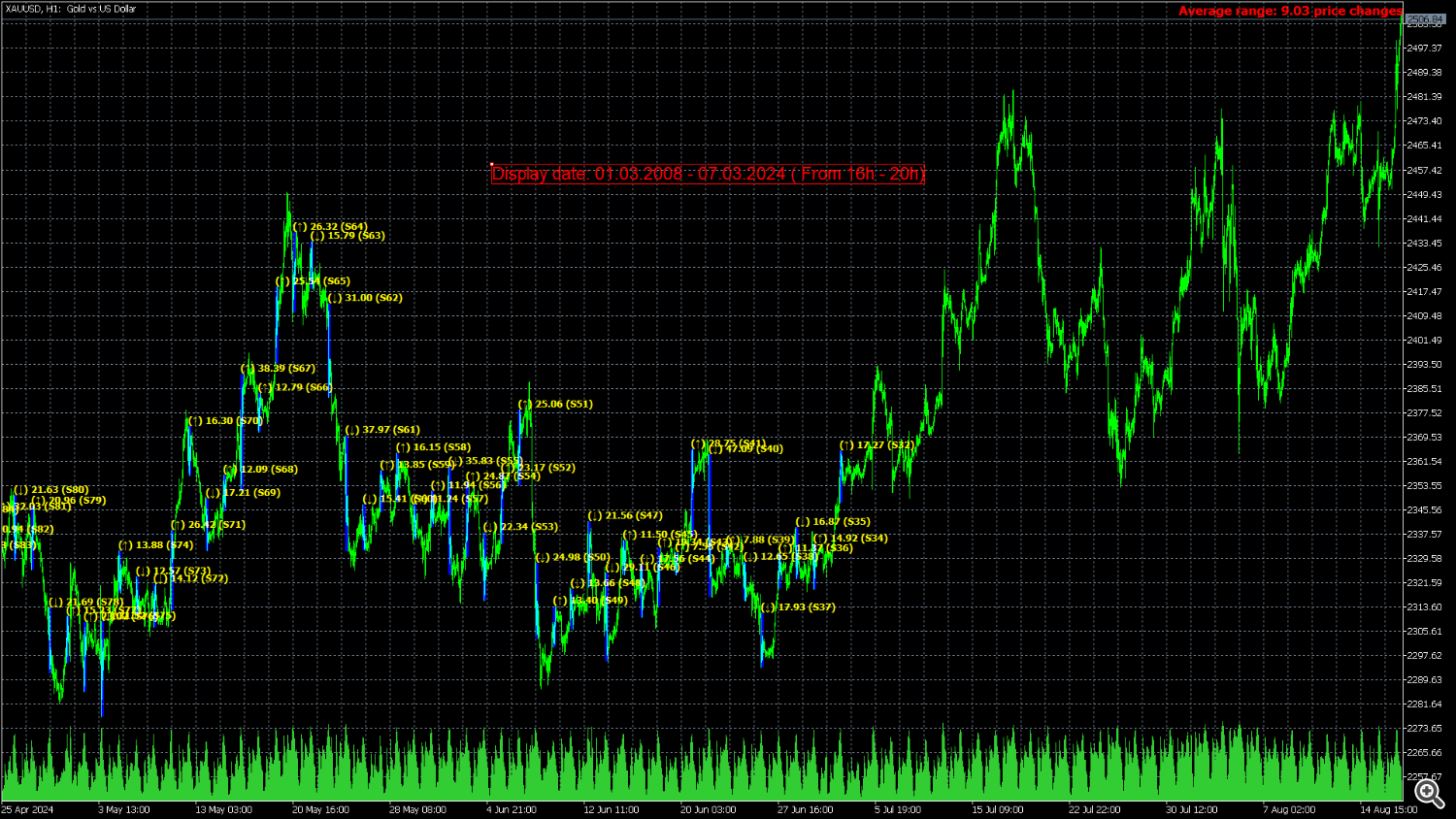

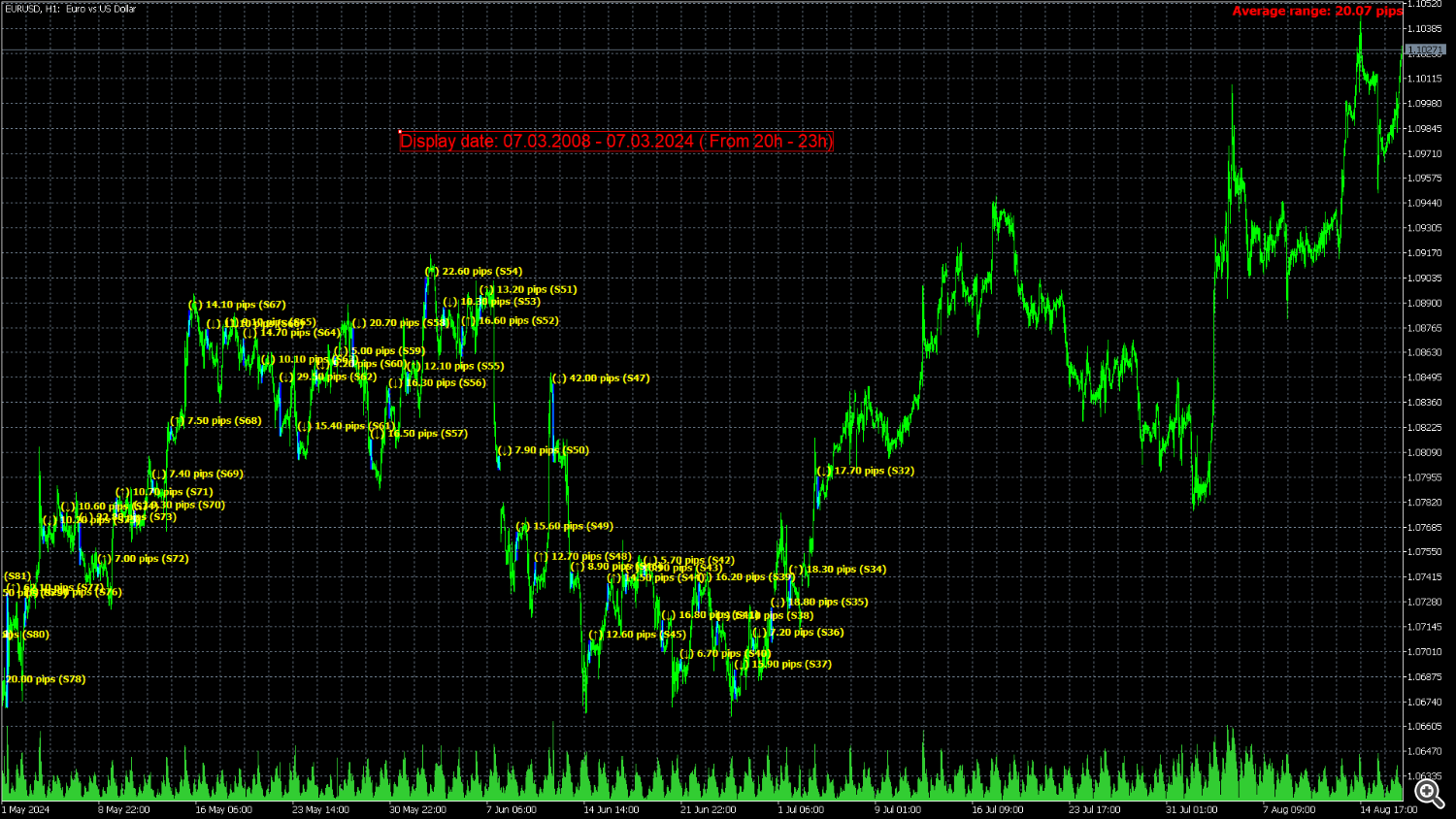

Session Common Date Vary: Analyze and common the volatility of particular buying and selling periods inside customized date ranges, providing insights into value actions and market conduct over chosen intervals.

The “Session Common Date Vary” instrument is a complicated analytical utility designed to empower merchants and analysts by permitting them to dissect and consider the volatility of particular buying and selling periods inside a user-defined date vary. This instrument supplies a versatile and exact strategy to analyzing value dynamics and volatility over chosen intervals, which is especially useful for these trying to perceive market conduct throughout essential historic occasions.

**Observe:** When the buying and selling platform is closed, the indicator might not load appropriately. To make sure it really works, chances are you’ll have to load the indicator, unload it, after which load it once more.

**Observe:** : This indicator can solely be used with historic information. It doesn’t help real-time information evaluation.

Key Options:

1. **Customizable Time and Date Enter:**

– **Begin Time and Finish Time:** Customers can specify the precise begin and finish occasions of the buying and selling session they want to analyze. This degree of element permits for the examination of particular market hours, such because the New York session, or some other timeframe related to the evaluation.

– **Begin Date and Finish Date:** Outline the vary of dates for evaluation, enabling customers to give attention to explicit intervals, such because the years 2007 to 2009, which had been notable for important financial occasions and market fluctuations.

2. **Session-Based mostly Evaluation:**

– The instrument presents the flexibility to zoom in on particular buying and selling periods inside the chosen date vary. This implies customers can analyze periods independently, offering insights into how volatility, value actions, and different metrics different throughout totally different elements of the buying and selling day.

3. **Historic Volatility Insights:**

– By analyzing intervals such because the financial crises from 2007 to 2009, customers can achieve a deeper understanding of how market volatility was influenced by main financial occasions. For instance, evaluating the New York session’s volatility throughout these years can reveal patterns and behaviors that had been distinctive to these tumultuous occasions.

4. **Enhanced Value Analytics:**

– Merchants and analysts can leverage this instrument to carry out detailed value evaluation by specializing in particular time frames and dates. That is notably helpful for backtesting methods or finding out historic value conduct throughout key financial occasions or market situations.

5. **Software for Lengthy-Time period Research:**

– The instrument helps long-term evaluation, making it very best for customers who need to examine historic market information over prolonged intervals. This characteristic is crucial for understanding how market dynamics evolve over time and for assessing the affect of great historic occasions on buying and selling periods.

Sensible Use Case:

Think about a dealer serious about evaluating the volatility of the New York buying and selling session through the world monetary disaster of 2007-2009. By utilizing the Session Common Date Vary instrument, the dealer can enter the precise begin and finish occasions for the New York session and set the date vary from 2007 to 2009. The instrument will then present detailed evaluation and common ranges of value actions throughout these periods, providing useful insights into how the session behaved beneath the stress of the monetary disaster.

This instrument is designed to help a broad vary of customers, from these conducting tutorial analysis to skilled merchants trying to refine their methods primarily based on historic information. By offering a customizable and detailed view of buying and selling periods, the Session Common Date Vary instrument stands as a robust asset for anybody concerned in value evaluation and volatility evaluation.

be aware: Works for timeframes of H4 and beneath.

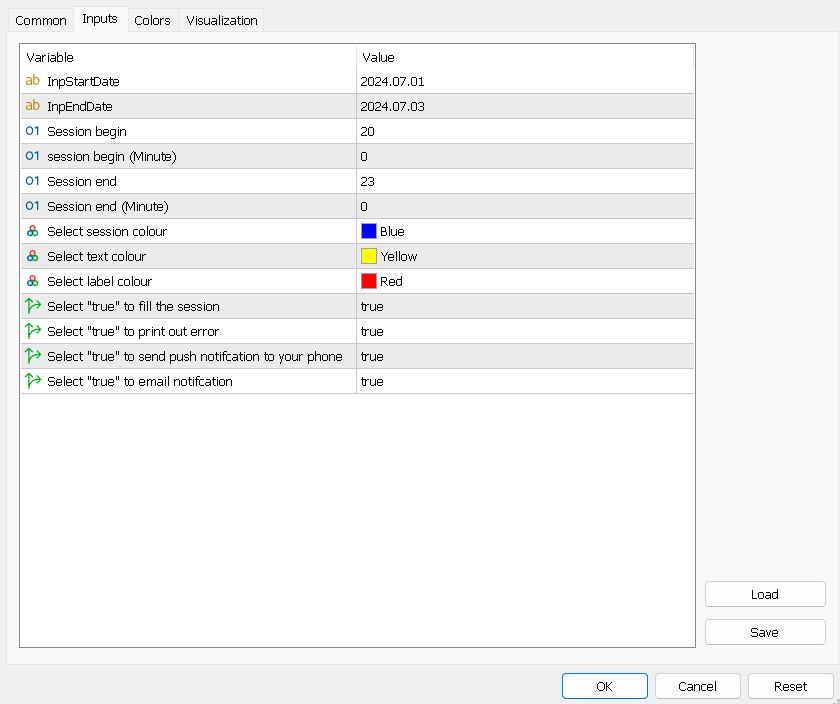

Foremost inputs

– InpStartDate: Specify the beginning date for the evaluation interval. This units the start of the vary for which session information shall be evaluated.

– InpEndDate: Outline the ending date for the evaluation interval. This marks the tip of the vary and limits the session information analysis to this date.

– SBegin (Dealer time): Units the beginning hour of the session in 24-hour format.

– SBeginMinute (Dealer time) : Defines the beginning minute of the session. A worth of 0 means the session begins precisely on the hour.

– SEnd (Dealer time) : Determines the ending hour of the session in 24-hour format.

– SEndMinute (Dealer time) : Specifies the ending minute of the session. A worth of 0 means the session ends precisely on the hour.

– SColor: Chooses the colour for displaying the session on the chart. `clrBlue` will present the session in blue.

– InpTextColor: Units the colour for the textual content displayed by the indicator. `clrYellow` will render the textual content in yellow.

– InpLabelColor: Defines the colour for labels inside the indicator. `clrRed` will colour the labels pink.

– InpFill: Selects whether or not to fill the session space with colour. `true` fills the session space with the colour specified by `S1Color`.

– InpPrint: Determines whether or not to print error messages to the log. `true` permits error logging.

– InpPushNotification: Chooses whether or not to ship push notifications to your cellular machine. `true` permits push alerts.

– InpEmailNotification: Specifies whether or not to ship e mail notifications. `true` permits e mail alerts.

Leave a Reply