[ad_1]

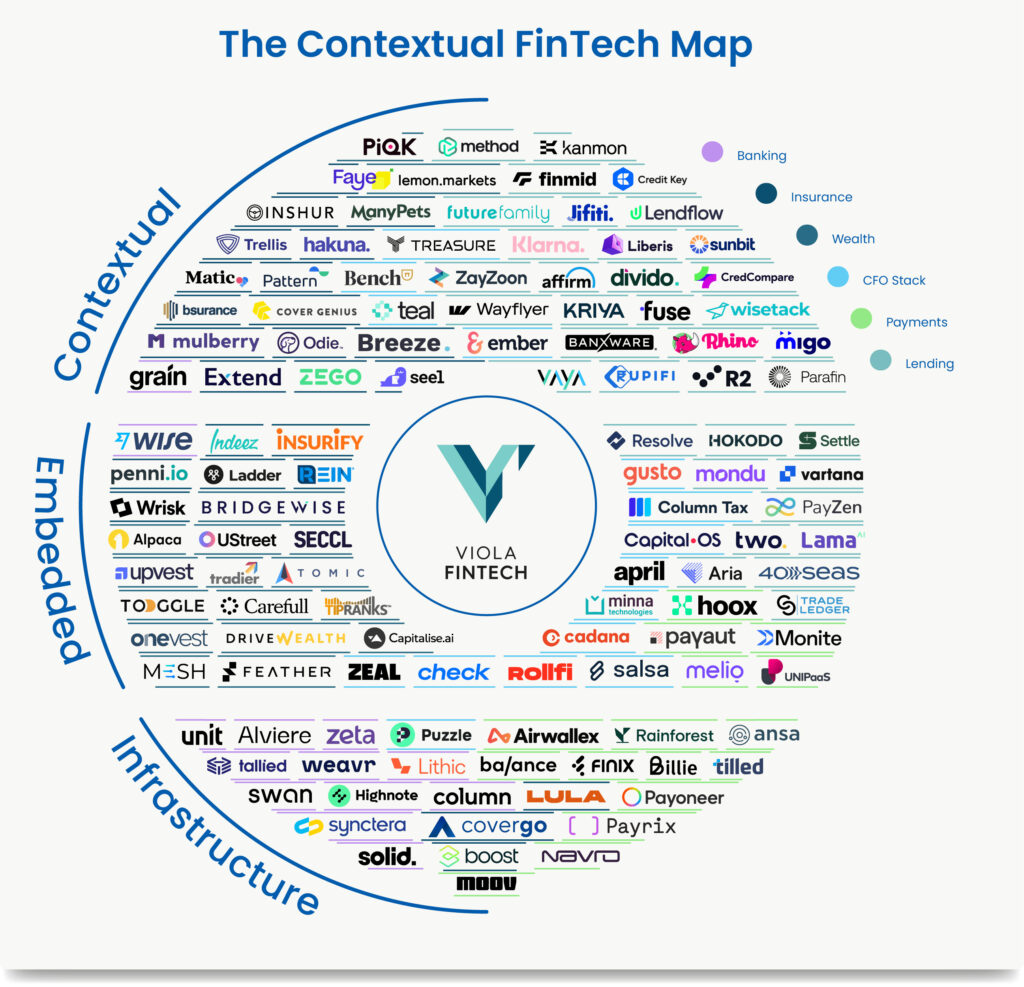

A brand new report from Viola Fintech exhibits why firms should transcend embedded finance to contextual finance if they need their share of a pie estimated to succeed in $588 billion by 2032. It Relies on the Context: From Embedded to Contextual Finance is offered right here.

Accomplice Noam Inbar mentioned the rise of Generative AI and mannequin commoditization make personalization extra achievable. The trick is distribution. Crack that nut, and your prices are close to zero.

How contextual finance goes past embedding

Most embedded finance companies restrict themselves as a result of they see distribution as merely embedding one product inside one other. Inbar mentioned their predominant fault is that they fail to think about the client’s wants when designing the service. Does this growth profit the client in any approach? Does it present worth?

Typically, the reply is not any.

“A lot of the discussions when VCs speak about embedded finance are about this particular person getting very low distribution,” Inbar mentioned. ”For those who take a look at the worth chain, it’s by no means in regards to the buyer.

“There’s a chance to leverage knowledge and perceive context to be able to tailor a really correct consumer expertise. For those who do this, you’ll additionally win by specializing in the client.”

The important thing to profitable contextual finance

Designing an optimum contextual finance expertise begins with understanding intent. Contemplate your entire buyer journey and look to factors the place you possibly can add worth. Inbar mentioned that monetary merchandise are sometimes a secondary concern. Of us don’t get up enthusiastic about purchasing for mortgage insurance coverage.

However they do dream about shopping for properties, and mortgage insurance coverage is a part of that course of. How will you bundle that have inside the contextual home-buying journey? Look to insurance coverage supplied inside on-line journey portals for instance.

Assembly that want intuitively is crucial. Buyers could have a trusted go-to grocery or clothes model. That relationship is a foundational piece for an embedded finance providing, but when there isn’t a have to be met by a banking providing, what’s the purpose?

“If you select to leverage your distribution energy, I feel you should be considerate in regards to the sorts of interactions you wish to provide your prospects inside that,” Inbar mentioned. “We are able to do that; we are able to select the experiences we tailor. It’s about how we undertake the angle of trying on the buyer’s intent and the journey.

“Once I consider scale, scale is usually addressed from a know-how perspective. I feel know-how’s nice; it’s continuously maturing and enabling many issues that weren’t potential previously. Nonetheless, it doesn’t exempt anybody utilizing the know-how from needing to be extra considerate about leveraging it.”

Prime contextual finance use instances

It Relies on the Context: From Embedded to Contextual Finance lists six fascinating use instances for contextual finance, starting with earned wage entry (EWA). Inbar sees EWA as half of a bigger employer play the place it contributes to worker wellness. That positively influences relationship constructing, intent and worker efficiency.

Viola Fintech not too long ago invested in ZayZoon, an EWA and monetary wellness platform. Inbar mentioned ZayZoon serves because the connective tissue between employers and staff by leveraging knowledge to assist the employer higher serve and educate the worker as a client. Utilized by firms like Mazda, Doubletree and McDonald’s, ZayZoon additionally gives perks at shops and eating places.

“We predict there’s a wealth of alternatives in that house as a result of there’s a lot knowledge and so many issues you possibly can create,” Inbar mentioned.

Insurance coverage is one other space. Inshur gives insurance coverage for drivers embedded inside Uber’s app. Financing supplies varied alternatives, from BNPL to in-purchase financing that drives conversion. Parafin manages exercise and payouts inside meals supply apps.

The CFO stack, banking and wealth administration are different very important areas. Embedding inside vertical fintechs like healthcare is a development to look at.

The problem in delivering monetary literacy

Monetary literacy is a much-talked-about matter that’s arduous to ship, Inbar mentioned. That training have to be delivered inside one other exercise that originally attracts the consumer. Once more, it will need to have the correct context.

“That’s the place I’m consuming as a result of I’m there proper now,” Inbar mentioned. “I feel that’s tremendous highly effective. I haven’t met the corporate doing that (with monetary literacy), however I’m very taken with assembly firms like that. That ties in big and has lots of potential.”

Additionally learn:

[ad_2]

Supply hyperlink

Leave a Reply