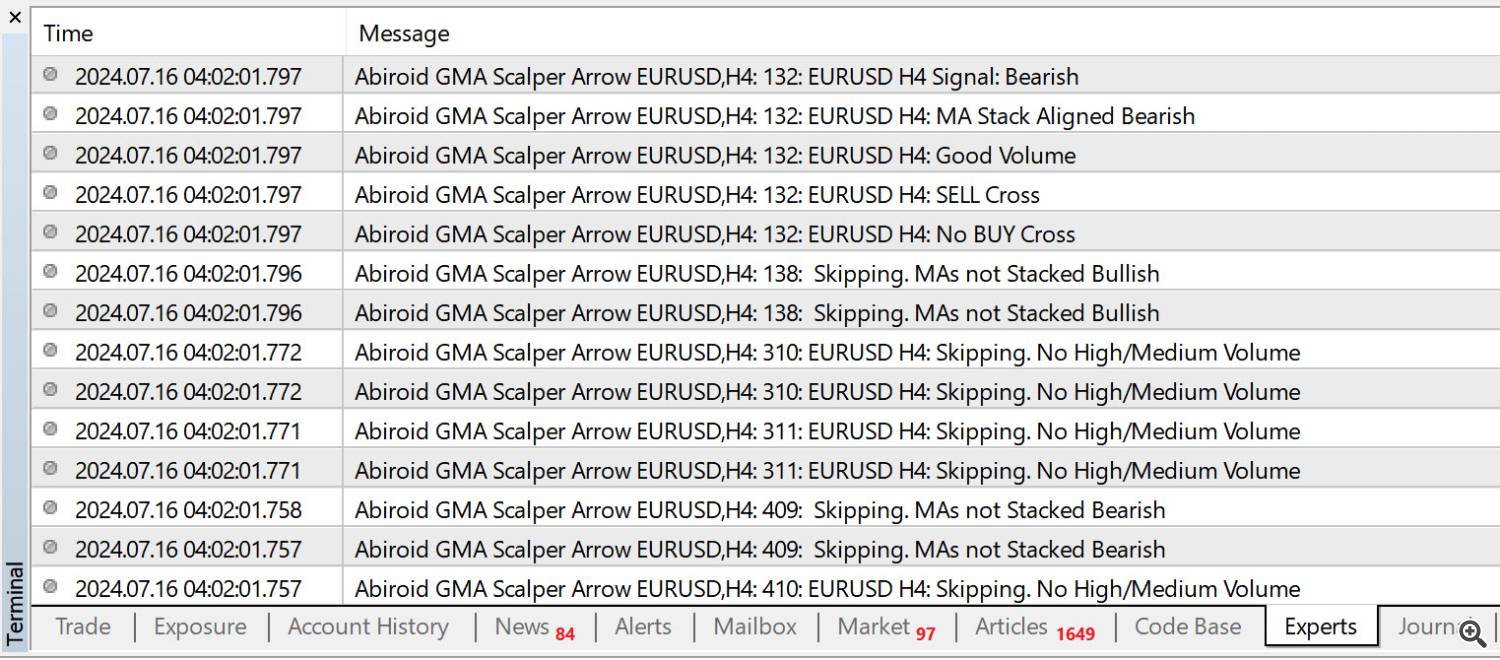

Debug:

Use debug settings when it is advisable to see why a sign is ignored on a selected bar.

Messages:

NO-MID: The mid stage wasn’t crossed in x variety of earlier bars

NO-VOL: Crossing bar just isn’t a excessive quantity bar

NO-NRTR-TF: NRTR just isn’t aligned for given timeframe

NO-MASTACK: MAs usually are not stacked – pattern not good

You possibly can even set a selected bar quantity for which you may get debug logs intimately in your Consultants tab.

E.g: Right here now we have 132 bar. So it reveals that it first appears for BUY and would not discover any Purchase begin stage cross. Then it appears for SELL and finds a stage cross. And good quantity and MAs Stacked. So it offers a Bearish sign. Not setting a bar quantity will simply present why a bar was skipped.

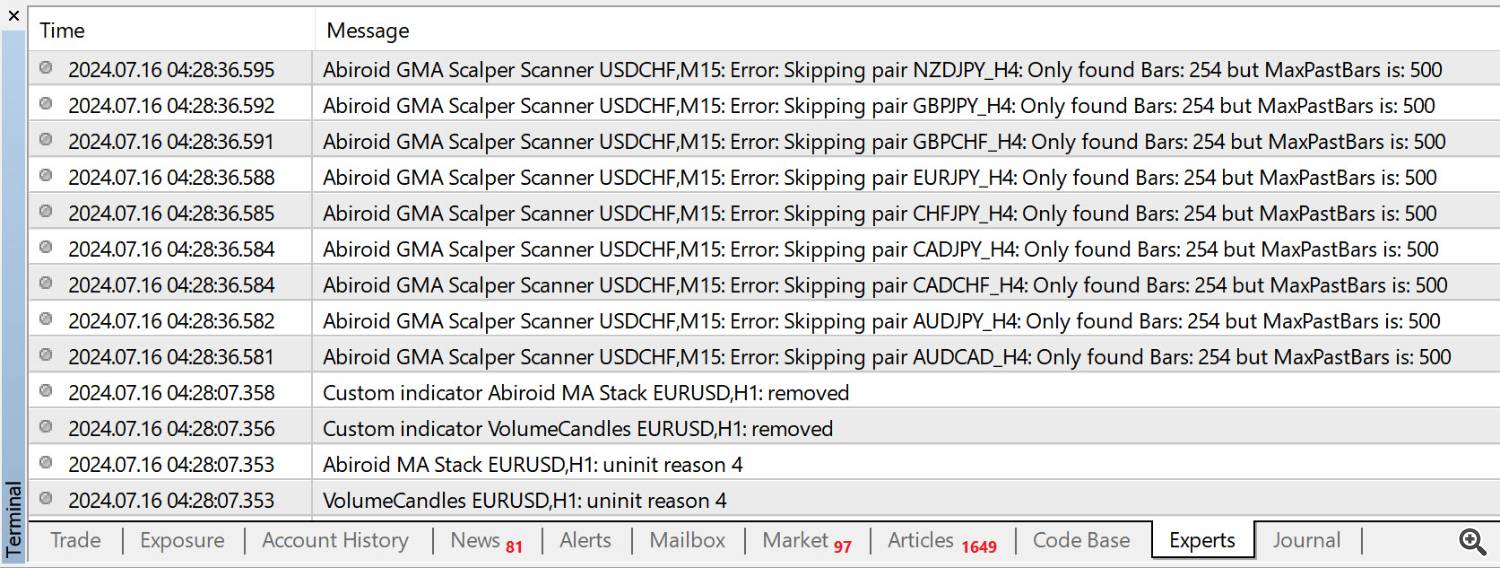

Troubleshooting:

When you have a brand new MT4 set up and all pairs do not have bars loaded but, you would possibly get error:

Error: Skipping pair NZDJPY_H4: Solely discovered Bars: 254 however MaxPastBars is: 500

You possibly can go to Historical past Heart and guarantee that bars are correctly downloaded.

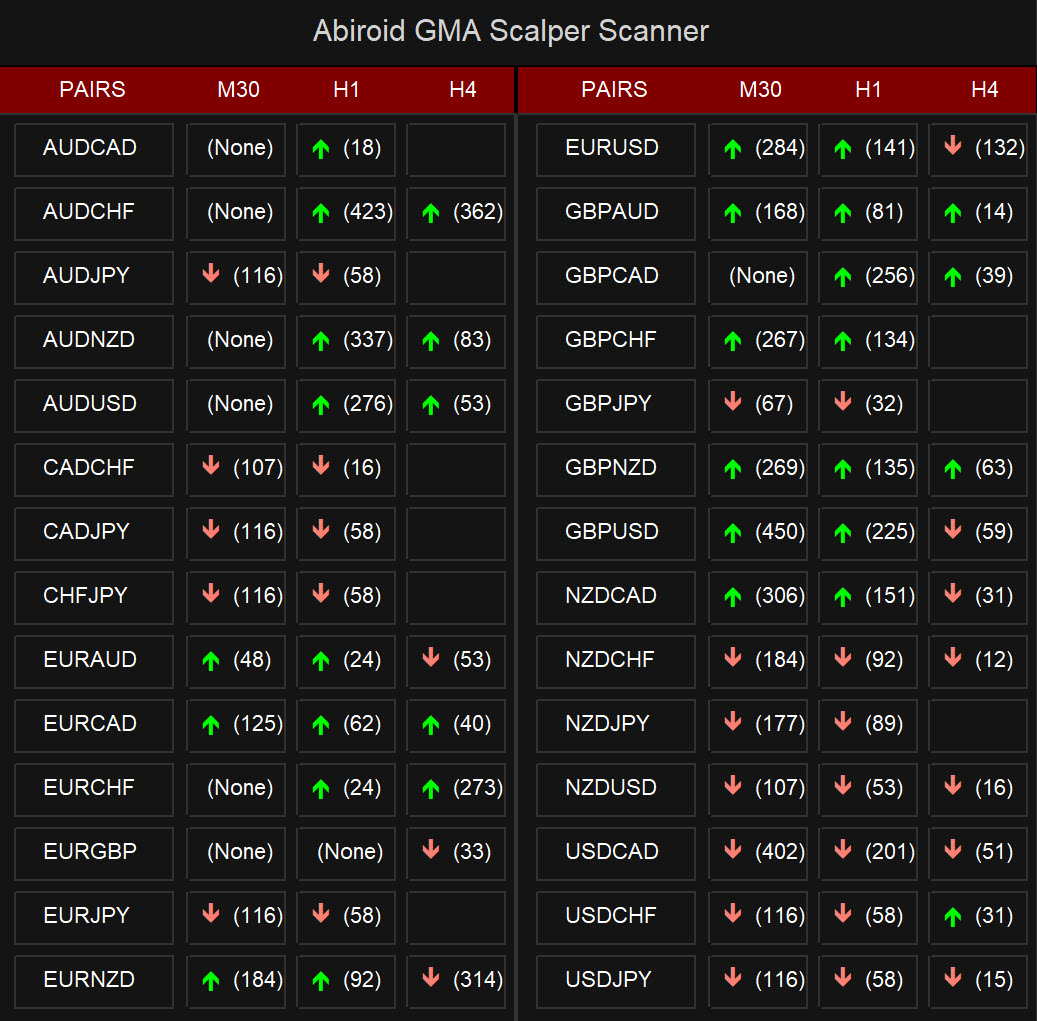

Scanner:

A simplistic scanner with Arrow sign and alerts. It’s going to present bracket numbers for what number of bars again the arrow occurred.

It’s nonetheless beneath growth. Please attempt the Arrows first.

And in case you like utilizing the technique and wish the scanner, let me know within the product feedback and I will ship it to you as soon as it is completed.

Place each Arrows and Scanner in similar listing. Scanner wants the Arrows indicator to work.

mql5 solely permits one ex4 per product. And since scanner can’t work with out the Arrows, I will be unable to make a separate product for scanner.

As their guidelines state that an ex4 shouldn’t be associated to a different.

[ad_2]

Supply hyperlink

Leave a Reply