[ad_1]

In keeping with Goldman Sachs, Bitcoin (BTC) value appreciation in 2024 did not compensate for its value volatility dangers. In the meantime, gold’s larger risk-adjusted returns reaffirmed its “secure haven” narrative.

Regardless of The Good points, Bitcoin Fails To Outshine Gold

The main digital asset by reported market cap surged from roughly $42,000 originally of the yr to as excessive as $73,000 in March 2024, recording greater than 73% good points. At its present market value of $62,790, BTC remains to be greater than 40% up from its value in January 2024.

Associated Studying

Notably, all through 2024, Bitcoin has persistently outperformed main fairness indices, fixed-income devices, gold, and crude oil.

Nonetheless, in line with knowledge tracked by Goldman Sachs, regardless of BTC’s spectacular good points, its value efficiency in absolute phrases fails to compensate for its volatility.

The evaluation by Goldman Sachs places BTC’s year-to-date (YTD) volatility ratio at slightly below 2%. Compared, gold gave a risk-adjusted return of three%, posting robust 28% good points in absolute phrases.

For the uninitiated, the volatility ratio measures the return an asset generates for every unit of threat or volatility it carries. The next ratio signifies that an asset offers higher returns relative to the chance taken, whereas a decrease ratio suggests much less environment friendly efficiency.

The evaluation notes that Bitcoin’s volatility ratio was solely higher than Ethereum’s native ETH token, S&P GSCI Vitality Index, and Japan’s TOPIX index among the many non-fixed earnings growth-sensitive investments.

Bitcoin’s low volatility ratio in comparison with gold cements the latter’s declare as a “secure haven asset.” This got here below the limelight final week when BTC slumped, and gold surged following Iran’s offensive towards Israel.

Nonetheless A Lengthy Means To Go For Bitcoin

Since its inception following the 2008 monetary disaster, Bitcoin’s ascent to a trillion-dollar market cap asset has been outstanding.

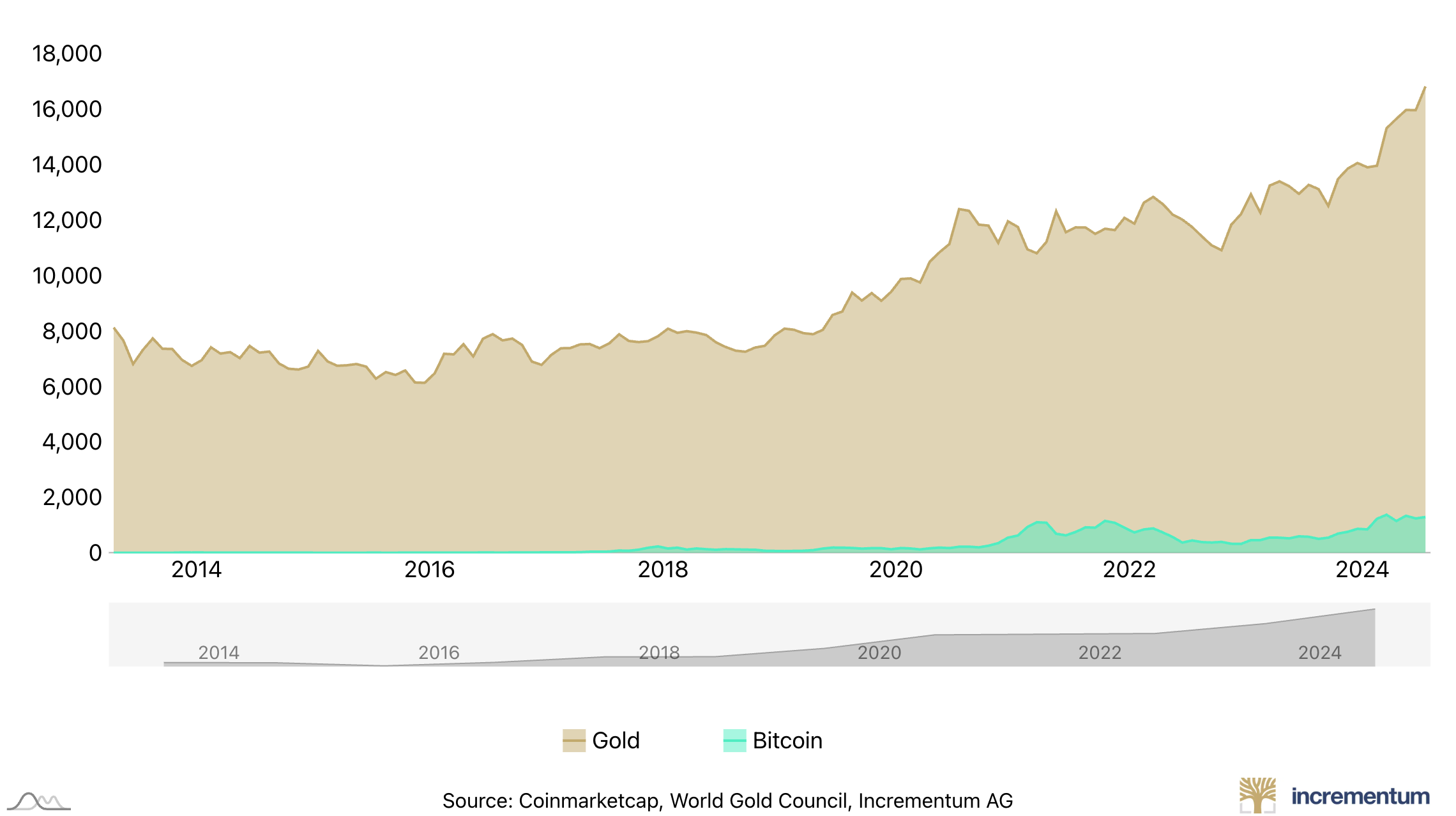

The fastened provide of 21 million, decentralized community structure, and halving each 4 years make BTC an interesting asset. Nonetheless, the market cap hole between Bitcoin and gold stays huge.

That mentioned, a number of crypto analysts are assured that Bitcoin will outperform the shining metallic within the coming years. As an example, seasoned analyst Peter Brandt just lately made an formidable prediction that by 2025, BTC might see its value leap 400% relative to gold.

Associated Studying

Equally, in August 2024, VanEck CEO Jan van Eck said that BTC might surge to $350,000 on the again of better adoption.

Most just lately, funding administration agency BlackRock declared Bitcoin a “gold different” because of its fastened provide and rising investor confidence in its means to sort out inflation and keep away from worth erosion throughout unsure instances.

Quite the opposite, billionaire Ray Dalio has expressed his opinion on the Bitcoin vs. gold narrative, saying that BTC won’t ever totally exchange gold. BTC trades at $62,790 at press time, down 2.3% within the final 24 hours.

Featured picture from Unsplash, charts from ingoldwetrust.report and Tradingview.com

[ad_2]

Supply hyperlink

Leave a Reply