Please go away a 5 stars ranking for those who like this free device! Thanks a lot 🙂

The “Threat Administration Assistant” Skilled Advisor Assortment is a complete suite of instruments designed to boost buying and selling methods by successfully managing danger throughout numerous market situations. This assortment includes three key elements: averaging, switching, and hedging professional advisors, every providing distinct benefits tailor-made to completely different buying and selling situations.

This EA is a growth of normal danger administration methods available on the market

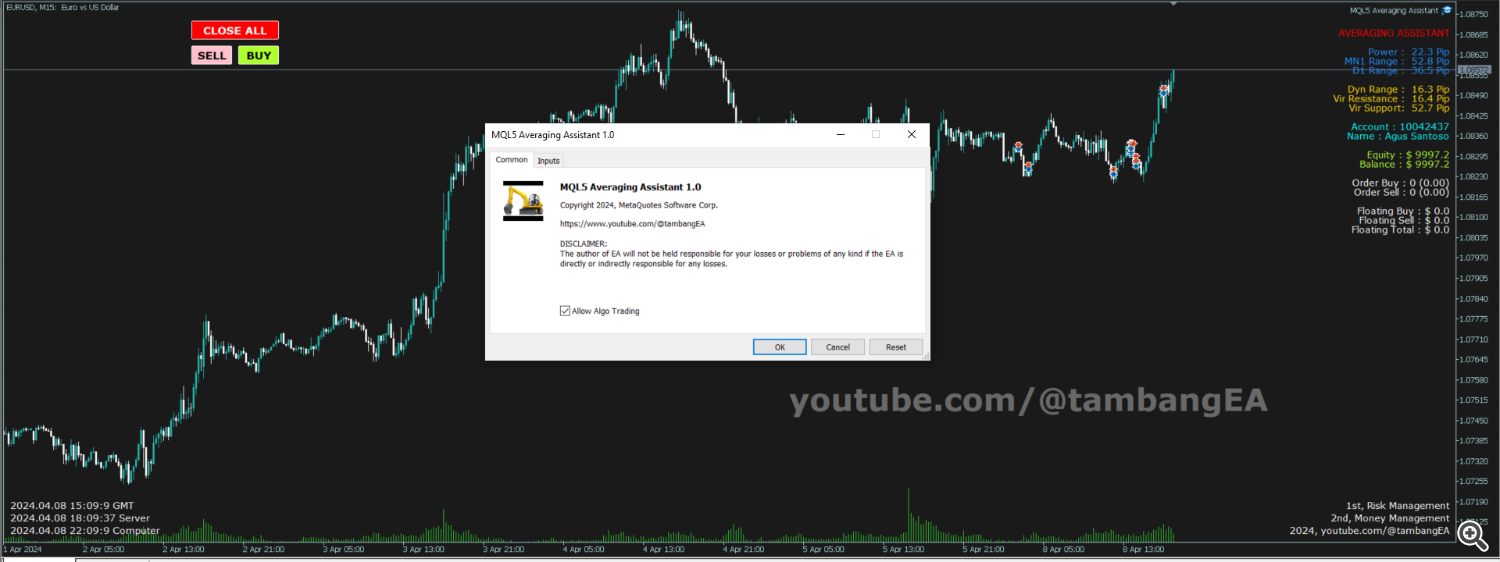

1. Averaging Assistant EA:

Benefit: Averaging professional advisors make the most of a method the place extra positions are opened at completely different worth ranges to attain a median entry worth. This method might help mitigate losses and enhance general profitability in trending markets.

Benefits:

Threat Mitigation: By averaging the entry worth of a place, the influence of sudden worth fluctuations is minimized, lowering the potential for vital losses.

Enhanced Revenue Potential: Averaging permits merchants to capitalize on worth actions by accumulating positions at favorable ranges, probably rising income when the market reverses.

Adaptive to Traits: Best for trending markets the place worth tends to maneuver persistently in a single path, because it permits merchants to capitalize on momentum whereas managing danger successfully.

The “Averaging Assistant” Skilled Advisor (EA) using the averaging technique is a complicated device designed to assist merchants handle their dangers successfully within the foreign exchange or monetary markets. This EA employs an averaging technique, which includes opening a number of positions at completely different worth ranges to mitigate the influence of market volatility and potential antagonistic actions.

Here is an in depth description of the important thing options and functionalities of this EA:

Threat Administration Parameters: The EA permits merchants to outline their danger administration parameters, together with the utmost danger per commerce, complete publicity restrict, and stop-loss ranges. Merchants can set these parameters based mostly on their danger tolerance and buying and selling methods.

Averaging Technique: The core of this EA is its averaging technique. When a commerce is initiated, and the market strikes towards the place, the EA will open extra positions (averaging down) at predetermined intervals or worth ranges. These extra positions are geared toward lowering the typical entry worth of the general place, thus probably enhancing the probabilities of the commerce ultimately turning worthwhile.

Dynamic Place Sizing: The EA dynamically adjusts the place sizes of the averaging trades based mostly on market situations and the dealer’s danger administration parameters. It might enhance or lower the scale of subsequent positions to make sure that the entire danger publicity stays inside predefined limits.

Cease-loss Administration: The EA incorporates clever stop-loss administration to restrict potential losses. Merchants can set trailing stop-loss ranges that robotically regulate because the commerce strikes of their favor. Moreover, the EA could shut out all positions if the cumulative loss reaches a sure threshold to stop extreme drawdowns.

Revenue-taking Methods: Along with managing losses, the EA additionally contains profit-taking methods. Merchants can set take-profit ranges for particular person positions or for all the basket of trades opened by the EA. This helps lock in income and forestall giving again positive factors throughout unstable market situations.

Threat Monitoring and Reporting: The EA constantly displays the general danger publicity, particular person commerce efficiency, and account steadiness. It offers real-time reporting and alerts to maintain merchants knowledgeable about their portfolio’s danger profile and efficiency.

Customization Choices: The EA provides a excessive diploma of customization, permitting merchants to fine-tune parameters comparable to averaging intervals, most variety of averaging trades, and risk-reward ratios to go well with their buying and selling preferences and market situations.

Backtesting and Optimization: Earlier than deploying the EA in stay buying and selling, merchants can conduct in depth backtesting and optimization to judge its efficiency beneath numerous market situations and parameter settings. This helps validate the effectiveness of the averaging technique and fine-tune the EA for optimum outcomes.

General, the Threat Administration Assistant Skilled Advisor utilizing the averaging technique is a strong device for merchants in search of to handle dangers successfully whereas implementing a disciplined and systematic method to buying and selling within the monetary markets. By combining refined danger administration methods with the averaging technique, this EA goals to boost the general profitability and resilience of merchants’ portfolios.

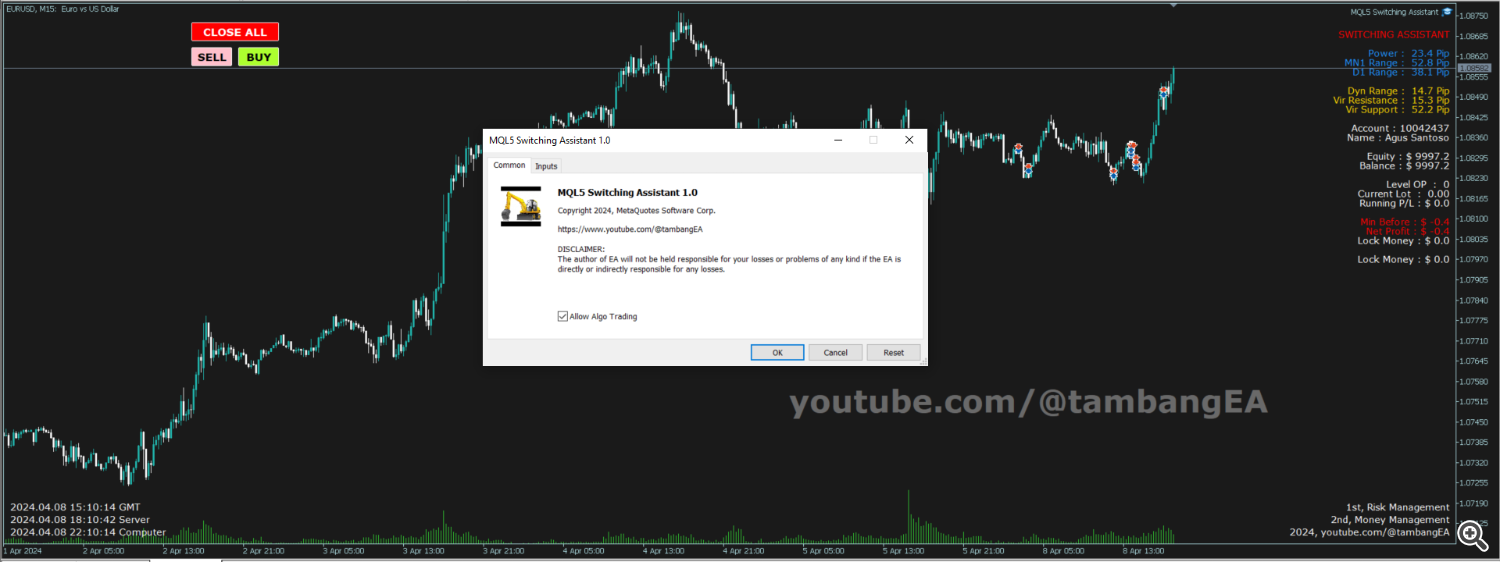

2. Switching Assistant EA :

Benefit: Switching professional advisors make use of a dynamic technique that switches between completely different buying and selling programs or parameters based mostly on market situations. This adaptive method helps optimize efficiency and scale back danger publicity.

Benefits:

Adaptability: Switching between completely different buying and selling programs or parameters allows the professional advisor to adapt to altering market situations, maximizing profitability in numerous environments.

Threat Diversification: By using a number of methods, the switching professional advisor spreads danger throughout completely different approaches, lowering reliance on any single technique and enhancing general portfolio resilience.

Improved Consistency: The power to regulate methods based mostly on market dynamics helps preserve constant efficiency over time, at the same time as market situations evolve.

The “Switching Assistant’ Skilled Advisor (EA) using the switching technique is a complicated device designed to boost danger administration inside buying and selling methods, notably within the realm of algorithmic buying and selling in monetary markets. This EA operates throughout the MetaTrader platform, leveraging its capabilities to automate danger administration choices based mostly on predefined parameters and market situations.

Here is a breakdown of its key options and performance:

Dynamic Threat Adjustment: The EA employs a dynamic danger adjustment mechanism that constantly evaluates market situations, account measurement, and different related elements to find out the suitable stage of danger for every commerce.

Switching Methodology: On the core of this EA is the switching technique, which includes dynamically switching between completely different danger administration methods based mostly on predefined standards. These methods could embody fastened lot measurement, proportion danger per commerce, or different customized danger administration approaches.

Commerce Evaluation: The EA conducts real-time evaluation of every potential commerce, contemplating elements comparable to volatility, correlation, and market sentiment to evaluate the risk-reward profile earlier than executing a commerce.

Customizable Parameters: Customers have the flexibleness to customise numerous parameters, together with danger thresholds, commerce measurement limits, and switching standards, to align with their particular buying and selling targets and danger tolerance.

Threat Monitoring and Reporting: The EA constantly displays account fairness, drawdown ranges, and different danger metrics, offering real-time alerts and complete reporting to assist merchants keep knowledgeable about their publicity and efficiency.

Place Sizing Optimization: By dynamically adjusting place sizes based mostly on market situations and danger parameters, the EA goals to optimize risk-adjusted returns and mitigate the potential for vital drawdowns.

Backtesting and Optimization: Previous to deployment, the EA permits customers to conduct in depth backtesting and optimization to evaluate its efficiency beneath numerous market situations and fine-tune its parameters for optimum outcomes.

Compatibility and Integration: The EA seamlessly integrates with MetaTrader platforms, making certain compatibility with a variety of brokers and buying and selling devices, together with foreign exchange, shares, commodities, and indices.

Threat Management Mechanisms: Along with dynamic place sizing, the EA could incorporate extra danger management mechanisms comparable to stop-loss orders, trailing stops, and hedging methods to additional mitigate draw back danger.

General, the Threat Administration Assistant Skilled Advisor using the switching technique empowers merchants to implement a disciplined and adaptive method to danger administration, serving to to safeguard their capital whereas maximizing the potential for long-term profitability within the dynamic and infrequently unpredictable world of economic markets.

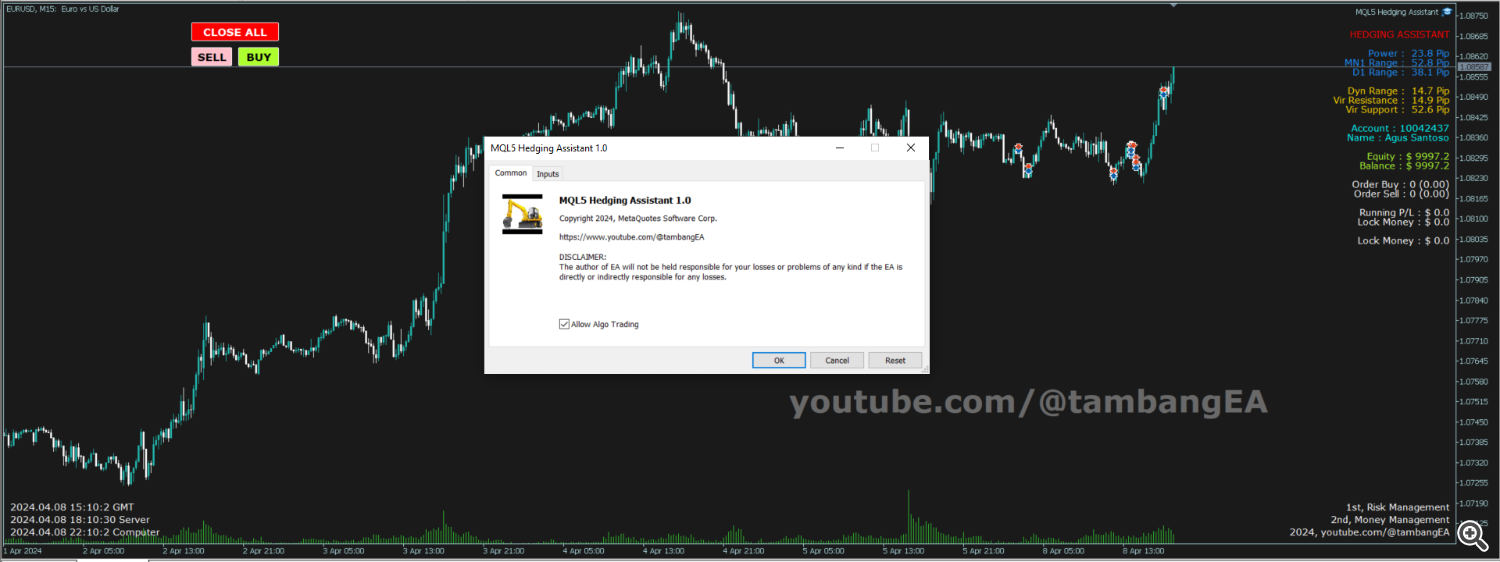

3. Hedging Assistant EA :

Benefit: Hedging professional advisors make use of hedging methods to offset potential losses by opening reverse positions in correlated property or markets. This technique offers a safeguard towards antagonistic worth actions whereas permitting merchants to stay lively out there.

Benefits:

Threat Safety: Hedging professional advisors act as a type of insurance coverage towards unfavorable market actions by offsetting losses in a single place with positive factors in one other, thereby lowering general danger publicity.

Continued Market Participation: By hedging positions, merchants can keep away from the necessity to exit the market totally in periods of uncertainty or volatility, sustaining publicity to potential alternatives.

Flexibility: Hedging methods may be tailor-made to particular market situations and particular person danger preferences, providing flexibility in danger administration approaches.

In abstract, the Threat Administration Assistant Skilled Advisor Assortment provides a complete set of instruments designed to successfully handle danger in buying and selling operations. Whether or not by way of averaging, switching, or hedging methods, merchants can mitigate losses, optimize profitability, and adapt to altering market situations with confidence.

The “Hedging Assistant” Skilled Advisor with Hedging Methodology is a complicated device designed to help merchants in managing their danger publicity successfully throughout the unstable world of economic markets. Using superior algorithms and hedging methods, this professional advisor goals to reduce potential losses whereas maximizing revenue potential.

Key Options:

Threat Evaluation: The advisor evaluates the dealer’s danger tolerance, account steadiness, and market situations to find out acceptable danger ranges for every commerce. It considers elements comparable to volatility, liquidity, and correlation to make knowledgeable choices.

Dynamic Place Sizing: Based mostly on the chance evaluation, the advisor dynamically adjusts place sizes to align with the dealer’s danger parameters. It ensures that every commerce’s publicity is proportional to the dealer’s account measurement and danger tolerance.

Hedging Technique Implementation: The advisor employs hedging methods to mitigate potential losses in antagonistic market situations. By opening offsetting positions, it goals to neutralize draw back danger whereas permitting for continued participation in market actions.

Actual-Time Monitoring: The advisor constantly displays market situations and the dealer’s positions to establish potential dangers and alternatives. It offers real-time alerts and notifications to immediate motion when mandatory, making certain proactive danger administration.

Customizable Parameters: Merchants can customise numerous parameters comparable to stop-loss ranges, take-profit targets, and hedging thresholds to go well with their particular person buying and selling preferences and danger urge for food. This flexibility permits for customized danger administration methods.

Backtesting and Optimization: The advisor provides strong backtesting capabilities, permitting merchants to judge the effectiveness of various danger administration methods over historic knowledge. Via optimization, merchants can fine-tune parameters to boost efficiency and adapt to altering market situations.

Person-Pleasant Interface: The advisor options an intuitive interface that makes it simple for merchants to watch their positions, regulate settings, and analyze efficiency. It offers clear visualizations and studies to facilitate knowledgeable decision-making.

Advantages:

Enhanced Threat Administration: By using superior algorithms and hedging methods, the advisor helps merchants reduce potential losses and protect capital throughout antagonistic market situations.

Improved Profitability: The dynamic place sizing and proactive danger administration methods employed by the advisor intention to optimize revenue potential whereas mitigating draw back danger.

Time Effectivity: The advisor automates many points of danger administration, permitting merchants to give attention to technique growth and evaluation somewhat than guide monitoring and intervention.

Versatility: Whether or not buying and selling foreign exchange, shares, commodities, or different monetary devices, the advisor may be tailored to varied markets and buying and selling kinds, offering flexibility for merchants with various preferences.

In conclusion, the Threat Administration Assistant Skilled Advisor with Hedging Methodology provides merchants a strong device to navigate the complexities of economic markets with confidence. By combining superior danger administration methods with automated execution, it goals to empower merchants to attain their monetary objectives whereas minimizing publicity to market volatility.

// ========

Leave a Reply