EUR/USD: Doves Outplay Hawks, Rating 76:24

● Final week, 4 key occasions attracted the eye of the markets. The week started on Monday, Seventh October, with the discharge of eurozone retail gross sales knowledge. In keeping with the statistics, retail gross sales in August grew by 0.2% month-on-month and by 0.8% year-on-year, which was virtually consistent with forecasts. Analysts surveyed by Reuters had anticipated progress of 0.2% (m/m) and 1.0% (y/y).

● The subsequent vital occasion was the discharge of the minutes from the September FOMC (Federal Open Market Committee) assembly of the US Federal Reserve on Wednesday, Ninth October. This 13-page doc offered an in depth evaluation of the financial scenario and the opinions of Committee members on the prospects for financial coverage. The Fed downgraded its forecast for US financial progress in 2024 from 2.1% to 2.0%, whereas holding the 2025 estimate unchanged at 2.0%. The inflation forecast for the present 12 months was lowered from 2.6% to 2.3%, and for the next 12 months, from 2.3% to 2.1%.

In keeping with Fed Chair Jerome Powell’s assertion, the regulator’s baseline situation assumes additional financial coverage easing. Nonetheless, he famous that the Fed is in no hurry to behave. The minutes revealed that Committee members are divided into two camps concerning the anticipated tempo and magnitude of the important thing rate of interest cuts. Some imagine that it’s important to keep away from a charge discount that’s both too late or inadequate, citing dangers to the labour market. Others argue {that a} charge lower that’s too swift or too massive might halt the progress made within the battle towards inflation and even result in its resurgence.

● The subsequent assembly of the US regulator will happen on 6-Seventh November. Market individuals count on to see two extra charge cuts this 12 months, every by 25 foundation factors. In keeping with the CME FedWatch instrument, there’s a 76% likelihood that the primary of those cuts will happen subsequent month, whereas the likelihood that the speed will stay unchanged is estimated at round 24%. Towards this backdrop, the main US inventory indices rallied, with the S&P 500 and Dow Jones reaching document closing ranges.

● The third occasion came about on Thursday, tenth October, with the discharge of US inflation knowledge. In keeping with the US Division of Labour, whereas shopper costs in September barely exceeded forecasts, annual inflation reached its lowest degree since February 2021.

The Shopper Worth Index (CPI) remained at 0.2% month-on-month, regardless of forecasts of 0.1%. On an annual foundation, the CPI was 2.4% in September, which was increased than the forecast of two.3% however decrease than the earlier worth of two.5%. Core inflation (Core CPI), which excludes risky meals and vitality costs, rose to three.3% year-on-year, exceeding each the forecast and expectations of three.2%.

These figures strengthened buyers’ expectations that the US Federal Reserve would proceed with one other charge lower in November. The EUR/USD pair reacted to the inflation knowledge with volatility, fluctuating inside a 50-point vary (1.0904-1.0954), however by the beginning of Friday, it had returned to the place it had been in the beginning of Thursday – in the midst of the vary round 1.0935.

● It’s price recalling that on 18th September, the Federal Reserve lowered the important thing rate of interest for the primary time for the reason that begin of the COVID-19 pandemic, and by 50 foundation factors without delay. In keeping with Jerome Powell, this sharp transfer was obligatory to guard the labour market. Nonetheless, knowledge from the US Bureau of Labour Statistics, launched on 4th October, confirmed the most important enhance in new jobs in six months and a lower in unemployment. The variety of new jobs within the non-farm sector (NFP) rose by 254K, following a rise of 159K in August, and much exceeded market expectations of 140K. The unemployment charge dropped to 4.1% from 4.2%. In keeping with analysts, this confirmed the resilience of the financial system, and the expectation of a gradual charge lower this 12 months.

● The ultimate occasion of the week, which had the potential to affect the dynamics of the US Greenback Index (DXY) and consequently EUR/USD quotes, was the discharge of one other vital inflation indicator on Friday, eleventh October – the US Producer Worth Index (PPI). In keeping with the report from the US Bureau of Labour Statistics, the PPI rose by 1.8% year-on-year in September. This adopted a rise of 1.9% in August and exceeded market expectations of 1.6%. The core PPI, on a yearly foundation, grew by 2.8% (forecast 2.7%). On a month-to-month foundation, the PPI remained unchanged, whereas the core index rose by 0.2%.

● Although producer value inflation exceeded forecasts, the market barely reacted to those figures. Consequently, the week’s ultimate word was struck on the identical degree, 1.0935. Most analysts (70%) predict a decline within the EUR/USD pair forward of the ECB assembly. The remaining 30% have taken a impartial stance. Indicators on D1 principally align with the analysts’ outlook. All oscillators are in pink, although a 3rd of them sign the pair is oversold. Amongst development indicators, 75% level south, whereas 25% level north.

The closest assist for the pair is within the 1.0890-1.0905 zone, adopted by 1.0780-1.0805, 1.0725, 1.0665-1.0680, 1.0600-1.0620, 1.0520-1.0565, and 1.0450-1.0465. Resistance zones are positioned round 1.0990-1.1010, then 1.1045, 1.1100, 1.1155, 1.1185-1.1210, 1.1275, 1.1385, 1.1485-1.1505, 1.1670-1.1690, and 1.1875-1.1905.

● Probably the most attention-grabbing day subsequent week is predicted to be Thursday, seventeenth October. On at the present time, eurozone shopper inflation (CPI) knowledge can be launched, adopted by a gathering of the European Central Financial institution. Some specialists anticipate that the ECB may go for one other 25 foundation level lower in the important thing rate of interest. Along with this choice, the ECB’s management feedback on financial coverage will undoubtedly appeal to vital curiosity. Furthermore, on seventeenth October, knowledge on US retail gross sales and preliminary jobless claims may even be launched.

![]()

CRYPTOCURRENCIES: The Crypto Business’s Struggle with the SEC Enters a ‘Scorching’ Section

● We’ll start our evaluation of the crypto business by choosing up the place we left off final time—with the “info bomb” that was anticipated to blow up on 8-Ninth October. The American tv channel HBO had promised to disclose the true id of Satoshi Nakamoto. And certainly, they did identify somebody, however few believed it. In keeping with the authors of the documentary Digital Cash: The Thriller of Bitcoin, the pseudonym Nakamoto allegedly belonged to 39-year-old Canadian Peter Todd. Todd was certainly one of many early builders of Bitcoin Core, however he was by no means among the many primary suspects considered Nakamoto.

The filmmakers offered a number of arguments, together with using British/Canadian spelling in Nakamoto’s writings and a correlation between the timing of Todd’s instructional schedule and Nakamoto’s posts. The important thing “proof” was a message posted on the Bitcoin discussion board in 2010, supposedly left by Todd beneath Nakamoto’s identify. Nonetheless, these arguments didn’t persuade most viewers. Ki Younger Ju, CEO of CryptoQuant, even referred to as the documentary “disgusting” and expressed astonishment at how misguided the conclusions had been.

● One other, extra tangible, sensation might emerge from the most recent spherical within the ongoing battle between the US Securities and Alternate Fee (SEC) and representatives of the crypto business. Talking at New York College’s College of Regulation, SEC Chair Gary Gensler acknowledged that cryptocurrencies are unlikely to ever be broadly used as a cost technique and can proceed to be seen primarily as a retailer of worth. Gensler additionally praised his company’s strategy to implementing laws on crypto firms by means of authorized motion. “Typically we have to take enforcement actions to convey individuals again to the fitting facet,” he stated.

Underneath Gensler’s management, the SEC has filed quite a few lawsuits towards crypto firms for violating securities legal guidelines. Defendants embody main centralized exchanges equivalent to Coinbase, Binance, and Kraken, in addition to the fintech firm Ripple, the issuer of the XRP token. The SEC, nonetheless, has refused to determine clearer regulatory tips or standards for figuring out whether or not a cryptocurrency falls into certainly one of two classes: a safety or a commodity. In assessing the way forward for cryptocurrencies, Gensler struck a blow to the digital business by citing Gresham’s Regulation: “Unhealthy cash drives out good.”

● It is definitely disheartening when cryptocurrencies are labelled as “the worst,” and crypto advocates are described as being on “the mistaken facet.” Nonetheless, within the US, it isn’t solely authorities that may file lawsuits towards industrial organisations— the reverse can also be potential. And so they may even name the SEC an “unlawful entity.” In a daring transfer, the cryptocurrency change Crypto.com has filed a lawsuit towards the SEC, accusing the company of overstepping its authority in regulating the crypto business. This was introduced by the co-founder and CEO of the platform, Kris Marszalek.

“This unprecedented motion by our firm towards a federal company is a justified response to the SEC’s enforcement measures, which have harmed greater than 50 million American cryptocurrency holders,” he wrote on his social media web page. In keeping with Marszalek, the Fee has overreached its authorized boundaries and now operates as an illegal entity, labelling virtually all cryptocurrencies as securities. The Crypto.com CEO additionally promised that the corporate would use “all out there regulatory instruments” to convey readability to the business and shield the way forward for the crypto sector within the US by means of authorized means.

● Persevering with with the subject of the US Securities and Alternate Fee (SEC), here is one other improvement. Following within the footsteps of Bitwise, the crypto funding agency Canary Capital has filed an utility with the SEC to launch a spot XRP-ETF based mostly on Ripple. The concept behind this exchange-traded fund is to provide buyers entry to one of many largest altcoins by means of a conventional brokerage account, with out the dangers related to immediately shopping for and storing cryptocurrency. And that is excellent news.

The applying was submitted utilizing Kind S-1, which implies there aren’t any particular deadlines by which the regulator should decide. And that is the dangerous information: understanding Gary Gensler’s stance, the evaluation course of might vary from “simply a very long time” to “endlessly lengthy.” Moreover, a second obligatory step in launching the ETF is the submission of one other utility—this time by the inventory change the place the brand new product can be listed. As of now, the SEC has not acquired such a submitting from any change.

● The end result of the US presidential elections might considerably affect the crypto business. Geoff Kendrick, Head of Crypto Analysis at Commonplace Chartered Financial institution, predicts that if Donald Trump is elected, the worth of bitcoin might triple by the tip of 2025, and Solana might rise fivefold. Kendrick believes that the Trump administration could be extra beneficial in the direction of the Solana ecosystem in comparison with a Harris administration. Due to this fact, if Kamala Harris turns into the occupant of the White Home, bitcoin is predicted to outpace Ethereum in progress, whereas Ethereum would surpass Solana and attain $7,000. Kendrick additionally means that bitcoin might rise to $200,000 by the tip of 2025, whatever the election outcomes on fifth November.

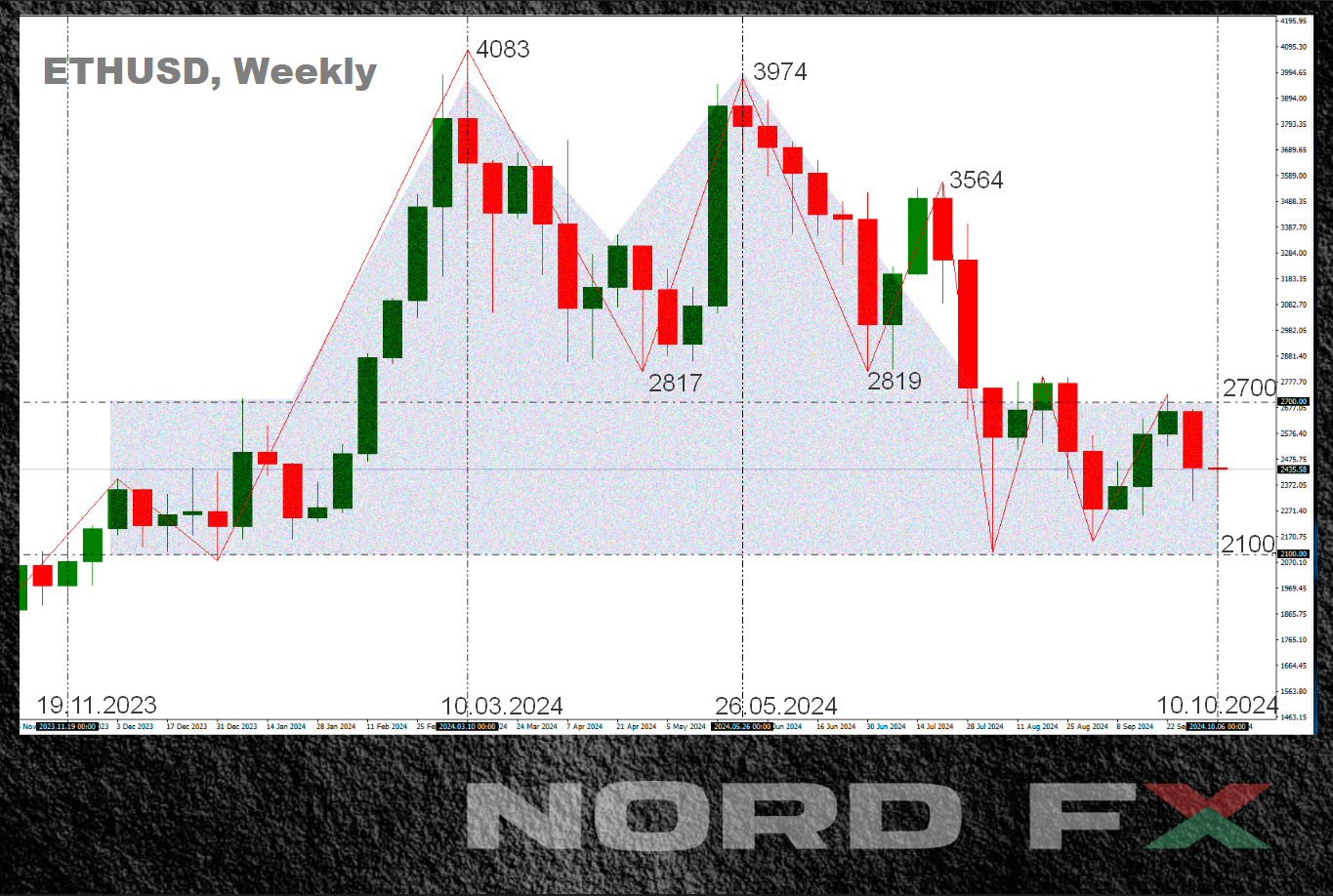

● At the moment, each bitcoin and Ethereum are beneath stress. Bitcoin, the world’s largest cryptocurrency, faces hypothesis a few potential sale of numerous tokens held by the US authorities, though no choice has been made but. In keeping with analysts at QCP Capital, the rising demand for meme cash can also be hindering BTC’s progress. As for Ethereum, its value could possibly be negatively impacted by the Chinese language authorities, who’re reportedly getting ready to promote $1.3 billion price of Ethereum seized from workers of the cryptocurrency firm PlusToken.

● On the time of penning this evaluation, on the night of Friday, tenth October, the BTC/USD pair is buying and selling round $63,080, the ETH/USD pair at $2,460, and SOL/USD at $146.0. The entire cryptocurrency market capitalisation has remained comparatively unchanged, standing at $2.20 trillion (in comparison with $2.17 trillion every week in the past). The Bitcoin Crypto Worry & Greed Index has dropped from 41 to 32 factors, inserting it within the Worry zone.

● And eventually, an occasion that might flip into one other international sensation. Famend economist Tyler Cowen has nominated Ethereum co-founder Vitalik Buterin for the Nobel Prize in Economics. This initiative was supported by one other distinguished skilled, Professor Alexander Tabarrok. Each economists praised Buterin for his vital contributions to the financial economics of cryptocurrencies, emphasising that his work has far surpassed that of some other economist. In keeping with Tyler, Vitalik constructed the sensible Ethereum platform and created a digital forex that challenges Mises’ Regression Theorem. This theorem asserts that the worth of cash may be traced again (“regressed”) to the worth of the products and companies it represents.

Cowen and his colleague additionally counseled Buterin’s continued efforts to develop the Ethereum community and highlighted that he would make a superb speaker on the Nobel Prize ceremony (if he’s accepted), noting his politeness and good communication expertise.

For reference: Vitalik Buterin was born close to Moscow in 1994, that means he’s at the moment 30 years outdated. On the age of 6, he moved along with his mother and father from Russia to Canada. He’s the co-founder and former editor of *Bitcoin Journal* and the co-founder of the Ethereum challenge, for which he gained the World Know-how Award in 2014, beating out Fb founder Mark Zuckerberg and different contenders. In 2021, Buterin turned the youngest cryptocurrency billionaire on the earth. American *Forbes* estimated Buterin’s internet price at $1.3 billion.

NordFX Analytical Group

Disclaimer: These supplies are usually not an funding suggestion or a information for engaged on monetary markets and are for informational functions solely. Buying and selling on monetary markets is dangerous and might lead to an entire lack of deposited funds.

#eurusd #gbpusd #usdjpy #foreign exchange #forex_forecast #nordfx #cryptocurrencies #bitcoin

Leave a Reply