[ad_1]

Word to the reader: That is the seventeenth in a collection of articles I am publishing right here taken from my guide, “Investing with the Pattern.” Hopefully, you can see this content material helpful. Market myths are typically perpetuated by repetition, deceptive symbolic connections, and the whole ignorance of details. The world of finance is filled with such tendencies, and right here, you may see some examples. Please understand that not all of those examples are completely deceptive — they’re generally legitimate — however have too many holes in them to be worthwhile as funding ideas. And never all are straight associated to investing and finance. Take pleasure in! – Greg

To start Half III: Guidelines-Primarily based Cash Administration, we have to overview just a few primary technical indicators which might be referenced ceaselessly. Their ideas are used all through this a part of the guide. Keep in mind, Half III is the creating of the burden of the proof to establish developments within the general market, a rating and choice course of for finding securities to purchase primarily based on their particular person and relative momentum, a algorithm and tips to give you a guidelines on the way to commerce the knowledge, and the outcomes of my rules-based development following technique, known as Dance with the Pattern.

Transferring Averages and Smoothing

Most instances, day by day inventory market knowledge is just too unstable to investigate correctly. What’s wanted is a means of eradicating a lot of this day by day volatility. There’s such a technique, and that’s the topic of this part on smoothing strategies.

Smoothing refers back to the act of creating the time collection knowledge smoother to take away oscillations, however preserving the final development. It’s a higher adverb to make use of than at all times making an attempt to clarify that you just take a shifting common of it or take the exponential common of it; simply say you might be smoothing it. A few of the benefits of doing this are:

- Lowering day-to-day fluctuations.

- Making it simpler to establish developments.

- Making it simpler to see modifications in development.

- Offering preliminary help and resistance ranges.

- Significantly better for development following.

One of many easiest market programs created, the shifting common, works virtually in addition to the most effective of the difficult smoothing strategies. A shifting common is precisely the identical as an everyday common (imply), besides that it “strikes” as a result of it’s repeatedly up to date as new knowledge grow to be out there. Every knowledge level in a shifting common is given equal weight within the computation; therefore, the time period arithmetic, or easy, is usually used when referring to a shifting common.

A shifting common smooths a sequence of numbers in order that the consequences of short-term fluctuations are decreased, whereas these of longer-term fluctuations stay comparatively unchanged. Clearly, the time span of the shifting common will alter its traits.

J. M. Hurst, in The Profit Magic of Inventory Transaction Timing (1970), defined these alterations with three common guidelines:

- A shifting common of any given time span precisely reduces the magnitude of the fluctuations of durations equal to that point span to zero.

- The identical shifting common additionally vastly reduces (however doesn’t eradicate) the magnitude of all fluctuations of length lower than the time span of the shifting common.

- All fluctuations which might be higher than the time span of the typical “come by,” or are current within the ensuing shifting common line. These with durations just a bit higher than the span of the typical are vastly decreased in magnitude, however the impact lessens as periodicity length will increase. Very lengthy length periodicities come by almost unscathed.

Easy or Arithmetic Transferring Common

To take a median of nearly any set of numbers or costs, you add up the numbers, then divide by the variety of gadgets. For instance, when you’ve got 4+6+2, the sum is 12, and the typical is 12/3 = 4. A shifting common does precisely this, however as a brand new quantity is added, the oldest quantity is eliminated. Within the earlier instance, as an example that 8 is the brand new quantity, so the brand new sequence can be 6+2+8. The unique first quantity (4) was eliminated as a result of we’re solely including the latest three numbers. On this case, the brand new common can be 16/3 = 5.33. So by including an 8 and eradicating a 4, we elevated the typical by 1.33 on this instance. For these so inclined, here is the maths: 8-4=4, and 4/3 =1.33.

One other characteristic of the easy shifting common is that every element is handled equally — that’s, it carries an equal weight within the calculation of the typical. That is proven graphically in Determine 12.1. Word that it doesn’t matter what number of knowledge factors you might be averaging; they every carry an equal contribution to the worth of the typical.

Due to the equal weighting of the info elements in a easy shifting common, the bigger the typical, the slower it’s going to react to modifications in worth.

Due to the equal weighting of the info elements in a easy shifting common, the bigger the typical, the slower it’s going to react to modifications in worth.

Let me share a little bit story about worth charts and shifting averages. Again within the Eighties, we had one of many unique on-line companies, known as Prodigy. At one level, they began to supply some easy inventory charts with a single shifting common on them. I saved it and knew one thing was flawed, as a result of I had studied and created some of these charts for years. I lastly found that they have been utilizing separate scales for the worth and the worth’s shifting common. Though the values can be appropriate, the show was not as a result of the typical was utilizing its remoted worth scale. I wrote (sure, there was no e-mail then) them and defined. The first response was denial that they may very well be doing it flawed. I mailed them some charts displaying their means and the right option to show shifting averages over worth by sharing the identical vertical scale. It took a very long time and lots of letters earlier than I lastly satisfied somebody that they’d it flawed. In appreciation, they despatched me a small digital clock price about $1.25 (battery not included).

Exponential Transferring Common

This technique of averaging was developed by scientists, comparable to Pete Haurlan, in an try to help and enhance the monitoring of missile steerage programs. Extra weight is given to the latest knowledge, and it’s due to this fact a lot sooner to alter path and reply to modifications in worth. It’s generally represented as a proportion (development p.c) as a substitute of by the extra acquainted intervals. For instance, to calculate a 5% exponential common, you’ll take the final closing worth and multiply it by 5%, then add this outcome to the worth of the earlier interval’s exponential common worth multiplied by the complement, which on this case is 1 –.05 =.95. Here’s a system that may show you how to convert between the 2:

Okay=2/(N + 1) the place Okay is the smoothing fixed (development p.c) and N is the variety of intervals.

Algebraically fixing for N: N =(2/Okay)-1.

For instance, in the event you wished to know the smoothing fixed of a 19-period exponential common, you can do the maths, Okay=2/(19 +1)=2/20=0.10 (smoothing fixed), or 10% development as it’s many instances expressed. Within the instance beforehand that used a 5% exponential common, the maths is as follows:

5% Exp Avg=(Present worth x 0.05) + (Earlier Exp Avg x 0.95)

Determine 12.2 reveals how the burden of every element impacts the typical. The latest knowledge is represented by the far proper on the graph.

Now for the actually necessary piece of information concerning the distinction between the easy shifting common and the exponential shifting common. Discover in Determine 12.3 how lengthy it takes the easy common (dashed) to reverse path to the upside. From the time the worth line climbs by the dashed line, it takes 5 to 6 days earlier than the dashed line begins to rise on this instance (upward arrow—SMA). In truth, instantly after the worth goes beneath the dashed line, the dashed line continues to be falling. Each averages used the identical variety of intervals.

Now word how shortly the darker exponential common modifications path when the worth line strikes by it (upward arrow—EMA). Instantly! Sure, due to the arithmetic, the exponential common will at all times change path as quickly as the worth line strikes by it. That’s the reason the exponential common is used, as a result of it hugs the info tighter and eliminates a lot of the lag that’s current within the easy common.

Now, in terms of the query as to which is healthier, the reply is at all times that it depends upon what you are attempting to perform. Generally the easy common is healthier due to its lag, and generally not. The identical goes for the exponential common; generally it’s higher, generally not. Personally, I’ve discovered that the exponential common is healthier for longer-term evaluation, say, greater than 65 intervals (days). Nonetheless, that turns into a private desire as you construct expertise.

Stochastics

George Lane promoted it and Ralph Dystant most likely created it; nevertheless, I do know that Tim Slater, the creator of CompuTrac software program in 1978, was most likely the one which coined the title Stochastics. That is an odd title, as stochastic is a mathematical time period that refers back to the evolution of a random variable over time. Stochastics is a range-based indicator that normalizes worth knowledge over a particular time frame, often 14 intervals or days. It mainly reveals the place the latest worth is relative to the complete vary of costs over the chosen variety of intervals. This show of worth location inside a spread of costs is scaled between 0 and 100. Often there are two variations, one known as %Okay, which is the uncooked calculation, and the opposite %D, which is only a three-period shifting common of %Okay. Do not get me began why there are two names for a calculation and its smoothed worth. I met George Lane quite a lot of instances and located him to be a pleasant gentleman; George handed away in 2008.

Personally, that is about my favourite price-based indicator. Evidently virtually everybody makes use of Stochastics as an overbought/oversold indicator. Whereas it’s good in a buying and selling vary or sideways market, it doesn’t work nicely in a trending market when used this fashion. Nonetheless, additionally it is a wonderful development measure. That is good as a result of many shares and markets development greater than they go sideways.

So how does it work as a development measure? If you consider the system and understand that so long as costs are rising, then %Okay goes to stay at or close to its highest degree, say over 80. Subsequently, so long as %Okay is over 80, you may assume you might be in an uptrending market. Likewise, when %Okay is beneath 20 for a time frame, you might be in a downtrending market. Personally, I like to make use of %D as a substitute of %Okay for development evaluation, as it’s smoother with much less false indicators.

Determine 12.4 reveals a 14-day Stochastic with the S&P 500 Index above. The three horizontal strains on the Stochastic are at 20, 50, and 80.

In the event you use Stochastics as an overbought/oversold indicator, it’s going to work higher in the event you solely take indicators which might be aligned with a longer-term development. For instance, if the final development of the market is up, then solely adhere to the purchase indicators from Stochastics. Lastly, you aren’t restricted to the 80 and 20 ranges to find out overbought and oversold, you should utilize any ranges you are feeling snug with. In truth, if utilizing %D for development following, additionally utilizing 30 and 70 will assist eradicate whipsaws.

One of many actually distinctive properties of this indicator is that it may be used to normalize knowledge. Let me clarify. In the event you wished to see knowledge costs that have been contained inside a spread between 0 and 100, then this system would try this. For instance in the event you had a 12 months’s price of information, which is about 252 buying and selling days, all you want is to merely set the variety of intervals for %Okay to 252 and you’ll have the ability to see the place costs moved over the past 12 months. This turns into particularly invaluable when evaluating two totally different shares or indices.

It also needs to be famous that Stochastics was designed for use with knowledge that incorporates the Excessive, Low, and Shut worth. It could work with close-only knowledge, however the system have to be adjusted accordingly.

RSI (Relative Power Index)

RSI was one of many first really unique momentum oscillator indicators that was created previous to desktop or private computer systems. Welles Wilder laid out the idea on a columnar pad. Mainly, RSI takes a weighted common of the final 14 days’ (if utilizing 14 for the variety of intervals) up closes and divides by the final 14 days’ down closes. It’s then normalized in order that the indicator at all times reads between 0 and 100. Parameters usually related to RSI for overbought are when RSI is over 70, and oversold when it’s beneath 30.

The Relative Power Index (RSI) can be utilized quite a lot of other ways. In all probability the commonest is to make use of it the identical as Stochastics in an overbought/oversold method. Every time RSI rises above 70 after which reverses path and drops beneath 70, it’s a signal that the down closes have elevated relative to the up shut and the market is declining. Though this technique appears to at all times be well-liked, utilizing RSI as a development measure and one to assist spot divergences with worth looks like two higher makes use of for RSI. Determine 12.5 reveals RSI with the S&P 500 Index above. The horizontal strains on RSI are at 30, 50, and 70.

RSI might be one of the vital well-liked indicators ever developed. I believe that’s as a result of most couldn’t generate the system themselves if it weren’t a mainstay in virtually each technical evaluation software program bundle. Wilder developed it utilizing a columnar pad and needed to give you a option to do a weighted common of the up and down closes. It’s not a real weighted common, however will get the job carried out.

One of many actually massive issues that I see with RSI is that in lengthy steady developments, it may be utilizing some comparatively previous knowledge as a part of its calculation. For an instance, as an example the inventory is in an uptrend and has been for some time. The denominator is the typical of the down closes within the final 14 days. If the uptrend is powerful, there may not be any down closes for a time frame. If there weren’t any within the final 14 days, with out the Wilder smoothing method, the denominator can be equal to zero, and that might render the indicator ineffective. Due to this example, the calculation for RSI can use comparatively previous knowledge. That’s the reason RSI appears to work nicely as a divergence indicator, due to the previous knowledge. That is typically attributable to the truth that the earlier up development retains the denominator, which makes use of down closes, pretty inactive, however as soon as the down closes began hitting once more, it has a robust impact on RSI.

Transferring Common Convergence Divergence (MACD)

MACD is an idea utilizing two exponential averages developed by Gerald Appel. It was initially developed because the distinction between the 12- and 26-day exponential averages; the identical as a shifting common crossover system, with the intervals of the 2 averages being 12 and 26. The ensuing distinction, known as the MACD line, is then smoothed with a nine-day exponential common, which is known as the sign line. Gerald Appel initially designed this indicator utilizing totally different parameters for purchase and promote indicators, however that appears to have pale away and virtually everybody now makes use of the 12–26–9 mixture for each purchase and promote. The motion of the MACD line is the measurement of the distinction between the 2 shifting averages. When MACD is at its highest level, it simply implies that the 2 averages are at their best distance aside (with quick above lengthy). And when the MACD is at its lowest degree, it simply means the 2 averages are at their best distance aside when the quick common is beneath the lengthy common. It actually is a straightforward idea and is a superb instance of the advantages of charting, as a result of it’s so straightforward to see.

MACD, and particularly, the idea behind it, is a superb technical indicator for development dedication. Not solely that, however it additionally reveals some info that can be utilized to find out overbought and oversold, in addition to divergence. You might say it does virtually all the pieces.

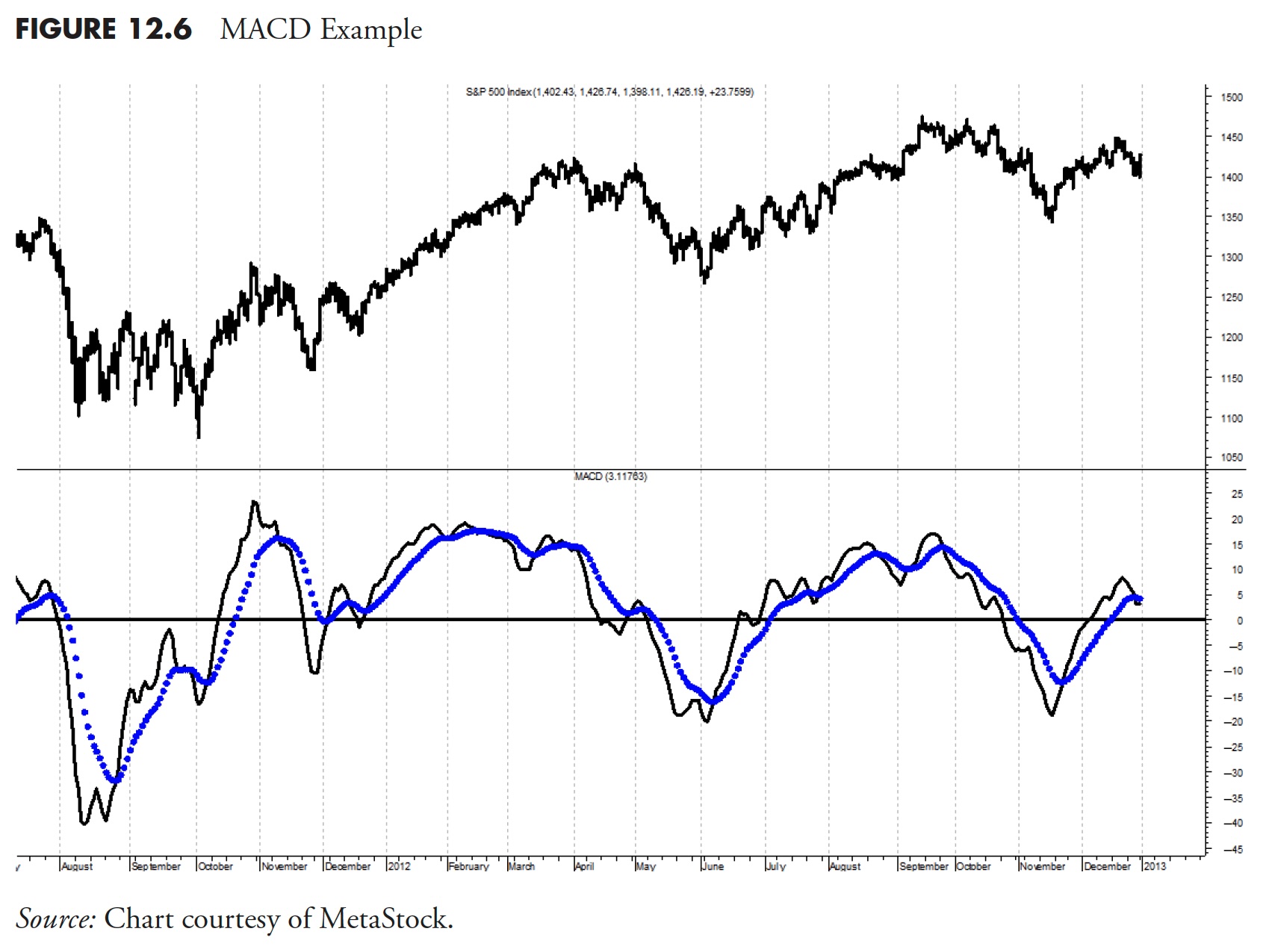

Determine 12.6 reveals the MACD with the S&P 500 Index above. The strong line is the 12–26 MACD line and the dotted line is the 9 interval common.

Please preserve this in thoughts: Though MACD is a invaluable indicator for development evaluation, it is just the distinction between two exponential shifting averages. In truth, in the event you used worth and one shifting common, it could be comparable in that one of many shifting averages was utilizing a interval of 1. This isn’t rocket science! Determine 12.6 is an instance of MACD with its sign line.

A Phrase of Warning

Technical indicators typically take care of worth and quantity. Worth entails the open, excessive, low, and shut values. There are actually a whole bunch, if not hundreds, of technical indicators that make the most of these worth elements. These indicators use varied parameters to make the indicator helpful in analyzing the market.

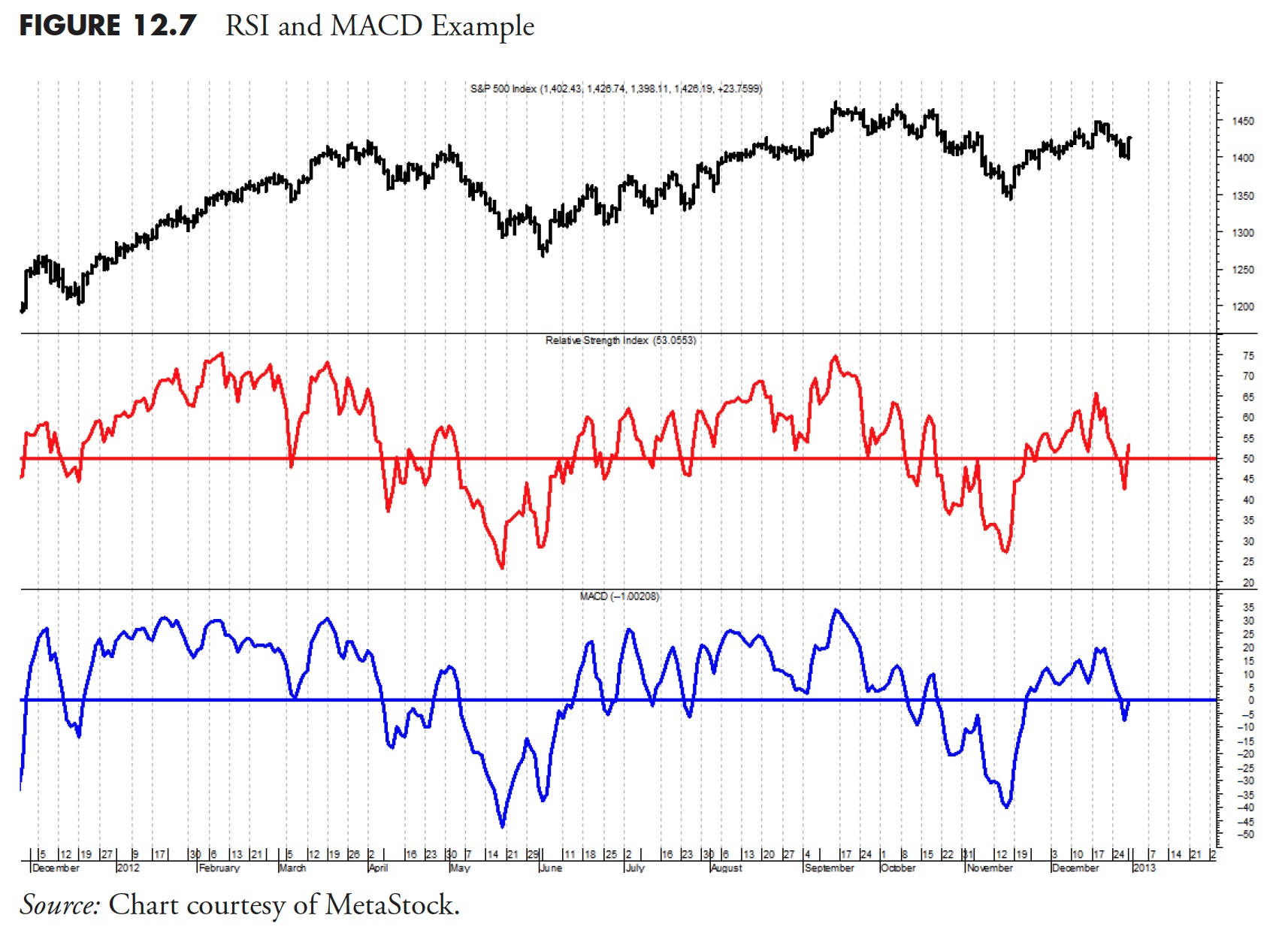

Usually, the Relative Power Index (RSI) is taken into account an overbought/oversold indicator, whereas Transferring Common Convergence Divergence (MACD) is taken into account a development indicator. With an intentional remodeling of the parameters utilized in every, Determine 12.7 reveals each the RSI and MACD of the S&P 500 Index.

Discover that they each look virtually precisely the identical. If you find yourself working with solely worth or its elements, you have to be cautious to not overanalyze or over-optimize the indicator or you’ll simply be trying on the similar info. See the part on Multicollinearity in earlier articles for extra proof of this potential drawback.

There are a number of cash administration strategies which have surfaced within the funding group. Every has its deserves and every has its shortcomings. This part is offered to enrich the guide’s completeness, and doesn’t dwell into the small print.

The Binary Indicator

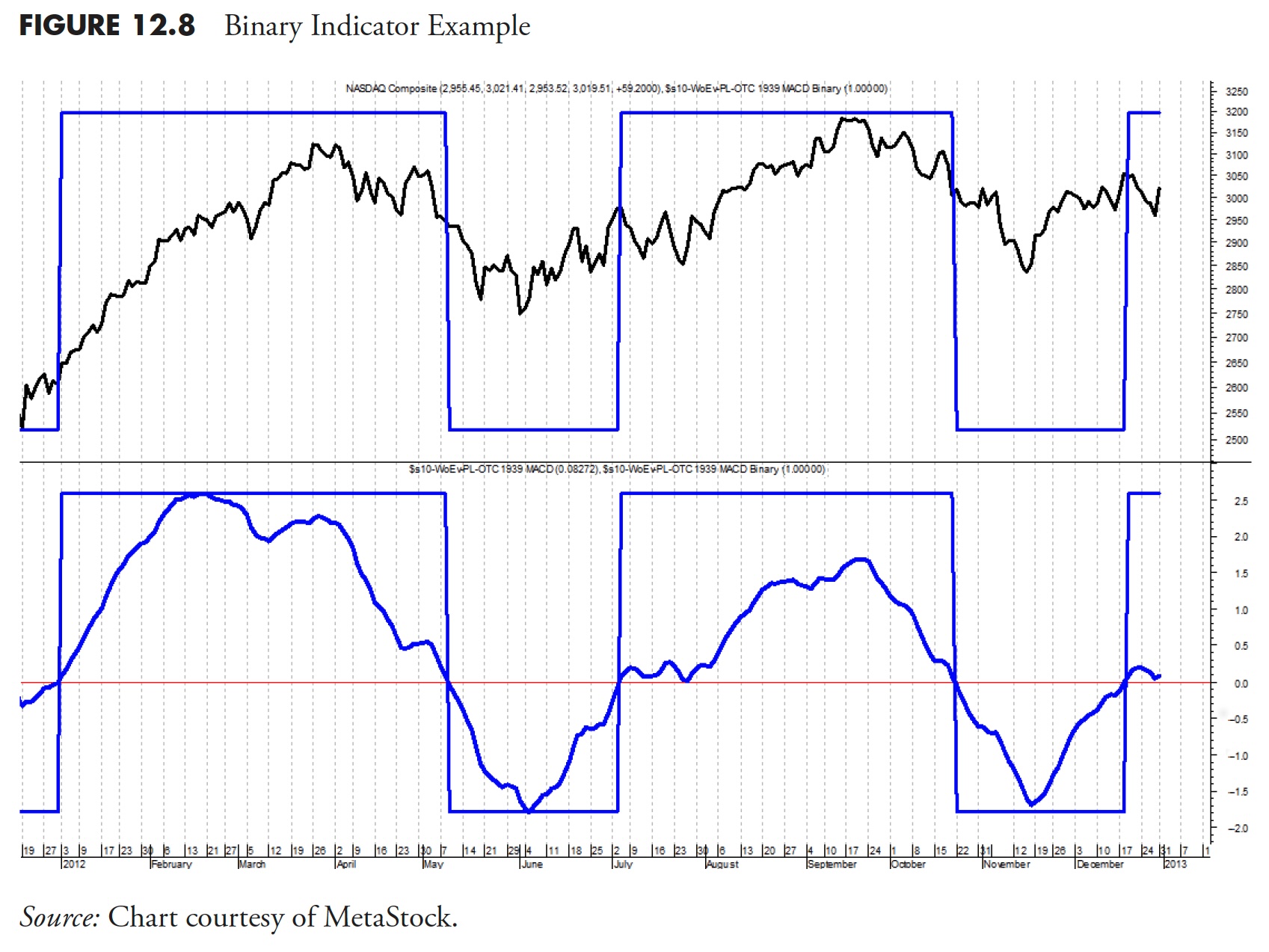

This a part of the guide additionally reveals many charts of market knowledge and indicators. Many will embrace what is named a binary measure. Binary implies that it solely offers two indicators; it’s both on or off, much like a easy digital sign.

Determine 12.8 is a chart of an index within the prime plot and an indicator within the backside plot. The indicators generated by the indicator are at any time when it crosses the zero line proven on the decrease plot. Every time the indicator is above the road, it means the development is up, and at any time when the indicator is beneath the road, it means the development is down (not up). To additional simplify that idea, the tooth-like sample, known as the binary and overlaid on the indicator, offers the very same info with out all of the volatility of the indicator. Discover that when the indicator is above the horizontal sign line that the binary can also be above the road, and at any time when the indicator is beneath the horizontal line, so is the binary. With that, we will then plot the binary straight on prime of the index within the prime plot and see the indicators. In truth, with this data, the whole backside plot may very well be eliminated and no important info can be misplaced.

Different conventions tailored to Half III of this guide that it’s essential know are that, when discussing indicators or market measures, there are parameters used to provide them particular values primarily based on intervals. A interval will be any measure of time, hourly, day by day, weekly, and so forth. Right here we’ll at all times persist with utilizing day by day evaluation until addressed domestically. The phrases concern and safety are sometimes used; I’ll persist with utilizing ETFs because the funding automobile.

When displaying many measures which might be in the identical class, comparable to rating measures, I try to point out them individually, however over the identical time frame utilizing the identical ETF, such because the SPY.

How Compound Measures Work

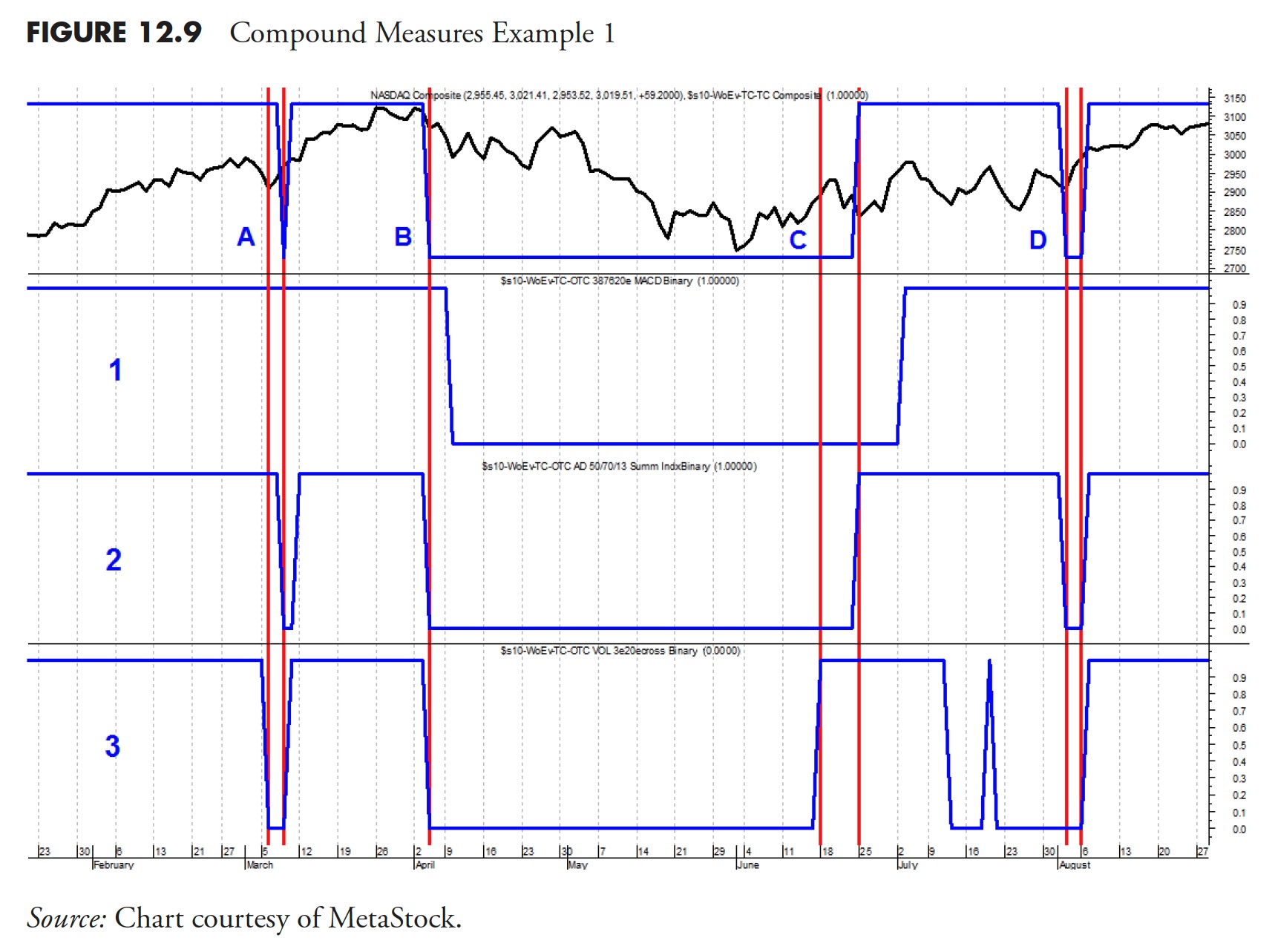

Earlier than shifting on, an idea must be defined. Determine 12.9 will show you how to perceive how a compound measure works. First, it’s essential know that this isn’t a posh system; at any time when two of the three indicators are in settlement, the compound measure strikes in the identical path. Because of this all three may very well be signaling, however it solely takes two to perform the aim.

In Determine 12.9 the highest plot is the Nasdaq Composite. The subsequent three plots comprise the binary indicators for the three elements; on this instance, they’re known as 1, 2, and three. There are 4 situations of indicators from these three elements, labeled within the prime plot as A, B, C, and D. Let’s undergo them, beginning with sign A. Discover that there are two vertical strains, with the primary one being created by indicator 3. Then discover how indicator 3 dropped from its excessive place to its low place; that may be a binary sign from indicator 3. The subsequent vertical line reveals up when indicator 2 drops to its low place. We now have two of the three indicators dropping to their low place, which suggests the compound binary indicator overlaid on the Nasdaq Composite within the prime plot now drops to its low place.

The second sign, at B, happens when each indicator 2 and three each drop to their low place on the similar time; as soon as once more, it is a sign for the compound binary within the prime plot to drop to its low place. Transferring over to sign C, you may see that indicator 3 rose to its prime place adopted just a few days later by indicator 2 rising to its prime place, which in flip causes the compound binary within the prime plot to rise to its prime place.

Instance D beneath reveals indicator 2 dropping to its low place. This has prompted the compound binary to drop as a result of, if you’ll discover, indicator 3 had already dropped to its low place many days previous to that of indicator 2. In instance D, discover that each indicator 2 and three each rose on the identical day and indicated by the rightmost vertical line, which after all prompted the compound binary to additionally rise. The idea is easy; it solely takes two of the three indicators to manage the compound binary within the prime plot. It doesn’t matter which two it’s or in what mixture. As you may hopefully see, the method may very well be expanded to utilizing 5 indicators and utilizing the most effective three of the 5.

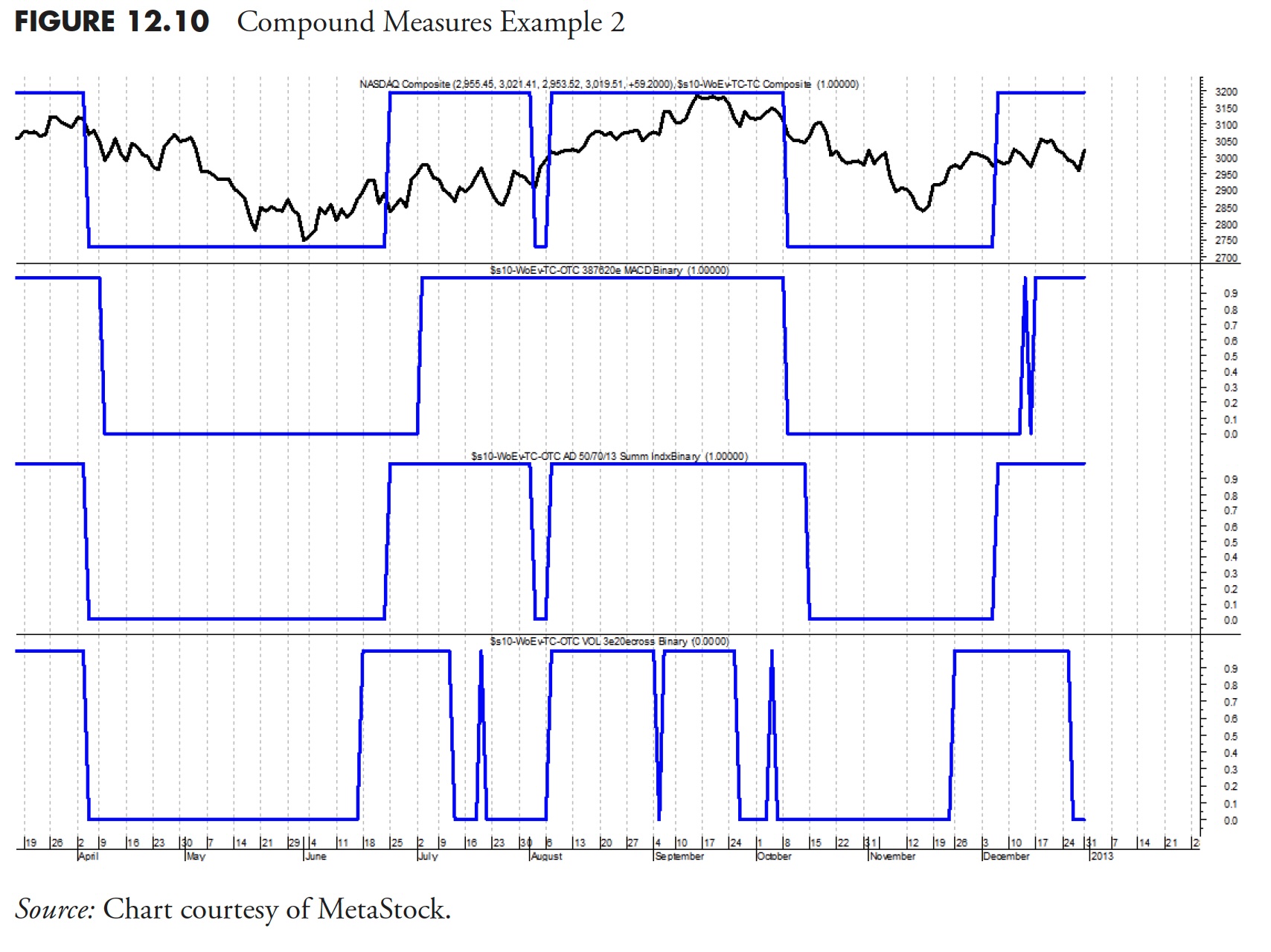

Now strive to determine the compound measure beneath with none visible or verbal help. In Determine 12.10, the highest plot incorporates the Nasdaq Composite and the compound binary. There are binaries for 3 indicators beneath they usually work identical to the instance above, any two which might be on is a sign for the compound binary to maneuver in the identical path. Good luck.

Thanks for studying this far. I intend to publish one article on this collection each week. Cannot wait? The guide is on the market right here.

[ad_2]

Supply hyperlink

Leave a Reply